PG&E 2012 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2012 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

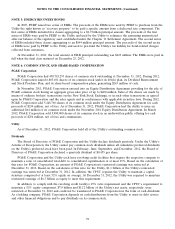

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

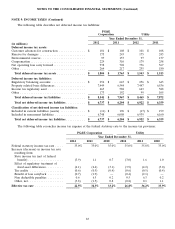

NOTE 9: INCOME TAXES (Continued)

Unrecognized tax benefits

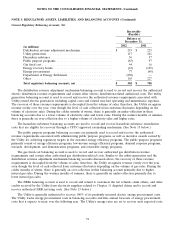

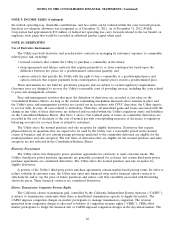

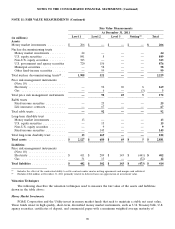

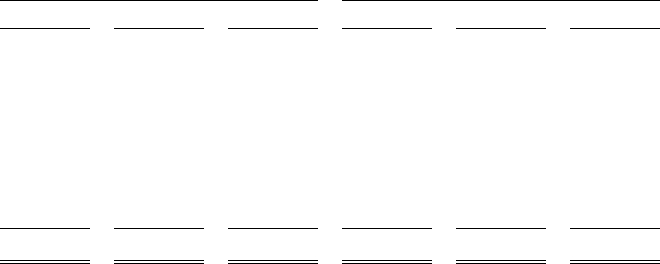

The following table reconciles the changes in unrecognized tax benefits:

PG&E Corporation Utility

2012 2011 2010 2012 2011 2010

(in millions)

Balance at beginning of year ........ $ 506 $ 714 $ 673 $ 503 $ 712 $ 652

Additions for tax position taken

during a prior year ............ 32 2 27 26 2 27

Reductions for tax position taken

during a prior year ............ (13) (198) (20) (10) (196) —

Additions for tax position taken

during the current year ......... 67 3 89 67 — 87

Settlements ................... (11) (15) (55) (11) (15) (54)

Balance at end of year ............ $ 581 $ 506 $ 714 $ 575 $ 503 $ 712

The component of unrecognized tax benefits that, if recognized, would affect the effective tax rate at

December 31, 2012 for PG&E Corporation and the Utility was $18 million, with the remaining balance representing

the potential deferral of taxes to later years.

PG&E Corporation and the Utility recognize accrued interest related to unrecognized tax benefits as income tax

expense in the Consolidated Statements of Income. Interest income and interest expense for the years ended

December 31, 2012, December 31, 2011, and December 31, 2010 were immaterial.

As of December 31, 2012 and December 31, 2011, PG&E Corporation and the Utility had receivables for

accrued interest income. The amounts of these receivables were immaterial.

The Internal Revenue Service (‘‘IRS’’) is working with the utility industry to finalize guidance on what is a

repair deduction for tax purposes for the natural gas transmission, natural gas distribution, and electric generation

businesses. PG&E Corporation and the Utility expect the IRS to release this guidance in the first half of 2013.

PG&E Corporation and the Utility expect the unrecognized tax benefits may change significantly within the next

12 months.

The IRS is auditing a 2008 accounting method change of the Utility to accelerate the amount of deductible

repairs. The audit is expected to be completed in 2013. The resolution of the audit could result in a significant

change in unrecognized tax benefit. However, PG&E Corporation and the Utility cannot estimate the change of

unrecognized tax benefits related to the items discussed above.

Tax settlements and years that remain subject to examination

In 2008, PG&E Corporation began participating in the Compliance Assurance Process (‘‘CAP’’), a real-time IRS

audit intended to expedite resolution of tax matters. The CAP audit culminates with a letter from the IRS indicating

its acceptance of the return. The IRS partially accepted the 2008 return, withholding two matters for further review.

In December 2010, the IRS accepted the 2009 tax return without change. In September 2011, the IRS partially

accepted the 2010 return, withholding two matters for further review. In September 2012, the IRS partially accepted

the 2011 return, withholding several matters for future review.

The most significant of the matters withheld for further review in each of these years relates to a tax accounting

method change of the Utility related to repairs. The IRS has not completed its review of these claims.

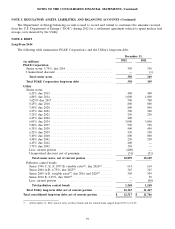

Loss carry forwards

As of December 31, 2012, PG&E Corporation had approximately $2.1 billion of federal net operating loss carry

forwards and $12 million of tax credit carry forwards, which will expire between 2029 and 2032. In addition, PG&E

Corporation had approximately $128 million of loss carry forwards related to charitable contributions, which will

expire between 2013 and 2017. PG&E Corporation believes it is more likely than not the tax benefits associated with

84