PG&E 2012 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2012 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Expected rates of return on plan assets were developed by determining projected stock and bond returns and

then applying these returns to the target asset allocations of the employee benefit trusts, resulting in a weighted

average rate of return on plan assets. Fixed-income returns were projected based on real maturity and credit spreads

added to a long-term inflation rate. Equity returns were estimated based on estimates of dividend yield and real

earnings growth added to a long-term rate of inflation. For the Utility’s defined benefit pension plan, the assumed

return of 5.4% compares to a ten-year actual return of 10.2%.

The rate used to discount pension benefits and other benefits was based on a yield curve developed from market

data of approximately 648 Aa-grade non-callable bonds at December 31, 2012. This yield curve has discount rates

that vary based on the duration of the obligations. The estimated future cash flows for the pension and other

postretirement benefit obligations were matched to the corresponding rates on the yield curve to derive a weighted

average discount rate.

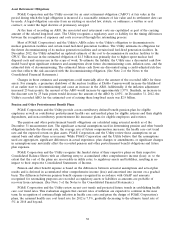

The following reflects the sensitivity of pension costs and projected benefit obligation to changes in certain

actuarial assumptions:

Increase (Decrease) Increase in 2012 Increase in Projected

in Pension Benefit Obligation at

Assumption Costs December 31, 2012

(in millions)

Discount rate ................ (0.50)% $ 110 $ 1,262

Rate of return on plan assets ..... (0.50)% 54 —

Rate of increase in compensation . . 0.50% 50 308

The following reflects the sensitivity of other postretirement benefit costs and accumulated benefit obligation to

changes in certain actuarial assumptions:

Increase Increase in 2012 Increase in Accumulated

(Decrease) in Other Postretirement Benefit Obligation at

Assumption Benefit Costs December 31, 2012

(in millions)

Health care cost trend rate . . 0.50% $ 4 $ 53

Discount rate .......... (0.50)% 2 132

Rate of return on plan assets . (0.50)% 7 —

39