PG&E 2012 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2012 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

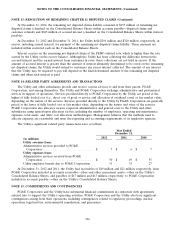

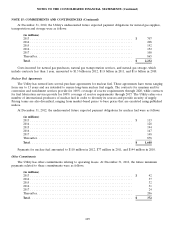

NOTE 15: COMMITMENTS AND CONTINGENCIES (Continued)

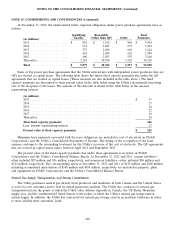

Payments for other commitments relating to operating leases amounted to $32 million in 2012, $27 million in

2011, and $25 million in 2010. PG&E Corporation and the Utility had operating leases on office facilities expiring at

various dates from 2013 to 2023. Certain leases on office facilities contain escalation clauses requiring annual

increases in rent ranging from 2% to 5%. The rentals payable under these leases may increase by a fixed amount

each year, a percentage of increase over base year, or the consumer price index. Most leases contain extension

options ranging between one and five years.

Underground Electric Facilities

At December 31, 2012, the Utility was committed to spending approximately $277 million for the conversion of

existing overhead electric facilities to underground electric facilities. These funds are conditionally committed

depending on the timing of the work, including the schedules of the respective cities, counties, and communications

utilities involved. The Utility expects to spend $86 million each year in connection with these projects. Consistent

with past practice, the Utility expects that these capital expenditures will be included in rate base as each individual

project is completed and that the amount of the capital expenditures will be recoverable from customers through

rates.

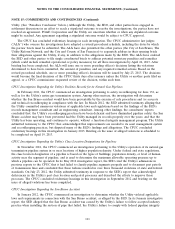

Contingencies

Legal and Regulatory Contingencies

PG&E Corporation and the Utility are subject to various laws and regulations and, in the normal course of

business, PG&E Corporation and the Utility are named as parties in a number of claims and lawsuits. In addition,

the Utility can incur penalties for failure to comply with federal, state, or local laws and regulations.

PG&E Corporation and the Utility record a provision for a loss when it is both probable that a loss has been

incurred and the amount of the loss can be reasonably estimated. PG&E Corporation and the Utility evaluate the

range of reasonably estimated losses and record a provision based on the lower end of the range, unless an amount

within the range is a better estimate than any other amount. These accruals, and the estimates of any additional

reasonably possible losses (or reasonably possible losses in excess of the amounts accrued), are reviewed quarterly

and are adjusted to reflect the impacts of negotiations, discovery, settlements and payments, rulings, advice of legal

counsel, and other information and events pertaining to a particular matter. In assessing the amounts related to such

contingencies, PG&E Corporation’s and the Utility’s policy is to exclude anticipated legal costs.

The accrued liability associated with claims and litigation, regulatory proceedings, penalties, and other legal

matters (other than the third-party claims, litigation, and investigations related to natural gas matters that are

discussed below) totaled $34 million at December 31, 2012 and $52 million at December 31, 2011 and are included

in PG&E Corporation’s and the Utility’s current liabilities—other in the Consolidated Balance Sheets. Except as

discussed below, PG&E Corporation and the Utility do not believe that losses associated with legal and regulatory

contingencies would have a material impact on their financial condition, results of operations, or cash flows.

Natural Gas Matters

On September 9, 2010, an underground 30-inch natural gas transmission pipeline (‘‘Line 132’’) owned and

operated by the Utility, ruptured in a residential area located in the City of San Bruno, California (the ‘‘San Bruno

accident’’). The ensuing explosion and fire resulted in the deaths of eight people, numerous personal injuries, and

extensive property damage. Following the San Bruno accident, various regulatory proceedings, investigations, and

lawsuits were commenced. The Natural Transportation Safety Board, an independent review panel appointed by the

CPUC, and the CPUC’s Safety and Enforcement Division (‘‘SED’’) completed investigations into the causes of the

accident, placing the blame primarily on the Utility.

Pending CPUC Investigations and Enforcement Matters

The CPUC is conducting three investigations pertaining to the Utility’s natural gas operations, which are

described below. In 2012, the SED issued reports in each of these investigations alleging that the Utility committed

numerous violations of applicable laws and regulations and recommending that the CPUC impose penalties on the

110