Pfizer 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

Tax liabilities associated with uncertain tax positions represent unrecognized tax benefits, which arise when the estimated benefit

recorded in our financial statements differs from the amounts taken or expected to be taken in a tax return because of the

uncertainties described above. These unrecognized tax benefits relate primarily to issues common among multinational

corporations. Substantially all of these unrecognized tax benefits, if recognized, would impact our effective income tax rate.

Tax assets associated with uncertain tax positions represent our estimate of the potential tax benefits in one tax jurisdiction that

could result from the payment of income taxes in another tax jurisdiction. These potential benefits generally result from cooperative

efforts among taxing authorities, as required by tax treaties to minimize double taxation, commonly referred to as the competent

authority process. The recoverability of these assets, which we believe to be more likely than not, is dependent upon the actual

payment of taxes in one tax jurisdiction and, in some cases, the successful petition for recovery in another tax jurisdiction.

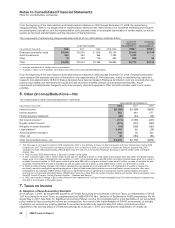

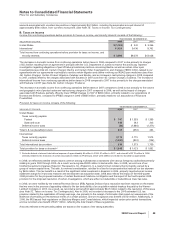

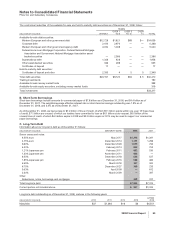

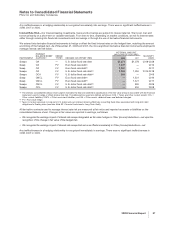

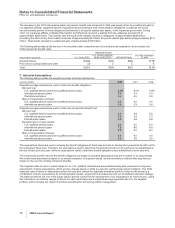

A reconciliation of the beginning and ending amounts of gross unrecognized tax benefits and accrued interest is as follows:

(MILLIONS OF DOLLARS) 2008 2007

Balance, January 1 $(6,654) $(5,009)

Decreases based on tax positions taken during a prior period(a) 1,022 —

Increases based on tax positions taken during the current period(b) (990) (1,089)

Increases in accrued interest due to the passage of time (333) (331)

Impact of foreign exchange 245 (191)

Other, net(c) 13 (34)

Balance, December 31(d) $(6,697) $(6,654)

(a) Decreases are primarily a result of effectively settling certain issues with various foreign tax authorities for a net benefit of $305 million, reflecting the

reversal of the related tax assets associated with the competent authority process (see Note 7B. Taxes on Income: Taxes on Income).

(b) Primarily included in Provision for taxes on income.

(c) Includes increases based on tax positions taken during a prior period, decreases due to settlements with taxing authorities and decreases as a

result of a lapse of the applicable statute of limitations.

(d) In 2008, included in Income taxes payable ($85 million), Taxes and other current assets ($44 million) and Other taxes payable ($6.6 billion). In

2007, included in Income taxes payable ($358 million), Taxes and other current assets ($50 million) and Other taxes payable ($6.2 billion).

If our estimates of unrecognized tax benefits and potential tax benefits are not representative of actual outcomes, our financial

statements could be materially affected in the period of settlement or when the statutes of limitations expire, as we treat these

events as discrete items in the period of resolution. Finalizing audits with the relevant taxing authorities can include formal

administrative and legal proceedings and, as a result, it is difficult to estimate the timing and range of possible change related to our

uncertain tax positions. However, any settlements or statute expirations would likely result in a significant decrease in our uncertain

tax positions. We estimate that within the next 12 months, our gross uncertain tax positions could decrease by as much as $200

million, as a result of settlements with taxing authorities or the expiration of the statute of limitations.

62 2008 Financial Report