PG&E 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

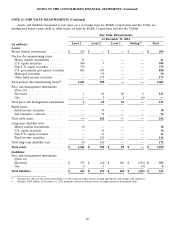

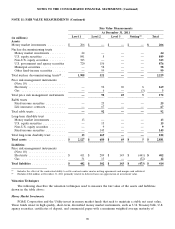

NOTE 11: FAIR VALUE MEASUREMENTS (Continued)

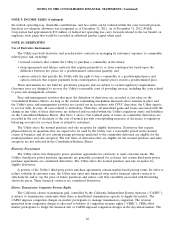

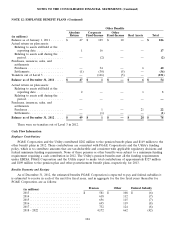

Nuclear Decommissioning Trust Investments

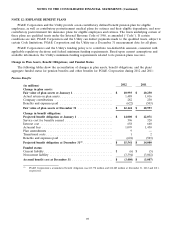

The following table provides a summary of available-for-sale investments held in the Utility’s nuclear

decommissioning trusts:

Total Total

Amortized Unrealized Unrealized Total Fair

Cost Gains Losses Value(1)

(in millions)

As of December, 2012

Money market investments ........ $ 21 $ —$ —$21

Equity securities

U.S. ....................... 331 618 — 949

Non-U.S. ................... 199 181 (1) 379

Debt securities

U.S. government and agency

securities ................ 723 97 — 820

Municipal securities .......... 56 4 (1) 59

Other fixed-income securities . . . 168 5 — 173

Total ........................ $ 1,498 $ 905 $ (2) $ 2,401

As of December 31, 2011

Money market investments ........ $ 24 $ —$ —$24

Equity securities

U.S. ....................... 334 518 (3) 849

Non-U.S. ................... 194 131 (2) 323

Debt securities

U.S. government and agency

securities ................ 774 102 — 876

Municipal securities .......... 56 2 — 58

Other fixed-income securities . . . 96 3 — 99

Total ........................ $ 1,478 $ 756 $ (5) $ 2,229

(1) Excludes $240 million and $188 million at December 31, 2012 and December 31, 2011, respectively, primarily related to deferred

taxes on appreciation of investment value.

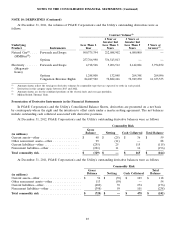

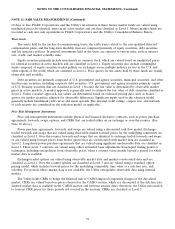

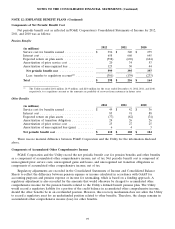

The fair value of debt securities by contractual maturity is as follows:

As of

December 31, 2012

(in millions)

Less than 1 year ............................................ $ 5

1 - 5 years ................................................. 456

5 - 10 years ................................................ 218

More than 10 years .......................................... 373

Total maturities of debt securities ................................ $ 1,052

The following table provides a summary of activity for the debt and equity securities:

2012 2011 2010

(in millions)

Proceeds from sales and maturities of nuclear decommissioning trust

investments .......................................... $ 1,133 $ 1,928 $ 1,405

Gross realized gains on sales of securities held as available-for-sale . . . 19 43 42

Gross realized losses on sales of securities held as available-for-sale . . . (17) (30) (11)

94