PG&E 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

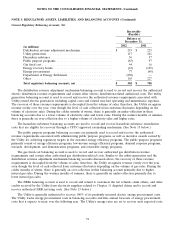

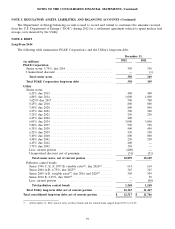

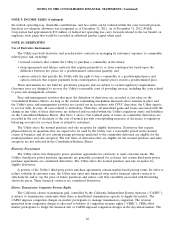

NOTE 5: ENERGY RECOVERY BONDS

In 2005, PERF issued two series of ERBs. The proceeds of the ERBs were used by PERF to purchase from the

Utility the right known as ‘‘recovery property’’ to be paid a specific amount from a dedicated rate component. The

first series of ERBs included five classes aggregating to a $1.9 billion principal amount. The proceeds of the first

series of ERBs were paid by PERF to the Utility and used by the Utility to refinance the remaining unamortized

after-tax balance of the regulatory asset established under the Chapter 11 Settlement Agreement. The second series

of ERBs included three classes aggregating to an $844 million principal amount. The proceeds of the second series

of ERBs were paid by PERF to the Utility and used to pre-fund the Utility’s tax liability for bond-related charges

collected from customers.

At December 31, 2011, the total amount of ERB principal outstanding was $423 million. The ERBs were paid in

full when the final class matured on December 25, 2012.

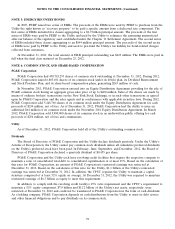

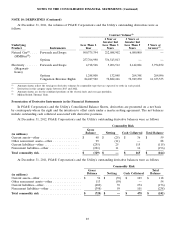

NOTE 6: COMMON STOCK AND SHARE-BASED COMPENSATION

PG&E Corporation

PG&E Corporation had 430,718,293 shares of common stock outstanding at December 31, 2012. During 2012,

PG&E Corporation issued 6,803,101 shares of its common stock under its 401(k) plan, its Dividend Reinvestment

and Stock Purchase Plan, and its share-based compensation plans, generating $263 million of cash.

In November 2011, PG&E Corporation entered into an Equity Distribution Agreement providing for the sale of

PG&E common stock having an aggregate gross sales price of up to $400 million. Sales of the shares are made by

means of ordinary brokers’ transactions on the New York Stock Exchange, or in such other transactions as agreed

upon by PG&E Corporation and the sales agents and in conformance with applicable securities laws. During 2012,

PG&E Corporation sold 5,446,760 shares of its common stock under the Equity Distribution Agreement for cash

proceeds of $234 million, net of fees. As of December 31, 2012, PG&E Corporation had the ability to issue an

additional $64 million of its common stock under the November 2011 Equity Distribution Agreement. In March

2012, PG&E Corporation sold 5,900,000 shares of its common stock in an underwritten public offering for cash

proceeds of $254 million, net of fees and commissions.

Utility

As of December 31, 2012, PG&E Corporation held all of the Utility’s outstanding common stock.

Dividends

The Board of Directors of PG&E Corporation and the Utility declare dividends quarterly. Under the Utility’s

Articles of Incorporation, the Utility cannot pay common stock dividends unless all cumulative preferred dividends

on the Utility’s preferred stock have been paid. In February, June, September, and December, 2012, the Board of

Directors of PG&E Corporation declared a quarterly dividend of $0.455 per share.

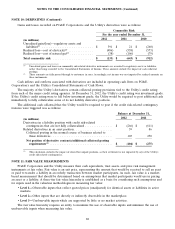

PG&E Corporation and the Utility each have revolving credit facilities that require the respective company to

maintain a ratio of consolidated total debt to consolidated capitalization of at most 65%. Based on the calculation of

this ratio for PG&E Corporation, no amount of PG&E Corporation’s reinvested earnings was restricted at

December 31, 2012. Based on the calculation of this ratio for the Utility, $1.1 billion of the Utility’s reinvested

earnings was restricted at December 31, 2012. In addition, the CPUC requires the Utility to maintain a capital

structure composed of at least 52% equity on average. At December 31, 2012, the Utility was required to maintain

reinvested earnings of $6.3 billion as equity to meet this requirement.

In addition, to comply with the revolving credit facility’s 65% ratio requirement and the CPUC’s requirement to

maintain a 52% equity component, $7.0 billion and $12.2 billion of the Utility’s net assets, respectively, were

restricted at December 31, 2012 and could not be transferred to PG&E Corporation in the form of cash dividends.

As a holding company, PG&E Corporation depends on cash distributions from the Utility to meet its debt service

and other financial obligations and to pay dividends on its common stock.

78