PG&E 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and claim that this violation also constitutes a violation of California Public Utilities Code Section 2106

(‘‘Section 2106’’), which provides a private right of action for violations of the California constitution or state laws by

public utilities. Plaintiffs seek restitution and disgorgement under Section 17200 and compensatory and punitive

damages under Section 2106.

PG&E Corporation and the Utility contest the plaintiffs’ allegations. In January 2013, PG&E Corporation and

the Utility requested that the court dismiss the complaint on the grounds that the CPUC has exclusive jurisdiction to

adjudicate the issues raised by the plaintiffs’ allegations. In the alternative, PG&E Corporation and the Utility

requested that the court stay the proceeding until the CPUC investigations described above are concluded. The court

has set a hearing on the motion for April 26, 2013. Due to the early stage of this proceeding, PG&E Corporation

and the Utility are unable to estimate the amount (or range of amounts) of reasonably possible losses that may be

incurred in connection with this matter.

Other Pending Lawsuits and Claim

In October 2010, a purported shareholder derivative lawsuit was filed in San Mateo Superior Court following

the San Bruno accident to seek recovery on behalf of PG&E Corporation and the Utility for alleged breaches of

fiduciary duty by officers and directors, among other claims, relating to the Utility’s natural gas business. The judge

has ordered that proceedings in the derivative lawsuit be delayed until further order of the court. On February 7,

2013, another purported shareholder derivative lawsuit was filed in U.S. District Court for the Northern District of

California to seek recovery on behalf of PG&E Corporation for alleged breaches of fiduciary duty by officers and

directors, among other claims.

In February 2011, the Board of Directors of PG&E Corporation authorized PG&E Corporation to reject a

demand made by another shareholder that the Board of Directors (1) institute an independent investigation of the

San Bruno accident and related alleged safety issues; (2) seek recovery of all costs associated with such issues

through legal proceedings against those determined to be responsible, including Board of Directors members,

officers, other employees, and third parties; and (3) adopt corporate governance initiatives and safety programs. The

Board of Directors also reserved the right to commence further investigation or litigation regarding the San Bruno

accident if the Board of Directors deems such investigation or litigation appropriate.

REGULATORY MATTERS

The Utility is subject to substantial regulation by the CPUC, the FERC, the NRC and other federal and state

regulatory agencies. The resolutions of these and other proceedings may affect PG&E Corporation’s and the Utility’s

results of operations and financial condition.

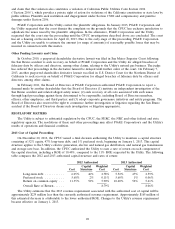

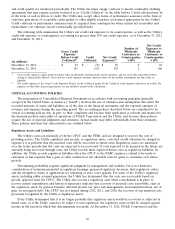

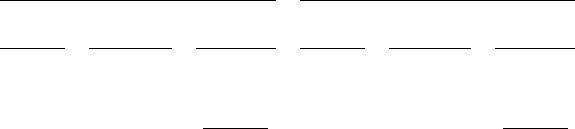

2013 Cost of Capital Proceeding

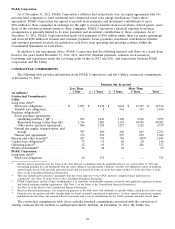

On December 20, 2012, the CPUC issued a final decision authorizing the Utility to maintain a capital structure

consisting of 52% equity, 47% long-term debt, and 1% preferred stock, beginning on January 1, 2013. This capital

structure applies to the Utility’s electric generation, electric and natural gas distribution, and natural gas transmission

and storage rate base. In addition, the CPUC authorized the Utility to earn a rate of return on each component of

the capital structure, including a ROE of 10.40%, compared to the 11% ROE requested by the Utility. The following

table compares the 2012 and 2013 authorized capital structure and rates of return:

2012 Authorized 2013 Authorized

Capital Weighted Capital Weighted

Cost Structure Cost Cost Structure Cost

Long-term debt ........... 6.05% 46% 2.78% 5.52% 47% 2.59%

Preferred stock ........... 5.68% 2% 0.11% 5.60% 1% 0.06%

Return on common equity . . . 11.35% 52% 5.90% 10.40% 52% 5.41%

Overall Rate of Return ...... 8.79% 8.06%

The Utility estimates that the 2013 revenue requirement associated with the authorized cost of capital will be

approximately $235 million less than the currently authorized revenue requirement. Approximately $165 million of

this estimated decrease is attributable to the lower authorized ROE. Changes to the Utility’s revenue requirement

became effective on January 1, 2013.

28