Pfizer 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

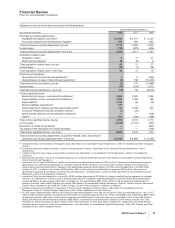

Financial Review

Pfizer Inc and Subsidiary Companies

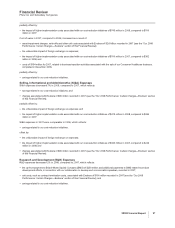

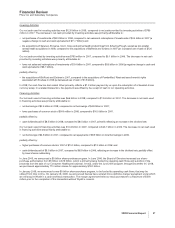

second quarter of 2008, we sold one of our biopharmaceutical companies, Esperion Therapeutics, Inc. (Esperion), to a newly

formed company that is majority-owned by a group of venture capital firms. The sale, for nominal consideration, resulted in a loss for

tax purposes that reduced our tax expense by $426 million. This tax benefit is a result of the significant initial investment in Esperion

in 2004, primarily reported on the consolidated statement of income as Acquisition-related in-process research and development

charges at acquisition date.

On October 3, 2008, the Tax Extenders and Alternative Minimum Tax Relief Act (the Extenders Act) extended the research and

development tax credit from January 1, 2008, through December 31, 2009. The research and development credit reduced income

tax expense in 2008 by approximately $110 million.

The lower tax rate in 2007 compared to 2006 is primarily due to the impact of charges associated with our decision to exit Exubera

(see the “Our 2008 Performance: Certain Charges—Exubera” section of this Financial Review), higher charges related to our cost-

reduction initiatives in 2007, lower non-deductible charges for acquisition-related IPR&D, and the volume and geographic mix of

product sales and restructuring charges in 2007 compared to 2006, partially offset by certain one-time tax benefits in 2006, all

discussed below.

In the third quarter of 2006, we recorded a decrease to the 2005 estimated U.S. tax provision related to the repatriation of foreign

earnings, due primarily to the receipt of information that raised our assessment of the likelihood of prevailing on the technical merits

of a certain position, and we recognized a tax benefit of $124 million.

In the first quarter of 2006, we were notified by the Internal Revenue Service (IRS) Appeals Division that a resolution had been

reached on the matter that we were in the process of appealing related to the tax deductibility of an acquisition-related breakup fee

paid by the Warner-Lambert Company in 2000. As a result, in the first quarter of 2006, we recorded a tax benefit of approximately

$441 million related to the resolution of this issue.

On January 23, 2006, the IRS issued final regulations on Statutory Mergers and Consolidations, which impacted certain prior-period

transactions. In the first quarter of 2006, we recorded a tax benefit of $217 million, reflecting the total impact of these regulations.

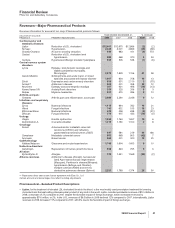

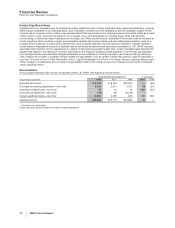

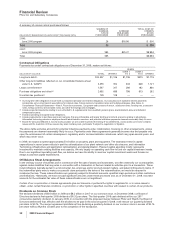

Discontinued Operations—Net of Tax

For further discussion about our dispositions, see the “Our Strategic Initiatives—Strategy and Recent Transactions: Dispositions”

section of this Financial Review. The following amounts, primarily related to our former Consumer Healthcare business, have been

segregated from continuing operations and included in Discontinued operations—net of tax in the consolidated statements of

income:

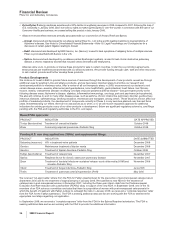

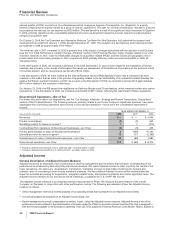

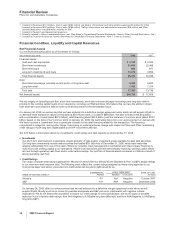

YEAR ENDED DECEMBER 31,

(MILLIONS OF DOLLARS) 2008 2007 2006

Revenues $— $ — $ 4,044

Pre-tax income/(loss) (3) (5) 643

Benefit/(provision) for taxes on income(a) 12 (210)

Income/(loss) from operations of discontinued businesses—net of tax (2) (3) 433

Pre-tax gains/(losses) on sales of discontinued businesses 6(168) 10,243

(Benefit)/provision for taxes on gains(b) 74 102 (2,363)

Gains/(losses) on sales of discontinued businesses—net of tax 80 (66) 7,880

Discontinued operations—net of tax $78 $ (69) $ 8,313

(a) Includes a deferred tax expense of nil in 2008 and 2007, and $24 million in 2006.

(b) Includes a deferred tax benefit of nil in 2008 and 2007, and $444 million in 2006.

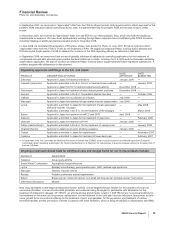

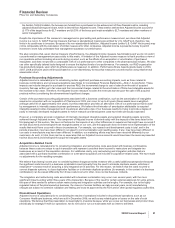

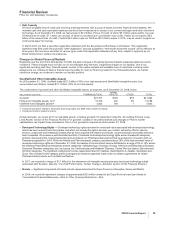

Adjusted Income

General Description of Adjusted Income Measure

Adjusted income is an alternative view of performance used by management and we believe that investors’ understanding of our

performance is enhanced by disclosing this performance measure. We report Adjusted income in order to portray the results of our

major operations—the discovery, development, manufacture, marketing and sale of prescription medicines for humans and

animals—prior to considering certain income statement elements. We have defined Adjusted income as Net income before the

impact of purchase accounting for acquisitions, acquisition-related costs, discontinued operations and certain significant items. The

Adjusted income measure is not, and should not be viewed as, a substitute for U.S. GAAP Net income.

The Adjusted income measure is an important internal measurement for Pfizer. We measure the performance of the overall

Company on this basis, in conjunction with other performance metrics. The following are examples of how the Adjusted income

measure is utilized.

•Senior management receives a monthly analysis of our operating results that is prepared on an Adjusted income basis;

•Our annual budgets are prepared on an Adjusted income basis; and

•Senior management’s annual compensation is derived, in part, using this Adjusted income measure. Adjusted income is one of the

performance metrics utilized in the determination of bonuses under the Pfizer Inc Executive Annual Incentive Plan that is designed to

limit the bonuses payable to the Executive Leadership Team (ELT) for purposes of Internal Revenue Code Section 162(m). Subject to

30 2008 Financial Report