Pfizer 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

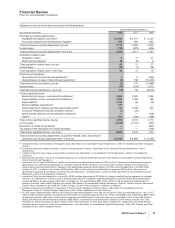

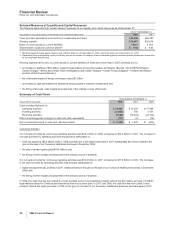

Financial Review

Pfizer Inc and Subsidiary Companies

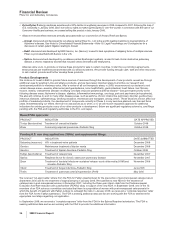

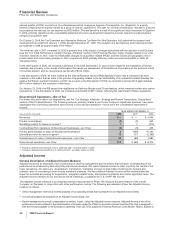

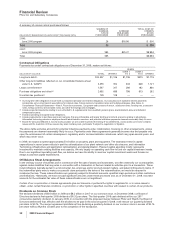

(i) Included in Revenues ($172 million), Cost of sales ($162 million) and Selling, informational and administrative expenses ($3 million) for 2008.

Included in Revenues ($219 million), Cost of sales ($194 million), Selling, informational and administrative expenses ($15 million) and Other

(income)/deductions—net ($16 million income) for 2007.

(j) Included in Research and development expenses.

(k) Primarily included in Other (income)/deductions—net. (See Notes to Consolidated Financial Statements—Note 6. Other (Income)/Deductions—Net.)

(l) Included in Provision for taxes on income. (See Notes to Consolidated Financial Statements—Note 7. Taxes on Income.)

Financial Condition, Liquidity and Capital Resources

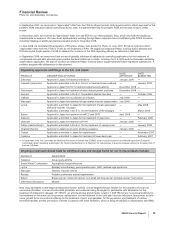

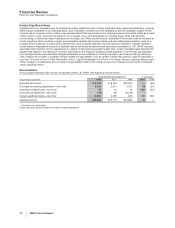

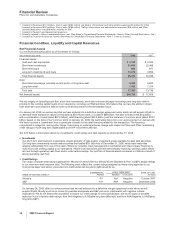

Net Financial Assets

Our net financial asset position as of December 31 follows:

(MILLIONS OF DOLLARS) 2008 2007

Financial assets:

Cash and cash equivalents $ 2,122 $ 3,406

Short-term investments 21,609 22,069

Short-term loans 824 617

Long-term investments and loans 11,478 4,856

Total financial assets 36,033 30,948

Debt:

Short-term borrowings, including current portion of long-term debt 9,320 5,825

Long-term debt 7,963 7,314

Total debt 17,283 13,139

Net financial assets $18,750 $ 17,809

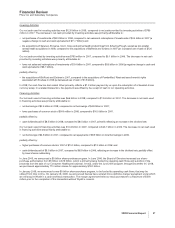

We rely largely on operating cash flow, short-term investments, short-term commercial paper borrowings and long-term debt to

provide for the working capital needs of our operations, including our R&D activities. We believe that we have the ability to obtain

both short-term and long-term debt to meet our financing needs for the foreseeable future.

On January 26, 2009, we announced that we have entered into a definitive merger agreement under which we will acquire Wyeth in

a cash-and-stock transaction valued on that date at $50.19 per share, or a total of $68 billion. We plan to finance this acquisition

with a combination of cash (about $22.5 billion), debt financing (about $22.5 billion) and the issuance of common stock (about $23.0

billion, based on the price of our common stock on January 23, 2009, the last trading day prior to our announcement on January 26).

We have received a commitment from a syndicate of banks for the debt financing related to this transaction. The financing

commitment is subject to, among other things, there being no material adverse change with respect to Pfizer and Pfizer maintaining

credit ratings of A2/A long-term stable/stable and A1/P1 short-term affirmed.

Set forth below is information about our investments, credit ratings and debt capacity as of December 31, 2008.

•Investments

Our short-term and long-term investments consist primarily of high-quality, investment-grade available-for-sale debt securities.

Our long-term investments include debt securities that totaled $9.1 billion as of December 31, 2008, which have maturities

ranging substantially from one to five years. Wherever possible, cash management is centralized and intercompany financing is

used to provide working capital to our operations. Where local restrictions prevent intercompany financing, working capital needs

are met through operating cash flows and/or external borrowings. Our portfolio of financial assets increased in 2008 as a result of

strong operating cash flow.

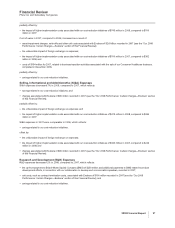

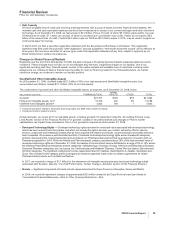

•Credit Ratings

Two major corporate debt-rating organizations, Moody’s Investors Service (Moody’s) and Standard & Poor’s (S&P), assign ratings

to our short-term and long-term debt. The following chart reflects the current ratings assigned by these rating agencies to our

commercial paper and senior unsecured non-credit enhanced long-term debt issued by us:

COMMERCIAL

PAPER

LONG-TERM DEBT DATE OF LAST

ACTIONNAME OF RATING AGENCY RATING OUTLOOK

Moody’s P-1 Aa1 Negative October 2007

S&P A1+ AAA Negative December 2006

On January 26, 2009, after our announcement that we had entered into a definitive merger agreement under which we will

acquire Wyeth, Moody’s put us on review for possible downgrade and S&P put us on credit watch with negative outlook

implications. We do not expect the acquisition to impact our credit ratings for commercial paper, but we do expect a possible

reduction in our long-term debt ratings, from Aa1/Negative to A1/Stable long term (Moody’s) and from AAA/Negative to AA/Stable

long term (S&P).

34 2008 Financial Report