Pfizer 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

we use an estimated allocation factor (based on historical payments) and total revenues by country against our actual invoiced sales to

project the expected level of reimbursement. We obtain third-party information that helps us to monitor the adequacy of these accruals.

•Provisions for pharmaceutical chargebacks (primarily reimbursements to wholesalers for honoring contracted prices to third parties)

closely approximate actual as we settle these deductions generally within two to four weeks of incurring the liability.

•Provisions for pharmaceutical returns are based on a calculation at each market that incorporates the following, as appropriate: local

returns policies and practices; returns as a percentage of sales; an understanding of the reasons for past returns; estimated shelf-life by

product; an estimate of the amount of time between shipment and return or lag time; and any other factors that could impact the

estimate of future returns, such as loss of exclusivity, product recalls, or a changing competitive environment, as appropriate.

•We record sales incentives as a reduction of revenues at the time the related revenues are recorded or when the incentive is offered,

whichever is later. We estimate the cost of our sales incentives based on our historical experience with similar incentives programs.

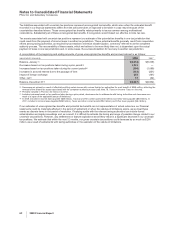

•Our accruals for Medicaid rebates, Medicare rebates, performance-based contract rebates and chargebacks were $1.5 billion as of

December 31, 2008, and $1.4 billion as of December 31, 2007, and are included in Other current liabilities.

Taxes collected from customers relating to product sales and remitted to governmental authorities are presented on a net basis; that

is, they are excluded from Revenues.

Alliances—We have agreements to co-promote pharmaceutical products discovered by other companies. Alliance revenues are

earned when our co-promotion partners ship the related product and title passes to their customer. Alliance revenues are primarily

based upon a percentage of our co-promotion partners’ net sales. Expenses for selling and marketing these products are included in

Selling, informational and administrative expenses.

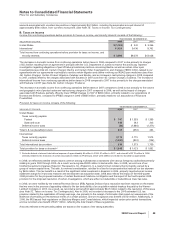

H. Cost of Sales and Inventories

We value inventories at lower of cost or market. Cost is determined as follows:

•finished goods and work in process at average actual cost; and

•raw materials and supplies at average or latest actual cost.

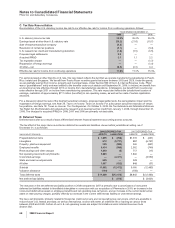

I. Selling, Informational and Administrative Expenses

Selling, informational and administrative costs are expensed as incurred. Among other things, these expenses include the costs of

marketing, advertising, shipping and handling, information technology and non-manufacturing employee compensation.

Advertising expenses relating to production costs are expensed as incurred and the costs of radio time, television time and space in

publications are expensed when the related advertising occurs. Advertising expenses totaled approximately $2.6 billion in 2008,

$2.7 billion in 2007 and $2.6 billion in 2006.

J. Research and Development Expenses

Research and development (R&D) costs are expensed as incurred. These expenses include the costs of our proprietary R&D

efforts, as well as costs incurred in connection with our third-party collaboration efforts. Before a compound receives regulatory

approval, we record milestone payments made by us to third parties under contracted R&D arrangements as expense when the

specific milestone has been achieved. Once a compound receives regulatory approval, we record any subsequent milestone

payments in Identifiable intangible assets, less accumulated amortization and, unless the assets are determined to have an

indefinite life, we amortize them evenly over the remaining agreement term or the expected product life cycle, whichever is shorter.

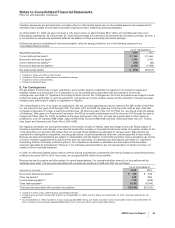

K. Amortization of Intangible Assets, Depreciation and Certain Long-Lived Assets

Long-lived assets include:

•Goodwill—Goodwill represents the excess of the purchase price of an acquired business over the assigned values of its net assets.

Goodwill is not amortized.

•Identifiable intangible assets, less accumulated amortization—These acquired assets are recorded at our cost. Intangible assets with

finite lives are amortized evenly over their estimated useful lives. Intangible assets with indefinite lives are not amortized.

•Property, plant and equipment, less accumulated depreciation—These assets are recorded at original cost and increased by the cost of

any significant improvements after purchase. We depreciate the cost evenly over the assets’ estimated useful lives. For tax purposes,

accelerated depreciation methods are used as allowed by tax laws.

Amortization expense related to acquired intangible assets that contribute to our ability to sell, manufacture, research, market and

distribute products, compounds and intellectual property are included in Amortization of intangible assets as they benefit multiple

business functions. Amortization expense related to intangible assets that are associated with a single function and depreciation of

property, plant and equipment are included in Cost of sales, Selling, informational and administrative expenses and Research and

development expenses, as appropriate.

We review all of our long-lived assets, including goodwill and other intangible assets, for impairment indicators at least annually and

we perform detailed impairment testing for goodwill and indefinite-lived assets annually and for all other long-lived assets whenever

impairment indicators are present. When necessary, we record charges for impairments of long-lived assets for the amount by which

the present value of future cash flows, or some other fair value measure, is less than the carrying value of these assets. The process

2008 Financial Report 53