PG&E 2012 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2012 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

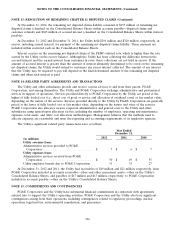

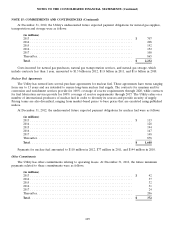

NOTE 15: COMMITMENTS AND CONTINGENCIES (Continued)

The CPUC has stated that it is prepared to impose significant penalties on the Utility if the CPUC determines

that the Utility violated applicable laws, rules, and orders. In determining the amount of penalties the ALJs may

consider the testimony of financial consultants engaged by the SED and the Utility. The SED’s financial consultant

prepared a report concluding that PG&E Corporation could raise approximately $2.25 billion through equity

issuances, in addition to equity PG&E Corporation had already forecasted it would issue in 2012, to fund

CPUC-imposed penalties on the Utility. The Utility’s financial consultant disagreed with this financial analysis and

asserted that a fine in excess of financial analysts’ expectations, which the consultant’s report cited as a mean of

$477 million, would make financing more difficult and expensive. The ALJs have scheduled a hearing to be held on

March 4 and March 5, 2013 to consider the SED’s and Utility’s testimony. The SED and other parties are scheduled

to file briefs to address potential monetary penalties and remedies in all three investigations by April 26, 2013.

PG&E Corporation and the Utility believe it is probable that the Utility will incur penalties of at least

$200 million in connection with these pending investigations and potential enforcement matters and have accrued

this amount in their consolidated financial statements. PG&E Corporation and the Utility are unable to make a

better estimate of probable losses or estimate the range of reasonably possible losses in excess of the amount accrued

due to the many variables that could affect the final outcome of these matters and the ultimate amount of penalties

imposed on the Utility could be materially higher than the amount accrued. These variables include how the CPUC

and the SED will exercise their discretion in calculating the amount of penalties, including how the total number of

violations will be counted; how the duration of the violations will be determined; whether the amount of penalties in

each investigation will be determined separately or in the aggregate; how the financial resources testimony submitted

by the SED and the Utility will be considered; whether the Utility’s costs to perform any required remedial actions

will be considered; and whether and how the financial impact of non-recoverable costs the Utility has already

incurred, and will continue to incur, to improve the safety and reliability of its pipeline system, will be considered.

(See ‘‘CPUC Gas Safety Rulemaking Proceeding’’ below.)

These estimates, and the assumptions on which they are based, are subject to change based on many factors,

including rulings, orders, or decisions that may be issued by the ALJs; whether the outcome of the investigations is

resolved through a fully litigated process or a stipulated outcome that is approved by the CPUC; whether the SED

will take additional action with respect to the Utility’s self-reports; and whether the CPUC or the SED takes any

action with respect to the encroachment matter described above. Future changes in these estimates or the

assumptions on which they are based could have a material impact on PG&E Corporation’s and the Utility’s

financial condition, results of operations, and cash flows.

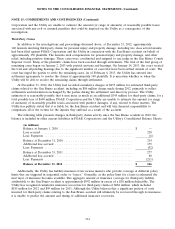

CPUC Gas Safety Rulemaking Proceeding

The CPUC is conducting a rulemaking proceeding to adopt new safety and reliability regulations for natural gas

transmission and distribution pipelines in California and the related ratemaking mechanisms. On December 20, 2012,

the CPUC approved the Utility’s proposed pipeline safety enhancement plan (filed in August 2011) to modernize

and upgrade its natural gas transmission system but disallowed the Utility’s request for rate recovery of a significant

portion of plan-related costs the Utility forecasted it would incur over the first phase of the plan (2011 through

2014). The CPUC decision limited the Utility’s recovery of capital expenditures to $1.0 billion of the total $1.4 billion

requested. Various parties have asked the CPUC to reconsider its decision, arguing that the Utility’s cost recovery

should be more limited. For 2012, the Utility recorded a $353 million charge to net income for plan-related capital

expenditures incurred that are forecasted to exceed the CPUC’s authorized levels or that were specifically disallowed.

Future disallowed amounts will be charged to net income in the period incurred and could have a material impact on

PG&E Corporation’s and the Utility’s financial condition, results of operations, and cash flows.

Criminal Investigation

In June 2011, the Utility was notified that representatives from the U.S. Department of Justice, the California

Attorney General’s Office, and the San Mateo County District Attorney’s Office are conducting an investigation of

the San Bruno accident. Federal and state authorities have indicated that the Utility is a target of the investigation.

The Utility is cooperating with the investigation. PG&E Corporation and the Utility are uncertain whether any

criminal charges will be brought against either company or any of their current or former employees. PG&E

113