Pfizer 2008 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2008 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc and Subsidiary Companies

Certain Significant Items

Adjusted income is calculated prior to considering certain significant items. Certain significant items represent substantive, unusual

items that are evaluated on an individual basis. Such evaluation considers both the quantitative and the qualitative aspect of their

unusual nature. Unusual, in this context, may represent items that are not part of our ongoing business; items that, either as a result

of their nature or size, we would not expect to occur as part of our normal business on a regular basis; items that would be

non-recurring; or items that relate to products we no longer sell. While not all-inclusive, examples of items that could be included as

certain significant items would be a major non-acquisition-related restructuring charge and associated implementation costs for a

program which is specific in nature with a defined term, such as those related to our cost-reduction initiatives; charges related to

certain sales or disposals of products or facilities that do not qualify as discontinued operations as defined by U.S. GAAP; amounts

associated with transition service agreements in support of discontinued operations after sale; certain intangible asset impairments;

adjustments related to the resolution of certain tax positions; the impact of adopting certain significant, event-driven tax legislation,

such as adjustments associated with charges attributable to the repatriation of foreign earnings in accordance with the American

Jobs Creation Act of 2004; or possible charges related to legal matters, such as certain of those discussed in Legal Proceedings in

our Form 10-K and in Part II: Other Information; Item 1, Legal Proceedings in our Form 10-Q filings. Normal, ongoing defense costs

of the Company or settlements and accruals on legal matters made in the normal course of our business would not be considered

certain significant items.

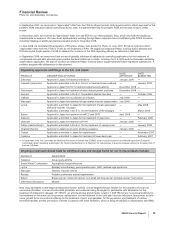

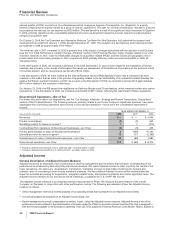

Reconciliation

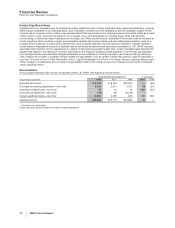

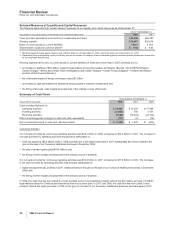

A reconciliation between Net income, as reported under U.S. GAAP, and Adjusted income follows:

YEAR ENDED DECEMBER 31, % CHANGE

(MILLIONS OF DOLLARS) 2008 2007 2006 08/07 07/06

Reported net income $ 8,104 $ 8,144 $19,337 —(58)

Purchase accounting adjustments—net of tax 2,439 2,511 3,131 (3) (20)

Acquisition-related costs—net of tax 39 10 14 305 (30)

Discontinued operations—net of tax (78) 69 (8,313) **

Certain significant items—net of tax 5,862 4,379 813 34 438

Adjusted income $16,366 $15,113 $14,982 81

* Calculation not meaningful.

Certain amounts and percentages may reflect rounding adjustments.

32 2008 Financial Report