Pfizer 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

We regularly evaluate all of our financial assets for impairment. For investments in debt and equity securities, when a decline in fair

value, if any, is determined to be other-than-temporary, an impairment charge is recorded and a new cost basis in the investment is

established. For loans, an impairment charge is recorded if it is probable that we will not be able to collect all amounts due according

to the loan agreement. There were no significant impairments recognized in 2008, 2007 or 2006.

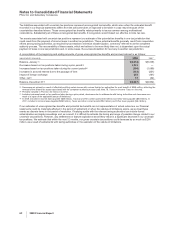

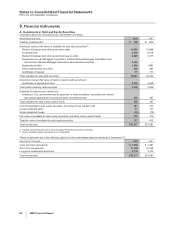

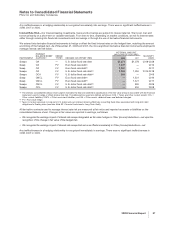

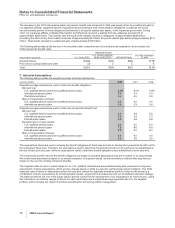

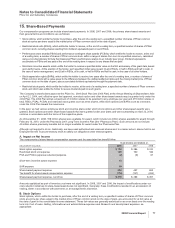

F. Credit Risk

We regularly review the creditworthiness of counterparties to foreign exchange and interest rate agreements and do not expect to

incur a significant loss from failure of any counterparties to perform under the agreements.

There are no significant concentrations of credit risk related to our financial instruments with any individual counterparty. As of

December 31, 2008, we had $3.8 billion due from a well-diversified, highly rated group (primarily Standard & Poor’s rating of AA or

better) of bank counterparties around the world.

In general, there is no requirement for collateral from customers. However, derivative financial instruments are executed under

master netting agreements with financial institutions. These agreements contain provisions that provide for the ability for collateral

payments, depending on levels of exposure, our credit rating and the credit rating of the counterparty. As of December 31, 2008, we

advanced cash collateral of $497 million and received cash collateral of $510 million against various counterparties. The collateral

primarily supports the approximate fair value of our derivative contracts. The collateral advanced receivables are reported in Short-

term loans, and the collateral received obligations are reported in Short-term borrowings, including current portion of long-term debt.

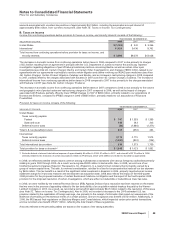

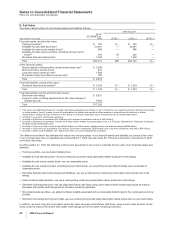

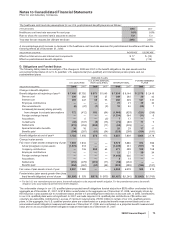

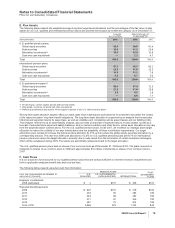

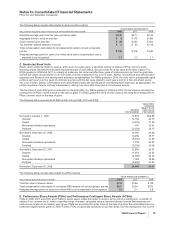

10. Inventories

The components of inventories as of December 31 follow:

(MILLIONS OF DOLLARS) 2008 2007

Finished goods $2,024 $2,064

Work-in-process 1,527 2,353

Raw materials and supplies 830 885

Total inventories(a) $4,381 $5,302

(a) Certain amounts of inventories are in excess of one year’s supply. There are no recoverability issues associated with these quantities and the

amounts are not significant.

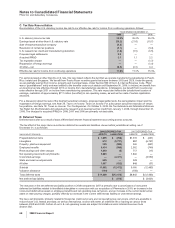

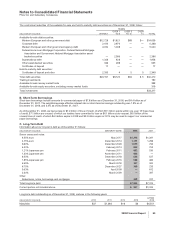

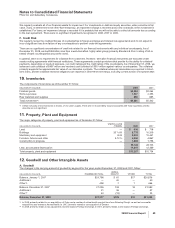

11. Property, Plant and Equipment

The major categories of property, plant and equipment as of December 31 follow:

(MILLIONS OF DOLLARS)

USEFUL LIVES

(YEARS) 2008 2007

Land — $ 616 $ 718

Buildings 33

1

⁄

3

-50 8,775 10,319

Machinery and equipment 8-20 9,583 10,441

Furniture, fixtures and other 3-12

1

⁄

2

4,350 4,867

Construction in progress — 1,804 1,758

25,128 28,103

Less: accumulated depreciation 11,841 12,369

Total property, plant and equipment $13,287 $15,734

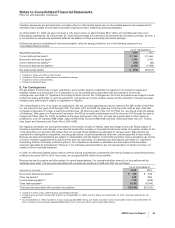

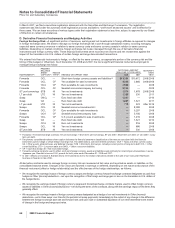

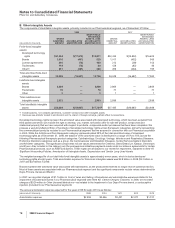

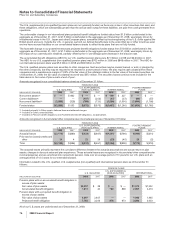

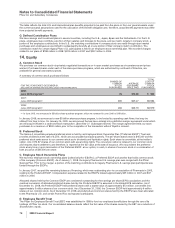

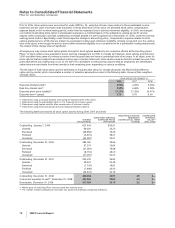

12. Goodwill and Other Intangible Assets

A. Goodwill

The changes in the carrying amount of goodwill by segment for the years ended December 31, 2008 and 2007, follow:

(MILLIONS OF DOLLARS) PHARMACEUTICAL

ANIMAL

HEALTH OTHER TOTAL

Balance, January 1, 2007 $20,798 $ 61 $17 $20,876

Additions(a) —40 — 40

Other(b) 458 7 1 466

Balance, December 31, 2007 21,256 108 18 21,382

Additions(a) 21 36 — 57

Other(b) 40 (15) — 25

Balance, December 31, 2008 $21,317 $129 $18 $21,464

(a) In 2008, primarily related to our acquisitions of Coley and a number of animal health product lines from Schering-Plough, as well as two smaller

acquisitions also related to Animal Health. In 2007, primarily related to our acquisition of Embrex.

(b) In 2008, primarily relates to tax adjustments and the impact of foreign exchange. In 2007, primarily relates to the impact of foreign exchange.

2008 Financial Report 69