PG&E 2012 Annual Report Download - page 10

Download and view the complete annual report

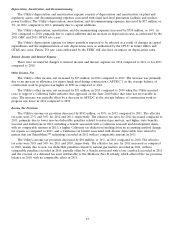

Please find page 10 of the 2012 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Utility’s capital expenditures, operating expenses, and collateral requirements associated with price risk

management activities. The Utility forecasts that capital spending will total approximately $5.1 billion in 2013,

including capital projects related to its pipeline safety enhancement plan. PG&E Corporation’s and the

Utility’s ability to access the capital markets and the terms and rates of future financings could be affected by

changes in their respective credit ratings, the outcome of natural gas matters, general economic and market

conditions, and other factors. (See ‘‘Liquidity and Financial Resources’’ below.)

•The Timing and Outcome of Ratemaking Proceedings. The Utility’s financial results are affected by the timing

and outcome of ratemaking proceedings. The CPUC issued decisions in 2011 that determined the majority of

the Utility’s base revenue requirements through 2013. In November 2012, the Utility filed its 2014 GRC

application with the CPUC to request that the CPUC determine the amount of revenue requirements the

Utility is authorized to collect through rates for its electric generation operations and electric and natural gas

distribution from 2014 through 2016. The Utility has requested that the CPUC increase the Utility’s base

revenues for 2014 by $1.28 billion over the comparable revenues for 2013 that were previously authorized.

(See ‘‘2014 General Rate Case’’ below.) The FERC is expected to determine in the pending TO rate case the

amount of electric transmission revenues the Utility can recover beginning in May 2013. (See ‘‘FERC

Transmission Owner Rate Case’’ below.) In addition, in late 2013, the Utility expects to file an application

with the CPUC to initiate the Utility’s 2015 GT&S rate case in which the CPUC will determine the rates, and

terms and conditions of the Utility’s gas transmission and storage services beginning January 1, 2015. The

outcome of these ratemaking proceedings can be affected by many factors, including general economic

conditions, the level of customer rates, regulatory policies, and political considerations.

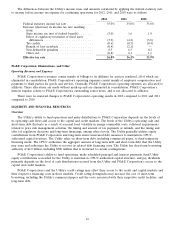

•The Ability of the Utility to Control Operating Costs and Capital Expenditures. Rates are primarily set based on

forecasts and assumptions about the amount of operating costs and capital expenditures the Utility will incur

in future periods. PG&E Corporation’s and the Utility’s net income is negatively affected when the revenues

provided by rates are not sufficient for the Utility to recover the costs it actually incurs. In 2012, in addition to

the non-recoverable costs related to the Utility’s natural gas system described above, the Utility incurred costs

of $255 million to improve the safety and reliability of its electric and natural gas operations that it will not

recover through rates. The Utility forecasts that it will incur approximately $250 million to make additional

incremental improvements in 2013 that it will not recover through rates. (See ‘‘Operating and Maintenance’’

below.) In addition, 2013 net income will be negatively affected by costs related to capital expenditures that

the Utility forecasts will exceed authorized levels. Any future increase in the Utility’s environmental-related

liabilities that are not recoverable through rates, such as costs associated with its natural gas compressor

station located in Hinkley, California, also will negatively affect PG&E Corporation’s and the Utility’s net

income. For 2012, the Utility recorded total charges to net income of $127 million for environmental

remediation related to the Hinkley site. (See ‘‘Environmental Matters’’ below.) Other differences between the

amount or timing of the Utility’s actual costs and forecasted or authorized amounts may also affect the

Utility’s ability to earn its authorized ROE.

6