PG&E 2012 Annual Report Download - page 103

Download and view the complete annual report

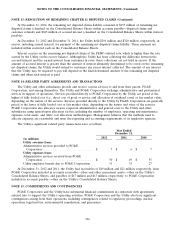

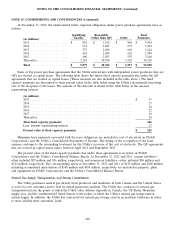

Please find page 103 of the 2012 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

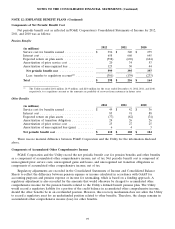

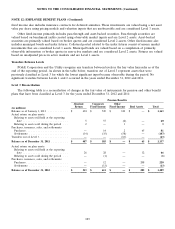

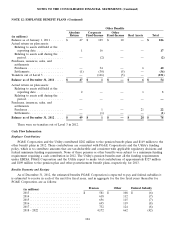

NOTE 12: EMPLOYEE BENEFIT PLANS (Continued)

non-callable bonds at December 31, 2012. This yield curve has discount rates that vary based on the duration of the

obligations. The estimated future cash flows for the pension benefits and other benefit obligations were matched to

the corresponding rates on the yield curve to derive a weighted average discount rate.

The difference between actual and expected return on plan assets is included in unrecognized gain (loss), and is

considered in the determination of future net periodic benefit income (cost). The actual return on plan assets in

2011 exceeded expectations due to a higher than expected return on fixed-income debt investments. The actual

return on plan assets in 2012 was in line with expectations.

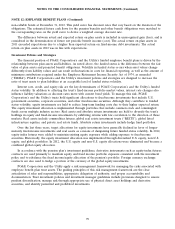

Investment Policies and Strategies

The financial position of PG&E Corporation’s and the Utility’s funded employee benefit plans is driven by the

relationship between plan assets and liabilities. As noted above, the funded status is the difference between the fair

value of plan assets and projected benefit obligations. Volatility in funded status occurs when asset values change

differently from liability values and can result in fluctuations in costs for financial reporting, as well as the amount of

minimum contributions required under the Employee Retirement Income Security Act of 1974, as amended

(‘‘ERISA’’). PG&E Corporation’s and the Utility’s investment policies and strategies are designed to increase the

ratio of trust assets to plan liabilities at an acceptable level of funded status volatility.

Interest rate, credit, and equity risk are the key determinants of PG&E Corporation’s and the Utility’s funded

status volatility. In addition to affecting the trust’s fixed-income portfolio market values, interest rate changes also

influence liability valuations as discount rates move with current bond yields. To manage this risk, PG&E

Corporation’s and the Utility’s trusts hold significant allocations to fixed-income investments that include U.S.

government securities, corporate securities, and other fixed-income securities. Although they contribute to funded

status volatility, equity investments are held to reduce long-term funding costs due to their higher expected return.

The equity investment allocation is implemented through portfolios that include common stock and commingled

funds across multiple industry sectors. Real assets and absolute return investments are held to diversify the trust’s

holdings in equity and fixed-income investments by exhibiting returns with low correlation to the direction of these

markets. Real assets include commodities futures, global real estate investment trusts (‘‘REITS’’), global listed

infrastructure equities, and private real estate funds. Absolute return investments include hedge fund portfolios.

Over the last three years, target allocations for equity investments have generally declined in favor of longer-

maturity fixed-income investments and real assets as a means of dampening future funded status volatility. In 2012,

equity index futures were added to maintain existing equity exposure while adding exposure to fixed-income

securities. Historically, the equity investment allocation was implemented through diversified U.S. equity, non-U.S.

equity, and global portfolios. In 2012, the U.S. equity and non-U.S. equity allocations were eliminated and became a

combined global equity allocation.

In accordance with the pension plan’s investment guidelines, derivative instruments such as equity-index futures

contracts are used primarily to maintain equity and fixed income portfolio exposure consistent with the investment

policy and to rebalance the fixed income/equity allocation of the pension’s portfolio. Foreign currency exchange

contracts are also used to hedge a portion of the currency of the global equity investments.

PG&E Corporation and the Utility apply a risk management framework for managing the risks associated with

employee benefit plan trust assets. The guiding principles of this risk management framework are the clear

articulation of roles and responsibilities, appropriate delegation of authority, and proper accountability and

documentation. Trust investment policies and investment manager guidelines include provisions designed to ensure

prudent diversification, manage risk through appropriate use of physical direct asset holdings and derivative

securities, and identify permitted and prohibited investments.

99