PG&E 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

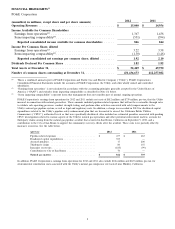

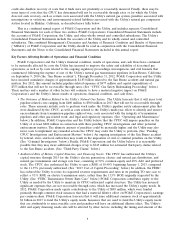

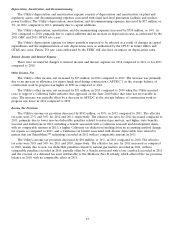

Summary of Changes in Earnings per Common Share and Income Available for Common Shareholders for 2012

The following table is a summary reconciliation of the key changes, after-tax, in PG&E Corporation’s income

available for common shareholders and earnings per common share for the year ended December 31, 2012:

Earnings Per

Common Share

Earnings (Diluted)

(in millions, except per share amounts)

Income Available for Common Shareholders—2011 ...................... $ 844 $ 2.10

Increase in rate base earnings .................................... 80 0.19

Natural gas matters(1) .......................................... 32 0.15

Storm and outage expenses ...................................... 28 0.06

Litigation and regulatory matters ................................. 27 0.06

Gas transmission revenues ...................................... 15 0.04

Environmental-related costs ..................................... 11 0.03

Planned incremental work ...................................... (151) (0.36)

Employee operational performance incentive ......................... (33) (0.08)

Energy efficiency incentive ...................................... (3) (0.01)

Increase in shares outstanding(2) .................................. —(0.19)

Other ..................................................... (34) (0.07)

Income Available for Common Shareholders—2012 ...................... $ 816 $ 1.92

(1) The Utility incurred charges related to natural gas matters of $812 million and $739 million, pre-tax, for 2012 and 2011, respectively. The

amount shown above represents the favorable tax impact attributable to the lower amount of non-deductible penalties recorded in 2012 of

$17 million, as compared to $200 million recorded in 2011.

(2) Represents the impact of a higher number of shares outstanding at December 31, 2012, compared to the number of shares outstanding at

December 31, 2011. PG&E Corporation issues shares to fund its equity contributions to the Utility to maintain the Utility’s capital structure

and fund operations, including expenses related to natural gas matters. This has no dollar impact on earnings.

CAUTIONARY LANGUAGE REGARDING FORWARD-LOOKING STATEMENTS

This 2012 Annual Report contains forward-looking statements that are necessarily subject to various risks and

uncertainties. These statements reflect management’s judgment and opinions which are based on current estimates,

expectations, and projections about future events and assumptions regarding these events and management’s

knowledge of facts as of the date of this report.

These forward-looking statements relate to, among other matters, estimated losses associated with various

investigations; estimated losses and insurance recoveries associated with the civil litigation arising from the San

Bruno accident; forecasts of costs the Utility will incur to make safety and reliability improvements, including costs to

perform work under the pipeline safety enhancement plan, that the Utility will not recover through rates; forecasts of

capital expenditures; estimates and assumptions used in critical accounting policies, including those relating to

environmental remediation, tax, litigation, third-party claims, and other liabilities; and the level of future equity or

debt issuances. These statements are also identified by words such as ‘‘assume,’’ ‘‘expect,’’ ‘‘intend,’’ ‘‘forecast,’’

‘‘plan,’’ ‘‘project,’’ ‘‘believe,’’ ‘‘estimate,’’ ‘‘predict,’’ ‘‘anticipate,’’ ‘‘may,’’ ‘‘should,’’ ‘‘would,’’ ‘‘could,’’ ‘‘potential’’ and

similar expressions. PG&E Corporation and the Utility are not able to predict all the factors that may affect future

results. Some of the factors that could cause future results to differ materially from those expressed or implied by the

forward-looking statements, or from historical results, include, but are not limited to:

• the timing and terms of the resolution of pending investigations and enforcement matters related to the

Utility’s natural gas system operating practices and the San Bruno accident, including the ultimate amount of

penalties the Utility will be required to pay, the cost of any remedial actions the Utility may be ordered to

perform, and whether the resolution is reached through settlement negotiations, or a fully litigated

proceeding; the ultimate amount of third-party claims associated with the San Bruno accident and the timing

and amount of related insurance recoveries; the ultimate amount of punitive damages, if any, the Utility may

incur related to third-party claims; and the ultimate amount of civil or criminal penalties, if any, the Utility

may incur related to the criminal investigation;

• the outcomes of current ratemaking proceedings, such as the 2014 GRC and the pending TO rate case; the

outcome of future ratemaking and regulatory proceedings, such as the 2015 GT&S rate case, and the CPUC’s

natural gas rulemaking proceeding in which the CPUC will consider the Utility’s proposed scope, timing, and

7