PG&E 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

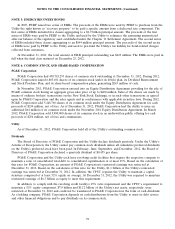

NOTE 10: DERIVATIVES (Continued)

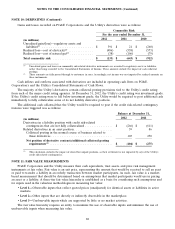

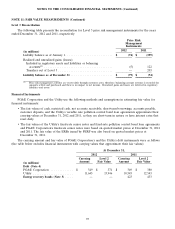

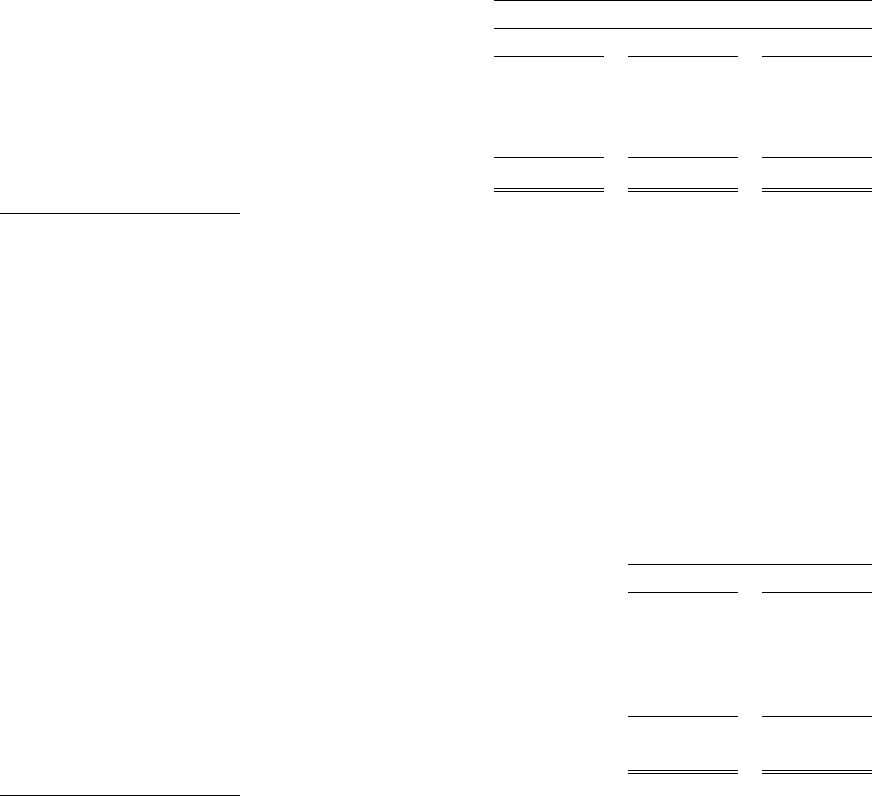

Gains and losses recorded on PG&E Corporation’s and the Utility’s derivatives were as follows:

Commodity Risk

For the year ended December 31,

2012 2011 2010

(in millions)

Unrealized gain/(loss)—regulatory assets and

liabilities(1) ............................. $ 391 $ 21 $ (260)

Realized loss—cost of electricity(2) .............. (486) (558) (573)

Realized loss—cost of natural gas(2) ............. (38) (106) (79)

Total commodity risk ....................... $ (133) $ (643) $ (912)

(1) Unrealized gains and losses on commodity risk-related derivative instruments are recorded to regulatory assets or liabilities,

rather than being recorded to the Consolidated Statements of Income. These amounts exclude the impact of cash collateral

postings.

(2) These amounts are fully passed through to customers in rates. Accordingly, net income was not impacted by realized amounts on

these instruments.

Cash inflows and outflows associated with derivatives are included in operating cash flows on PG&E

Corporation’s and the Utility’s Consolidated Statements of Cash Flows.

The majority of the Utility’s derivatives contain collateral posting provisions tied to the Utility’s credit rating

from each of the major credit rating agencies. At December 31, 2012, the Utility’s credit rating was investment grade.

If the Utility’s credit rating were to fall below investment grade, the Utility would be required to post additional cash

immediately to fully collateralize some of its net liability derivative positions.

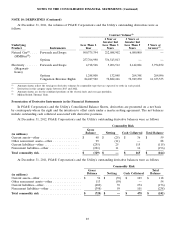

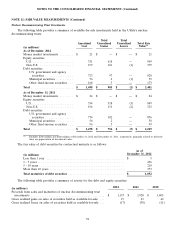

The additional cash collateral that the Utility would be required to post if the credit risk-related contingency

features were triggered was as follows:

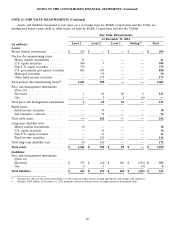

Balance at December 31,

2012 2011

(in millions)

Derivatives in a liability position with credit risk-related

contingencies that are not fully collateralized ................ $ (266) $ (611)

Related derivatives in an asset position ...................... 59 86

Collateral posting in the normal course of business related to

these derivatives ................................... 103 250

Net position of derivative contracts/additional collateral posting

requirements(1) .................................... $ (104) $ (275)

(1) This calculation excludes the impact of closed but unpaid positions, as their settlement is not impacted by any of the Utility’s

credit risk-related contingencies.

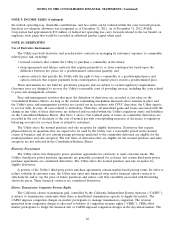

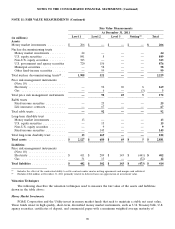

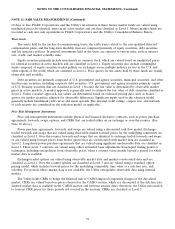

NOTE 11: FAIR VALUE MEASUREMENTS

PG&E Corporation and the Utility measure their cash equivalents, trust assets, and price risk management

instruments at fair value. Fair value is an exit price, representing the amount that would be received to sell an asset

or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-

based measurement that should be determined based on assumptions that market participants would use in pricing

an asset or a liability. A three-tier fair value hierarchy is established as a basis for considering such assumptions and

for inputs used in the valuation methodologies in measuring fair value:

•Level 1—Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active

markets.

•Level 2—Other inputs that are directly or indirectly observable in the marketplace.

•Level 3—Unobservable inputs which are supported by little or no market activities.

The fair value hierarchy requires an entity to maximize the use of observable inputs and minimize the use of

unobservable inputs when measuring fair value.

88