PG&E 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 15: COMMITMENTS AND CONTINGENCIES (Continued)

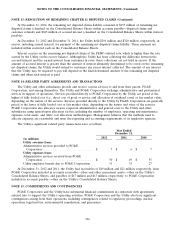

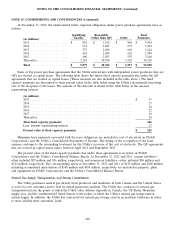

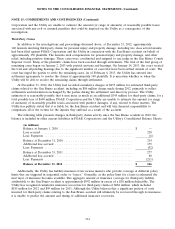

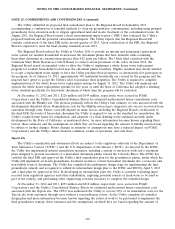

At December 31, 2012, the undiscounted future expected obligations under power purchase agreements were as

follows:

Qualifying Renewable Total

Facility (Other than QF) Other Payments

(in millions)

2013 ..................... $ 892 $ 1,356 $ 846 $ 3,094

2014 ..................... 914 1,843 677 3,434

2015 ..................... 727 2,038 649 3,414

2016 ..................... 618 2,054 626 3,298

2017 ..................... 490 2,053 597 3,140

Thereafter ................. 2,238 30,958 3,322 36,518

Total ..................... $ 5,879 $ 40,302 $ 6,717 $ 52,898

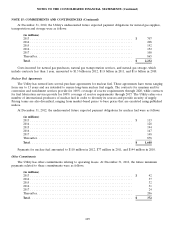

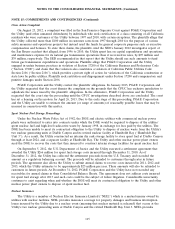

Some of the power purchase agreements that the Utility entered into with independent power producers that are

QFs are treated as capital leases. The following table shows the future fixed capacity payments due under the QF

agreements that are treated as capital leases. (These amounts are also included in the table above.) The fixed

capacity payments are discounted to their present value in the table below using the Utility’s incremental borrowing

rate at the inception of the leases. The amount of this discount is shown in the table below as the amount

representing interest.

(in millions)

2013 .......................................................... $ 35

2014 .......................................................... 27

2015 .......................................................... 24

2016 .......................................................... 22

2017 .......................................................... 18

Thereafter ...................................................... 20

Total fixed capacity payments ........................................ 146

Less: amount representing interest .................................... 21

Present value of fixed capacity payments ............................... $ 125

Minimum lease payments associated with the lease obligations are included in cost of electricity on PG&E

Corporation’s and the Utility’s Consolidated Statements of Income. The timing of the recognition of the lease

expense conforms to the ratemaking treatment for the Utility’s recovery of the cost of electricity. The QF agreements

that are treated as capital leases expire between April 2014 and September 2021.

The present value of the fixed capacity payments due under these agreements is recorded on PG&E

Corporation’s and the Utility’s Consolidated Balance Sheets. At December 31, 2012 and 2011, current liabilities—

other included $29 million and $36 million, respectively, and noncurrent liabilities—other included $96 million and

$212 million, respectively. The corresponding assets at December 31, 2012 and 2011 of $125 million and $248 million

including accumulated amortization of $148 million and $160 million, respectively are included in property, plant,

and equipment on PG&E Corporation’s and the Utility’s Consolidated Balance Sheets.

Natural Gas Supply, Transportation, and Storage Commitments

The Utility purchases natural gas directly from producers and marketers in both Canada and the United States

to serve its core customers and to fuel its owned-generation facilities. The Utility also contracts for natural gas

transportation from the points at which the Utility takes delivery (typically in Canada, the US Rocky Mountain

supply area, and the southwestern United States) to the points at which the Utility’s natural gas transportation

system begins. In addition, the Utility has contracted for natural gas storage services in northern California in order

to more reliably meet customers’ loads.

108