PG&E 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PG&E Corporation and Pacific Gas and Electric Company

2012 Annual Report

Table of contents

-

Page 1

PG&E Corporation and Pacific Gas and Electric Company 2012 Annual Report -

Page 2

-

Page 3

... Statements Quarterly Consolidated Financial Data Management's Report on Internal Control Over Financial Reporting PG&E Corporation and Pacific Gas and Electric Company Boards of Directors Officers of PG&E Corporation and Pacific Gas and Electric Company Shareholder Information 1 2 3 4 53 65 120... -

Page 4

-

Page 5

... and regulatory costs. In addition, a charge was recorded in 2012 for disallowed capital expenditures related to the Utility's pipeline safety enhancement plan that are forecasted to exceed the California Public Utilities Commission's (''CPUC'') authorized levels or that were specifically disallowed... -

Page 6

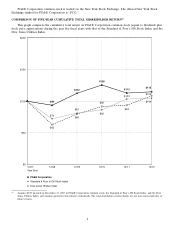

... is traded on the New York Stock Exchange. The official New York Stock Exchange symbol for PG&E Corporation is ''PCG.'' COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL SHAREHOLDER RETURN(1) This graph compares the cumulative total return on PG&E Corporation common stock (equal to dividends plus stock price... -

Page 7

... stock price per share ...Total assets ...Long-term debt (excluding current portion) ...Capital lease obligations (excluding current portion)(3) ...Energy recovery bonds (excluding current portion)(4) ...Pacific Gas and Electric Company For the Year Operating revenues ...Operating income ...Income... -

Page 8

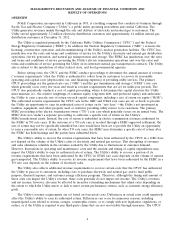

..., and decommissioning of the Utility's nuclear generation facilities. The CPUC has jurisdiction over the rates and terms and conditions of service for the Utility's electricity and natural gas distribution operations, electric generation, and natural gas transportation and storage. The FERC has... -

Page 9

...party claims related to the San Bruno accident. (See ''Third-Party Claims'' below.) • Authorized Rate of Return, Capital Structure, and Financing Needs. The CPUC has authorized the Utility's capital structure through 2015 for the Utility's electric generation, electric and natural gas distribution... -

Page 10

... enhancement plan. PG&E Corporation's and the Utility's ability to access the capital markets and the terms and rates of future financings could be affected by changes in their respective credit ratings, the outcome of natural gas matters, general economic and market conditions, and other factors... -

Page 11

... issues shares to fund its equity contributions to the Utility to maintain the Utility's capital structure and fund operations, including expenses related to natural gas matters. This has no dollar impact on earnings. CAUTIONARY LANGUAGE REGARDING FORWARD-LOOKING STATEMENTS This 2012 Annual Report... -

Page 12

... located near Hinkley, California; • the impact of new legislation or NRC regulations, recommendations, policies, decisions, or orders relating to the operations, seismic design, security, safety, or decommissioning of nuclear facilities, including the Utility's Diablo Canyon nuclear power plant... -

Page 13

... to the Utility's natural gas operations affects the Utility's ability to make distributions to PG&E Corporation in the form of dividends or share repurchases; and, in turn, PG&E Corporation's ability to pay dividends; • the outcome of federal or state tax audits and the impact of any changes in... -

Page 14

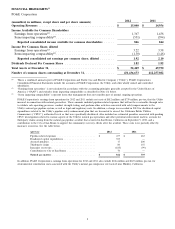

... 1,099 (in millions) Utility Electric operating revenues ...Natural gas operating revenues ...Total operating revenues ...Cost of electricity ...Cost of natural gas ...Operating and maintenance ...Depreciation, amortization, and decommissioning Operating income Interest income . . Interest expense... -

Page 15

... Revenues The Utility's electric operating revenues consist of amounts charged to customers for electricity generation, transmission and distribution services, as well as amounts charged to customers to recover the cost of electricity procurement and the cost of public purpose, energy efficiency... -

Page 16

... future cost of electricity also will be affected by legislation and rules applicable to GHG emissions. (See ''Environmental Matters'' below.) Natural Gas Operating Revenues The Utility's natural gas operating revenues consist of amounts charged for transportation, distribution, and storage services... -

Page 17

... the market price of natural gas and changes in customer demand. In addition, the Utility's future cost of natural gas may be affected by federal or state legislation or rules to regulate the GHG emissions from the Utility's natural gas transportation and distribution facilities and from natural gas... -

Page 18

... associated legal and regulatory costs. In addition, a $353 million charge was recorded in 2012 for disallowed capital expenditures related to the Utility's pipeline safety enhancement plan that are forecasted to exceed the CPUC's authorized levels or that were specifically disallowed. Also included... -

Page 19

... non-tax deductible penalties related to natural gas matters, and higher state benefits received and deductions in 2012, including a benefit associated with a California research and development claim, with no comparable amount in 2011; a higher California tax deduction resulting from an accounting... -

Page 20

... payments, fund Utility equity contributions as needed for the Utility to maintain its CPUC-authorized capital structure, and pay dividends primarily depends on the level of cash distributions received from the Utility and PG&E Corporation's access to the capital and credit markets. PG&E Corporation... -

Page 21

...revolving credit facilities and the Utility's commercial paper program at December 31, 2012: Termination Date May 2016 May 2016 $ $ Facility Limit Letters of Credit Outstanding - 266 266 Commercial Paper $ $ Facility Availability 180 2,364(3) 2,544 (in millions) PG&E Corporation ...Utility ...Total... -

Page 22

... with applicable securities laws. For 2012, PG&E Corporation sold 5,446,760 shares of its common stock under the Equity Distribution Agreement for cash proceeds of $234 million, net of fees and commissions paid of $2 million. The proceeds from these sales were used for general corporate purposes... -

Page 23

...: Allow sufficient cash to pay a dividend and to fund investments while avoiding having to issue new equity unless PG&E Corporation's or the Utility's capital expenditure requirements are growing rapidly and PG&E Corporation or the Utility can issue equity at reasonable cost and terms; and... -

Page 24

..., and decommissioning ...Allowance for equity funds used during construction ...Deferred income taxes and tax credits, net ...Disallowed capital expenditures ...Other ...Effect of changes in operating assets and liabilities: Accounts receivable ...Inventories ...Accounts payable ...Income taxes... -

Page 25

...discount, and issuance costs of $13 in 2012, $8 in 2011, and $23 in 2010 ...Short-term debt matured ...Long-term debt matured or repurchased ...Energy recovery bonds matured ...Preferred stock dividends paid ...Common stock dividends paid ...Equity contribution ...Other ...Net cash provided by (used... -

Page 26

... Energy (other than QF) . Other power purchase agreements . . Natural gas supply, transportation, and storage ...Nuclear fuel agreements ...Pension and other benefits(3) ...Capital lease obligations(4) ...Operating leases(4) ...Preferred dividends(5) ...PG&E Corporation Long-term debt(1): Fixed rate... -

Page 27

... TO, and GT&S rate cases. (See ''2014 General Rate Case'' below.) The Utility also collects additional revenue requirements to recover capital expenditures related to projects that have been specifically authorized by the CPUC, such as new power plants, gas or electric distribution projects, and the... -

Page 28

Corporation and the Utility have incurred total cumulative charges to net income of $1.83 billion related to natural gas matters. (in millions) Pipeline-related expenses(1) ...Disallowed capital expenditures(1) Accrued penalties(2) ...Third-party claims(3) ...Insurance recoveries(3) ...Contribution ... -

Page 29

...Utility's financial condition, results of operations, and cash flows. CPUC Gas Safety Rulemaking Proceeding The CPUC is conducting a rulemaking proceeding to develop and adopt new safety and reliability regulations for natural gas transmission and distribution pipelines in California and the related... -

Page 30

...incur additional non-recoverable costs. The CPUC also ordered the SED to engage consultants to conduct management and financial audits to address safety-related corporate culture and historical spending. (As discussed below, the financial audit of the Utility's natural gas distribution spending will... -

Page 31

... above, at December 31, 2012, approximately 140 lawsuits involving third-party claims for personal injury and property damage, including two class action lawsuits, had been filed against PG&E Corporation and the Utility in connection with the San Bruno accident on behalf of approximately 450... -

Page 32

... long-term debt, and 1% preferred stock, beginning on January 1, 2013. This capital structure applies to the Utility's electric generation, electric and natural gas distribution, and natural gas transmission and storage rate base. In addition, the CPUC authorized the Utility to earn a rate of return... -

Page 33

...to operate the Utility's hydroelectric system (including costs related to the Helms pumped storage facility and costs associated with operating licenses issued by the FERC), comply with new requirements adopted by the NRC applicable to the Utility's Diablo Canyon nuclear power plant, and operate and... -

Page 34

... the Utility's 2014 cost forecast to ensure that safety and security concerns have been addressed and that the plans properly incorporate risk assessments and mitigation measures. The SED has also engaged independent consultants to conduct a financial audit of the Utility's gas distribution system... -

Page 35

... Factors'' below.) Finally, the CPUC is also considering the Utility's application to recover estimated costs to decommission the Utility's nuclear facilities at Diablo Canyon and the retired nuclear facility located at the Utility's Humboldt Bay Generation Station. The Utility files an application... -

Page 36

... plant (''MGP'') sites, current and former power plant sites, former gas gathering and gas storage sites, sites where natural gas compressor stations are located, current and former substations, service center and general construction yard sites, and sites currently and formerly used by the Utility... -

Page 37

... Remediation costs for the Hinkley natural gas compressor site are not recovered from customers through rates. Future costs will depend on many factors, including the Regional Board's certification of the final EIR, the levels of hexavalent chromium the Utility is required to use as the standard for... -

Page 38

...to have, a current or future material effect on their financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures, or capital resources, other than those discussed in Note 2 (PG&E Corporation's tax equity financing agreements) and... -

Page 39

.... Energy Procurement Credit Risk The Utility conducts business with counterparties mainly in the energy industry, including other California investor-owned electric utilities, municipal utilities, energy trading companies, financial institutions, and oil and natural gas production companies located... -

Page 40

... many energy contracts to master commodity enabling agreements that may require security (referred to as ''Credit Collateral'' in the table below). Credit collateral may be in the form of cash or letters of credit. The Utility may accept other forms of performance assurance in the form of corporate... -

Page 41

...various potential sites, including former MGP sites, power plant sites, gas compressor stations, and sites used by the Utility for the storage, recycling, or disposal of potentially hazardous materials, even if the Utility did not deposit those substances on the site. The Utility generally commences... -

Page 42

... assumptions used in determining pension and other benefit obligations include the discount rate, the average rate of future compensation increases, the health care cost trend rate and the expected return on plan assets. PG&E Corporation and the Utility review these assumptions on an annual basis... -

Page 43

... real earnings growth added to a long-term rate of inflation. For the Utility's defined benefit pension plan, the assumed return of 5.4% compares to a ten-year actual return of 10.2%. The rate used to discount pension benefits and other benefits was based on a yield curve developed from market data... -

Page 44

... Utility's safety recordkeeping for its natural gas transmission system and the Utility's pipeline installation, integrity management, and other operational practices; and the media coverage of the accident and the related investigations and lawsuits. After the San Bruno accident, the CPUC initiated... -

Page 45

... of its natural gas and electricity operations. Although the CPUC approved most of the proposed scope and timing of projects under the Utility's pipeline safety enhancement plan, the CPUC disallowed the Utility's request for rate recovery of a significant portion of capital costs and expenses... -

Page 46

... mechanisms permit the Utility to pass through its costs to procure electricity and natural gas to customers in rates. A significant and sustained rise in commodity prices, caused by costs associated with new renewable energy resources and California's new cap-and-trade program and other factors... -

Page 47

... agreements, and purchases on the wholesale electricity market. The Utility must manage these sources using the principles of ''least cost dispatch.'' The Utility enters into power purchase agreements, including contracts to purchase renewable energy, in compliance with a long-term procurement plan... -

Page 48

... choice aggregators to purchase and sell electricity for their residents and businesses. Although the Utility is permitted to collect a non-bypassable charge for generation-related costs incurred on behalf of these customers, or distribution, metering, or other services it continues to provide... -

Page 49

... electricity or natural gas; cause unplanned outages or reduce generating output which may require the Utility to incur costs to purchase replacement power; cause damage to the Utility's assets or operations requiring the Utility to incur unplanned expenses to respond to emergencies and make repairs... -

Page 50

... reputational harm generated by the negative publicity stemming from the San Bruno accident. Any such occurrences could negatively impact PG&E Corporation's and the Utility's financial condition and results of operations. The operation and decommissioning of the Utility's nuclear power plants expose... -

Page 51

...outcome of these rate proceedings at the CPUC can be influenced by public and political opposition to nuclear power. If the Utility were unable to recover costs related to its nuclear facilities, PG&E Corporation's and the Utility's financial condition, results of operations, and cash flows could be... -

Page 52

... gas plant sites, current and former power plant sites, former gas gathering and gas storage sites, sites where natural gas compressor stations are located, current and former substations, service center and general construction yard sites, and sites currently and formerly used by the Utility... -

Page 53

... Electric Reliability Corporation and approved by the FERC. These standards relate to maintenance, training, operations, planning, vegetation management, facility ratings, and other subjects. These standards are designed to maintain the reliability of the nation's bulk power system and to protect... -

Page 54

... also affected by other factors, including the assumed rate of return on plan assets, employee demographics, discount rates used in determining future benefit obligations, rates of increase in health care costs, levels of assumed interest rates, future government regulation, and prior contributions... -

Page 55

... operations. As a holding company, PG&E Corporation depends on cash distributions and reimbursements from the Utility to meet its debt service and other financial obligations and to pay dividends on its common stock. PG&E Corporation is a holding company with no revenue generating operations of its... -

Page 56

... it cannot recover through rates, such as costs under its pipeline safety enhancement plan, to improve electricity and natural gas operations, and to pay penalties. PG&E Corporation may also be required to access the capital markets when the Utility is successful in selling long-term debt so that PG... -

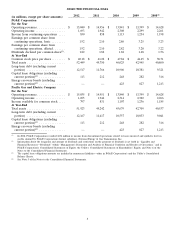

Page 57

... except per share amounts) Year ended December 31, 2012 2011 2010 Operating Revenues Electric ...Natural gas ...Total operating revenues ...Operating Expenses Cost of electricity ...Cost of natural gas ...Operating and maintenance ...Depreciation, amortization, and decommissioning . Operating Income... -

Page 58

PG&E Corporation CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Year ended December 31, 2012 2011 2010 $ 830 $ 858 $ 1,113 (in millions) Net Income ...Other Comprehensive Income Pension and other postretirement benefit plans Unrecognized prior service credit (cost) (net of income tax of $14, $24, ... -

Page 59

...unbilled revenue ...Regulatory balancing accounts ...Other ...Regulatory assets ($0 and $336 related to energy recovery bonds at December 31, 2012 and 2011, respectively) ...Inventories Gas stored underground and fuel oil ...Materials and supplies ...Income taxes receivable ...Other ...Total current... -

Page 60

...share amounts) Balance at December 31, 2012 2011 LIABILITIES AND EQUITY Current Liabilities Short-term borrowings ...Long-term debt, classified as current ...Energy recovery bonds, classified as current Accounts payable Trade creditors ...Disputed claims and customer refunds . . Regulatory balancing... -

Page 61

...costs of $13 in 2012, $8 in 2011, and $23 in 2010 ...Short-term debt matured ...Long-term debt matured or repurchased ...Energy recovery bonds matured ...Common stock issued ...Common stock dividends paid ...Other ... Net cash provided by (used in) financing activities ...Net change in cash and cash... -

Page 62

... Balance at December 31, 2011 ...Net income ...Other comprehensive income ...Common stock issued, net . Stock-based compensation amortization ...Common stock dividends declared ...Tax benefit from employee stock plans ...Preferred stock dividend requirement of subsidiary Balance at December 31, 2012... -

Page 63

... December 31, 2012 2011 2010 Operating Revenues Electric ...Natural gas ...Total operating revenues ...Operating Expenses Cost of electricity ...Cost of natural gas ...Operating and maintenance ...Depreciation, amortization, and decommissioning . Operating Income . . Interest income . . Interest... -

Page 64

... Gas and Electric Company CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Year ended December 31, 2012 2011 2010 $ 811 $ 845 $ 1,121 (in millions) Net Income ...Other Comprehensive Income Pension and other postretirement benefit plans Unrecognized prior service credit (cost) (net of income tax... -

Page 65

...unbilled revenue ...Regulatory balancing accounts ...Other ...Regulatory assets ($0 and $336 related to energy recovery bonds at December 31, 2012 and 2011, respectively) ...Inventories Gas stored underground and fuel oil ...Materials and supplies ...Income taxes receivable ...Other ...Total current... -

Page 66

... except share amounts) Balance at December 31, 2012 2011 LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities Short-term borrowings ...Long-term debt, classified as current ...Energy recovery bonds, classified as current ...Accounts payable Trade creditors ...Disputed claims and customer refunds... -

Page 67

...discount, and issuance costs of $13 in 2012, $8 in 2011, and $23 in 2010 ...Short-term debt matured ...Long-term debt matured or repurchased ...Energy recovery bonds matured ...Preferred stock dividends paid ...Common stock dividends paid ...Equity contribution ...Other ...Net cash provided by (used... -

Page 68

... 13,460 Balance at December 31, 2011 . . Net income ...Other comprehensive income ...Equity contribution ...Tax benefit from employee stock plans ...Common stock dividend ...Preferred stock dividend ... Balance at December 31, 2012 ... See accompanying Notes to the Consolidated Financial Statements... -

Page 69

... California. The Utility generates revenues mainly through the sale and delivery of electricity and natural gas to customers. The Utility is primarily regulated by the California Public Utilities Commission (''CPUC'') and the Federal Energy Regulatory Commission (''FERC''). In addition, the Nuclear... -

Page 70

... Utility for the estimated cost of debt (i.e., interest) and equity funds used to finance regulated plant additions and is capitalized as part of the cost of construction. AFUDC is recoverable from customers through rates over the life of the related property once the property is placed in service... -

Page 71

... in a general rate case (''GRC'') and a gas transmission and storage rate case (''GT&S'') does not depend on the volume of the Utility's sales of electricity and natural gas services. The Utility's recovery of a significant portion of its authorized revenue requirements through rates is independent... -

Page 72

.... During 2012, the Utility recorded a $353 million charge to net income for capital expenditures incurred in connection with its pipeline safety enhancement plan that were either specifically disallowed or that are forecasted to exceed the CPUC's authorized levels. (See ''CPUC Gas Safety Rulemaking... -

Page 73

... public purpose, demand response, and customer energy efficiency programs. Generally, the revenue recognition criteria for pass-through costs billed to customers are met at the time the costs are incurred. The FERC authorizes the Utility's revenue requirements in annual transmission owner rate cases... -

Page 74

... SIGNIFICANT ACCOUNTING POLICIES (Continued) Nuclear Decommissioning Trusts The Utility's nuclear generation facilities consist of two units at Diablo Canyon and the retired facility at Humboldt Bay. Nuclear decommissioning requires the safe removal of a nuclear generation facility from service and... -

Page 75

... 31, 2012, PG&E Corporation affiliates had entered into four tax equity agreements to fund residential and commercial retail solar energy installations with two privately held companies that are considered VIEs. Under these agreements, PG&E Corporation has agreed to provide lease payments and... -

Page 76

... Long-Term Regulatory Assets Long-term regulatory assets are composed of the following: Balance at December 31, 2012 2011 ...$ 3,275 1,627 552 604 210 194 141 206 6,809 $ 2,899 1,444 613 520 339 247 163 281 6,506 (in millions) Pension benefits ...Deferred income taxes ...Utility retained generation... -

Page 77

... purpose program costs expected to be incurred beyond the next 12 months, primarily related to energy efficiency programs designed to encourage the manufacture, design, distribution, and customer use of energy efficient appliances and other energy-using products, the California Solar Initiative... -

Page 78

... 2011 ...$ 219 $ 117 56 (83) 44 (43) 77 (250) 165 302 $ 223 241 57 97 16 (105) (48) - 227 708 (in millions) Distribution revenue adjustment mechanism Utility generation ...Hazardous substance ...Public purpose programs ...Gas fixed cost ...Energy recovery bonds ...Energy procurement ...Department... -

Page 79

...) The Department of Energy balancing account is used to record and refund to customers the amounts received from the U.S. Department of Energy (''DOE'') during 2012 for a settlement agreement related to spent nuclear fuel storage costs incurred by the Utility. NOTE 4: DEBT Long-Term Debt The... -

Page 80

...Utility's Diablo Canyon nuclear power plant and were issued as ''exempt facility bonds'' within the meaning of the Internal Revenue Code of 1954 (''Code''), as amended. In 1999, the Utility sold the Geysers geothermal power plant to Geysers Power Company, LLC pursuant to purchase and sale agreements... -

Page 81

...the lenders under the revolving credit facilities. The applicable margins and the facility fees will be based on PG&E Corporation's and the Utility's senior unsecured debt ratings issued by Standard & Poor's Rating Services and Moody's Investor Service. Facility fees are payable quarterly in arrears... -

Page 82

... 2012, PG&E Corporation issued 6,803,101 shares of its common stock under its 401(k) plan, its Dividend Reinvestment and Stock Purchase Plan, and its share-based compensation plans, generating $263 million of cash. In November 2011, PG&E Corporation entered into an Equity Distribution Agreement... -

Page 83

... share-based compensation costs capitalized during 2012, 2011, and 2010. There was no material difference between PG&E Corporation and the Utility for the information disclosed above. Restricted Stock Units Each RSU represents one hypothetical share of PG&E Corporation common stock. RSUs generally... -

Page 84

..., 2011, and 2010, as awards that settle in cash have no tax impact, and awards that settle in shares do not generate a tax benefit until vested. The performance shares awarded in March 2010 will vest in March 2013. As of December 31, 2012, $29 million of total unrecognized compensation costs related... -

Page 85

... of such shares plus all accumulated and unpaid dividends, as specified for the class and series. During each of 2012, 2011, and 2010 the Utility paid $14 million of dividends on preferred stock. NOTE 8: EARNINGS PER SHARE PG&E Corporation's basic earnings per common share (''EPS'') is calculated... -

Page 86

... INCOME TAXES The significant components of income tax provision (benefit) by taxing jurisdiction were as follows: PG&E Corporation (in millions) Current: Federal ...State ...Deferred: Federal ...State ...Tax credits . . 2012 ...$ $ (74) $ 33 374 (92) (4) 237 $ 2011 Year Ended December 31, 2010 2012... -

Page 87

... December 31, 2012 2011 2010 2012 Federal statutory income tax rate ...Increase (decrease) in income tax rate resulting from: State income tax (net of federal benefit) ...Effect of regulatory treatment of fixed asset differences ...Tax credits ...Benefit of loss carryback ...Non deductible penalties... -

Page 88

... immaterial. The Internal Revenue Service (''IRS'') is working with the utility industry to finalize guidance on what is a repair deduction for tax purposes for the natural gas transmission, natural gas distribution, and electric generation businesses. PG&E Corporation and the Utility expect the IRS... -

Page 89

... of the Utility's third-party power purchase agreements contain market-based pricing terms. In order to reduce volatility in customer rates, the Utility may enter into financial swap and/or financial option contracts to effectively fix and/or cap the price of future purchases and reduce cash flow... -

Page 90

... purchases to fuel natural gas generating facilities, and electricity procurement contracts indexed to natural gas prices. To reduce the volatility in customer rates, the Utility may enter into financial swap contracts or financial option contracts, or both. The Utility also enters into fixed-price... -

Page 91

... exists under a master netting agreement. The net balances include outstanding cash collateral associated with derivative positions. At December 31, 2012, PG&E Corporation's and the Utility's outstanding derivative balances were as follows: Commodity Risk (in millions) Current assets-other ...Other... -

Page 92

...impacted by any of the Utility's credit risk-related contingencies. NOTE 11: FAIR VALUE MEASUREMENTS PG&E Corporation and the Utility measure their cash equivalents, trust assets, and price risk management instruments at fair value. Fair value is an exit price, representing the amount that would be... -

Page 93

... securities ...Total nuclear decommissioning trusts(2) . . Price risk management instruments (Note 10) ...Electricity ...Gas ...Total price risk management instruments Rabbi trusts Fixed-income securities ...Life insurance contracts ...Total rabbi trusts ...Long-term disability trust Money market... -

Page 94

... securities ...Total nuclear decommissioning trusts(2) . . Price risk management instruments (Note 10) ...Electricity ...Gas ...Total price risk management instruments Rabbi trusts Fixed-income securities ...Life insurance contracts ...Total rabbi trusts ...Long-term disability trust Money market... -

Page 95

... Level 1. Money market funds are recorded as cash and cash equivalents in PG&E Corporation's and the Utility's Consolidated Balance Sheets. Trust Assets The assets held by the nuclear decommissioning trusts, the rabbi trusts related to the non-qualified deferred compensation plans, and the long-term... -

Page 96

... revenue rights . . Power purchase agreements . (1) Fair Value at December 31, 2012 Assets Liabilities $ $ 80 $ - $ Valuation Technique Unobservable Input Range(1) 16 Market approach CRR auction prices $ (9.04) - 55.15 145 Discounted cash flow Forward prices $ 8.59 - 62.90 Represents price... -

Page 97

... cash, restricted cash, net accounts receivable, short-term borrowings, accounts payable, customer deposits, and the Utility's variable rate pollution control bond loan agreements approximate their carrying values at December 31, 2012 and 2011, as they are short-term in nature or have interest rates... -

Page 98

...-for-sale investments held in the Utility's nuclear decommissioning trusts: Amortized Cost ...$ 21 331 199 Total Unrealized Gains $ - 618 181 Total Unrealized Losses $ - - (1) $ Total Fair Value(1) 21 949 379 (in millions) As of December, 2012 Money market investments ...Equity securities U.S...Non... -

Page 99

... Utility can deduct payments made to the qualified trusts, subject to certain Code limitations. PG&E Corporation and the Utility use a December 31 measurement date for all plans. PG&E Corporation's and the Utility's funding policy is to contribute tax-deductible amounts, consistent with applicable... -

Page 100

... Corporation and the Utility for the information disclosed above. During 2012, the Utility's defined benefit pension plan was amended to include a new cash balance benefit formula. Eligible employees hired after December 31, 2012 will participate in the cash balance benefit. Eligible employees hired... -

Page 101

... FINANCIAL STATEMENTS (Continued) NOTE 12: EMPLOYEE BENEFIT PLANS (Continued) Components of Net Periodic Benefit Cost Net periodic benefit cost as reflected in PG&E Corporation's Consolidated Statements of Income for 2012, 2011, and 2010 was as follows: Pension Benefits (in millions) Service cost... -

Page 102

... of dividend yield and real earnings growth added to a long-term inflation rate. For the pension plan, the assumed return of 5.4% compares to a ten-year actual return of 10.2%. The rate used to discount pension benefits and other benefits was based on a yield curve developed from market data of... -

Page 103

... Retirement Income Security Act of 1974, as amended (''ERISA''). PG&E Corporation's and the Utility's investment policies and strategies are designed to increase the ratio of trust assets to plan liabilities at an acceptable level of funded status volatility. Interest rate, credit, and equity... -

Page 104

...Benefits 2012 28% -% -% 4% 8% -% 60% 100% 38% -% -% 4% 8% -% 50% 100% 2013 Global equity securities ...U.S. equity securities ...Non-U.S. equity securities ...Absolute return ...Real assets ...Extended fixed-income securities Fixed-income securities ... 2011 5% 26% 14% 5% -% -% 50% 100% 2013 2011... -

Page 105

...1 688 - 689 Total ...$ Other Benefits: Money market investments ...$ U.S. equity securities Non-U.S. equity securities ...Global equity securities ...Absolute return ...Real assets ...Fixed-income securities: U.S. government . Corporate ...Other ...Total ...$ Total plan assets at fair value ...2,618... -

Page 106

... of U.S. government short-term securities that are considered Level 1 assets and valued at the net asset value of $1 per unit. The number of units held by the plan fluctuates based on the unadjusted price changes in active markets for the funds' underlying assets. Equity Securities The global equity... -

Page 107

... as Level 3 for the years ended December 31, 2012 and 2011: Absolute Return . $ 494 Corporate Fixed-Income $ 549 Pension Benefits Other Fixed-Income $ 120 (in millions) Balance as of January 1, 2011 ...Actual return on plan assets: Relating to assets still held at the reporting date ...Relating to... -

Page 108

...CONSOLIDATED FINANCIAL STATEMENTS (Continued) NOTE 12: EMPLOYEE BENEFIT PLANS (Continued) Other Benefits Corporate Other Fixed-Income Fixed-Income $ 129 $ 10 (in millions) Balance as of January 1, 2011 ...Actual return on plan assets: Relating to assets still held at the reporting date ...Relating... -

Page 109

...REMAINING CHAPTER 11 DISPUTED CLAIMS Various electricity suppliers filed claims in the Utility's Chapter 11 proceeding seeking payment for energy supplied to the Utility's customers through the wholesale electricity markets operated by the CAISO and the California Power Exchange (''PX'') between May... -

Page 110

... cost or fair market value, depending on the nature and value of the services. PG&E Corporation also allocates various corporate administrative and general costs to the Utility and other subsidiaries using agreed-upon allocation factors, including the number of employees, operating and maintenance... -

Page 111

...CPUC required California investor-owned electric utilities to enter into long-term power purchase agreements with QFs and approved the applicable terms and conditions, prices, and eligibility requirements. These agreements require the Utility to pay for energy and capacity. Energy payments are based... -

Page 112

...Balance Sheets. Natural Gas Supply, Transportation, and Storage Commitments The Utility purchases natural gas directly from producers and marketers in both Canada and the United States to serve its core customers and to fuel its owned-generation facilities. The Utility also contracts for natural gas... -

Page 113

...2,232 Total ... $ Costs incurred for natural gas purchases, natural gas transportation services, and natural gas storage, which include contracts less than 1 year, amounted to $1.3 billion in 2012, $1.8 billion in 2011, and $1.6 billion in 2010. Nuclear Fuel Agreements The Utility has entered into... -

Page 114

...-party claims, litigation, and investigations related to natural gas matters that are discussed below) totaled $34 million at December 31, 2012 and $52 million at December 31, 2011 and are included in PG&E Corporation's and the Utility's current liabilities-other in the Consolidated Balance Sheets... -

Page 115

...the class location designation of a pipeline is based on the types of buildings, population density, or level of human activity near the segment of pipeline, and is used to determine the maximum allowable operating pressure up to which a pipeline can be operated. In its May 2012 investigative report... -

Page 116

... may file. (See ''Penalties Conclusion'' below.) In addition, in July 2012, the Utility reported to the CPUC that it had discovered that its access to some pipelines has been limited by vegetation overgrowth or building structures that encroach upon some of the Utility's gas pipeline rights-of-way... -

Page 117

... safety and reliability regulations for natural gas transmission and distribution pipelines in California and the related ratemaking mechanisms. On December 20, 2012, the CPUC approved the Utility's proposed pipeline safety enhancement plan (filed in August 2011) to modernize and upgrade its natural... -

Page 118

... above, at December 31, 2012, approximately 140 lawsuits involving third-party claims for personal injury and property damage, including two class action lawsuits, had been filed against PG&E Corporation and the Utility in connection with the San Bruno accident on behalf of approximately 450... -

Page 119

...Diablo Canyon and its retired nuclear facility at Humboldt Bay (''Humboldt Bay Unit 3''). As a result, the Utility constructed an interim dry cask storage facility to store spent fuel at Diablo Canyon through at least 2024, and a separate facility at Humboldt Bay. The Utility and other nuclear power... -

Page 120

... damages at Humboldt Bay Unit 3. (NEIL also provides insurance coverage to the Utility for non-nuclear property damages and business interruption losses at Diablo Canyon, though with significantly lower limits beginning in April 2013.) Under this insurance, if any nuclear generating facility insured... -

Page 121

...) 910 Balance at December 31, 2012 ...The environmental remediation liability is composed of the following: (in millions) Utility-owned natural gas compressor site near Hinkley, California(1) Utility-owned natural gas compressor site near Topock, Arizona(1) . . Utility-owned generation facilities... -

Page 122

... Remediation costs for the Hinkley natural gas compressor site are not recovered from customers through rates. Future costs will depend on many factors, including the Regional Board's certification of the final EIR, the levels of hexavalent chromium the Utility is required to use as the standard for... -

Page 123

... amounts related to the Hinkley and Topock sites described above) if the extent of contamination or necessary remediation is greater than anticipated or if the other potentially responsible parties are not financially able to contribute to these costs, and could increase further if the Utility... -

Page 124

... capital expenditures associated with the Utility's pipeline safety enhancement plan. See Note 15 of the Notes to the Consolidated Financial Statements. During the second quarter 2012 the Utility recorded a provision of $80 million for estimated third-party claims related to the San Bruno accident... -

Page 125

...on its assessment and those criteria, management has concluded that PG&E Corporation and the Utility maintained effective internal control over financial reporting as of December 31, 2012. Deloitte & Touche LLP, an independent registered public accounting firm, has audited PG&E Corporation's and the... -

Page 126

... and Electric Company San Francisco, California We have audited the accompanying consolidated balance sheets of PG&E Corporation and subsidiaries (the ''Company'') and of Pacific Gas and Electric Company and subsidiaries (the ''Utility'') as of December 31, 2012 and 2011, and the Company's related... -

Page 127

... PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of PG&E Corporation and Pacific Gas and Electric Company San Francisco, California We have audited the internal control over financial reporting of PG&E Corporation and subsidiaries (the ''Company'') and of Pacific Gas and Electric... -

Page 128

BOARDS OF DIRECTORS OF PG&E CORPORATION AND PACIFIC GAS AND ELECTRIC COMPANY DAVID R. ANDREWS Senior Vice President, Government Affairs, General Counsel and Secretary, Retired, PepsiCo, Inc. LEWIS CHEW Executive Vice President and Chief Financial Officer, Dolby Laboratories, Inc. C. LEE COX(1) Vice ... -

Page 129

... Affairs JOHN R. SIMON Senior Vice President, Human Resources JESUS SOTO, JR. Senior Vice President, Gas Transmission Operations FONG WAN Senior Vice President, Energy Procurement DEBORAH T. AFFONSA Vice President, Corporate Strategy BARRY S. ALLEN Site Vice President, Diablo Canyon Power Plant... -

Page 130

...Investor Relations Office. Vice President, Investor Relations Gabriel B. Togneri PG&E Corporation P. O. Box 770000 San Francisco, CA 94177 415-972-7080 PG&E Corporation General Information 415-973-1000 Pacific Gas and Electric Company General Information 415-973-7000 Stock Held in Brokerage Accounts... -

Page 131

...May 6, 2013 Time: 10:00 a.m. Location: PG&E Corporation and Pacific Gas and Electric Company Headquarters 77 Beale Street San Francisco, CA 94105 Form 10-K If you would like to obtain a copy, free of charge, of PG&E Corporation's and Pacific Gas and Electric Company's joint Annual Report on Form 10... -

Page 132

(This page has been left blank intentionally.) -

Page 133

(This page has been left blank intentionally.) -

Page 134

(This page has been left blank intentionally.) -

Page 135

-

Page 136