PG&E 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.could also disallow recovery of costs that it finds were not prudently or reasonably incurred. Finally, there may be

some types of costs that the CPUC has determined will not be recoverable through rates or for which the Utility

does not seek recovery, such as certain costs associated with the Utility’s natural gas system, penalties associated with

investigations or violations, and environmental-related liabilities associated with the Utility’s natural gas compressor

station located in Hinkley, California, as described more fully below.

This is a combined annual report of PG&E Corporation and the Utility, and includes separate Consolidated

Financial Statements for each of these two entities. PG&E Corporation’s Consolidated Financial Statements include

the accounts of PG&E Corporation, the Utility, and other wholly owned and controlled subsidiaries. The Utility’s

Consolidated Financial Statements include the accounts of the Utility and its wholly owned and controlled

subsidiaries. This combined Management’s Discussion and Analysis of Financial Condition and Results of Operations

(‘‘MD&A’’) of PG&E Corporation and the Utility should be read in conjunction with the Consolidated Financial

Statements and the Notes to the Consolidated Financial Statements included in this annual report.

Key Factors Affecting Results of Operations and Financial Condition

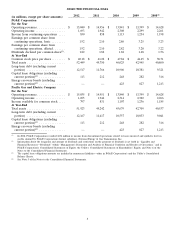

PG&E Corporation’s and the Utility’s financial condition, results of operations, and cash flows have continued

to be materially affected by costs the Utility has incurred to improve the safety and reliability of its natural gas

operations, as well as by costs related to the ongoing regulatory proceedings, investigations, and civil lawsuits that

commenced following the rupture of one of the Utility’s natural gas transmission pipelines in San Bruno, California

on September 9, 2010 (the ‘‘San Bruno accident’’). Through December 31, 2012, PG&E Corporation and the Utility

have incurred cumulative charges of approximately $1.83 billion related to the San Bruno accident and natural gas

matters. For 2012, this amount includes pipeline-related expenses of $477 million and capital expenditures of

$353 million that will not be recoverable through rates. (See ‘‘CPUC Gas Safety Rulemaking Proceeding’’ below.)

These matters and a number of other factors will continue to have a material negative impact on PG&E

Corporation’s and the Utility’s future results of operations, financial condition, and cash flows.

•The Outcome of Matters Related to the Utility’s Natural Gas System. The Utility forecasts that it will incur total

pipeline-related costs ranging from $400 million to $500 million in 2013 that will not be recoverable through

rates. These amounts include costs to perform work under the Utility’s pipeline safety enhancement plan that

were disallowed by the CPUC, as well as costs related to the Utility’s multi-year effort to identify and remove

encroachments from transmission pipeline rights-of-way; costs associated with the integrity of transmission

pipelines and other gas-related work; and legal and regulatory expenses. (See ‘‘Operating and Maintenance’’

below.) In addition, PG&E Corporation and the Utility believe that the CPUC will impose penalties on the

Utility of at least $200 million in connection with three pending CPUC investigations and other potential

enforcement matters. The ultimate amount of penalties could be materially higher and the Utility may also

incur costs to implement any remedial actions the CPUC may order the Utility to perform. (See ‘‘Pending

CPUC Investigations and Enforcement Matters’’ below.) An ongoing investigation of the San Bruno accident

by federal, state, and local authorities may result in the imposition of civil or criminal penalties on the Utility.

(See ‘‘Criminal Investigation’’ below.) Finally, PG&E Corporation and the Utility believe it is reasonably

possible that they may incur additional charges of up to $145 million for estimated third-party claims related

to the San Bruno accident. (See ‘‘Third-Party Claims’’ below.)

•Authorized Rate of Return, Capital Structure, and Financing Needs. The CPUC has authorized the Utility’s

capital structure through 2015 for the Utility’s electric generation, electric and natural gas distribution, and

natural gas transmission and storage rate base, consisting of 52% common equity and 48% debt and preferred

stock. The CPUC also authorized the Utility to earn a ROE of 10.40% beginning January 1, 2013, compared

to the 11.35% previously authorized. (See ‘‘2013 Cost of Capital Proceeding’’ below.) In addition, the FERC

has ordered the Utility to revise its requested revenue requirements and rates in its pending TO rate case to

reflect a 9.1% ROE on electric transmission assets, rather than the 11.5% ROE originally requested by the

Utility. (See ‘‘FERC Transmission Owner Rate Case’’ below.) PG&E Corporation contributes equity to the

Utility as needed by the Utility to maintain its CPUC-authorized capital structure. The Utility has incurred

significant expenses that are not recoverable through rates, which has increased the Utility’s equity needs. In

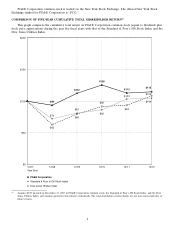

2012, PG&E Corporation made equity contributions to the Utility of $885 million, which were funded

primarily through common stock issuances that had a material dilutive effect on PG&E Corporation’s earnings

per common share. PG&E Corporation forecasts that it will issue additional common stock of approximately

$1 billion in 2013 to fund the Utility’s equity needs. Issuances that are used to fund the Utility’s equity needs

that are attributable to unrecoverable costs and penalties will have an additional dilutive effect. The Utility’s

debt and equity financing needs also will be affected by other factors, including the timing and amount of the

5