PG&E 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136

|

|

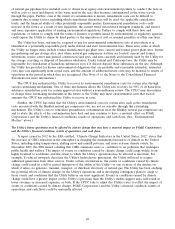

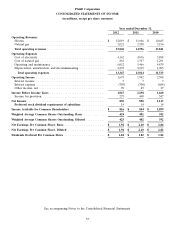

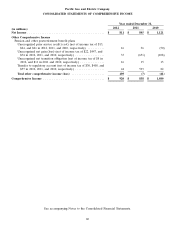

PG&E Corporation

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Year ended December 31,

2012 2011 2010

(in millions)

Net Income ............................................ $ 830 $ 858 $ 1,113

Other Comprehensive Income

Pension and other postretirement benefit plans

Unrecognized prior service credit (cost) (net of income tax of $14,

$24, and $20 in 2012, 2011, and 2010, respectively) .......... 17 36 (29)

Unrecognized net gain (loss) (net of income tax of $20, $452, and

$73 in 2012 , 2011, and 2010, respectively) ................ 31 (655) (110)

Unrecognized net transition obligation (net of income tax of $8 in

2012, and $11 in 2011 and 2010, respectively) .............. 16 15 15

Transfer to regulatory account (net of income tax of $30, $408, and

$57 in 2012, 2011, and 2010, respectively) ................. 44 593 82

Other (net of income tax of $3 in 2012) ...................... 4 ——

Total other comprehensive income (loss) ................... 112 (11) (42)

Comprehensive Income ................................... 942 847 1,071

Preferred stock dividend requirement of subsidiary ............. 14 14 14

Comprehensive Income Attributable to Common Shareholders ....... $ 928 $ 833 $ 1,057

See accompanying Notes to the Consolidated Financial Statements.

54