PG&E 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

‘‘Spent Nuclear Fuel Storage Proceedings’’ in Note 15 below). Recovered amounts will be refunded to customers

through rates. In its 2012 NDCTP application, the Utility requested that the CPUC issue a final decision by the end

of 2013.

The estimated undiscounted nuclear decommissioning cost for the Utility’s nuclear generation facilities was

approximately $3.5 billion at December 31, 2012 and $2.3 billion at December 31, 2011, as filed in the 2012 and 2009

NDCTPs, respectively. In future dollars, the estimated nuclear decommissioning cost is approximately $6.1 billion and

$4.4 billion, respectively. These estimates are based on the 2012 and 2009 decommissioning cost studies, respectively,

and are prepared in accordance with CPUC requirements. The estimated nuclear decommissioning cost in future

dollars is discounted for GAAP purposes and recognized as an ARO on the Consolidated Balance Sheets. The total

nuclear decommissioning obligation accrued in accordance with GAAP was $2.5 billion at December 31, 2012 and

$1.2 billion at December 31, 2011.

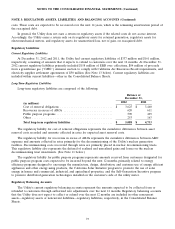

A reconciliation of the changes in the ARO liability is as follows:

(in millions)

ARO liability at December 31, 2010 ................................... $ 1,586

Revision in estimated cash flows ...................................... 10

Accretion ...................................................... 100

Liabilities settled ................................................. (87)

ARO liability at December 31, 2011 ................................... 1,609

Revision in estimated cash flows ...................................... 1,301

Accretion ...................................................... 101

Liabilities settled ................................................. (92)

ARO liability at December 31, 2012 ................................... $ 2,919

The Utility has identified the following AROs for which a reasonable estimate of fair value could not be made.

As a result, the Utility has not recorded a liability related to these AROs:

•Restoration of land to its pre-use condition under the terms of certain land rights agreements. Land rights will be

maintained for the foreseeable future, and therefore, the Utility cannot reasonably estimate the settlement

date(s) or range of settlement dates for the obligations associated with these assets;

•Removal and proper disposal of lead-based paint contained in some Utility facilities. The Utility does not have

information available that specifies which facilities contain lead-based paint and, therefore, cannot reasonably

estimate the settlement date(s) associated with the obligations; and

•Removal of certain communications equipment from leased property, and retirement activities associated with

substation and certain hydroelectric facilities. The Utility will maintain and continue to operate its hydroelectric

facilities until the operation of a facility becomes uneconomical. The operation of the majority of the Utility’s

hydroelectric facilities is currently, and for the foreseeable future, expected to be economically beneficial.

Therefore, the settlement date(s) cannot be reasonably estimated at this time.

Disallowance of Plant Costs

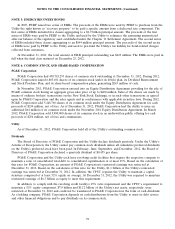

PG&E Corporation and the Utility record a charge to net income when it is both probable that costs incurred

or projected to be incurred for recently completed plant will not be recoverable through rates charged to customers

and the amount of disallowance can be reasonably estimated. During 2012, the Utility recorded a $353 million charge

to net income for capital expenditures incurred in connection with its pipeline safety enhancement plan that were

either specifically disallowed or that are forecasted to exceed the CPUC’s authorized levels. (See ‘‘CPUC Gas Safety

Rulemaking Proceeding’’ in Note 15 below). No material disallowance losses were recorded in 2011 and $36 million

in disallowance losses were recorded in 2010.

68