Nissan 2013 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2013 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

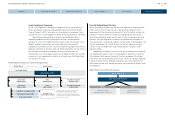

through several measures including keeping adequate liquidity in the form of

cash and unutilized committed lines, unencumbered assets (mainly vehicle

loans and leases), liquidity support from auto operations to the extent we have

excess cash in auto operations, diversified funding sources and geographical

diversification of capital market access.

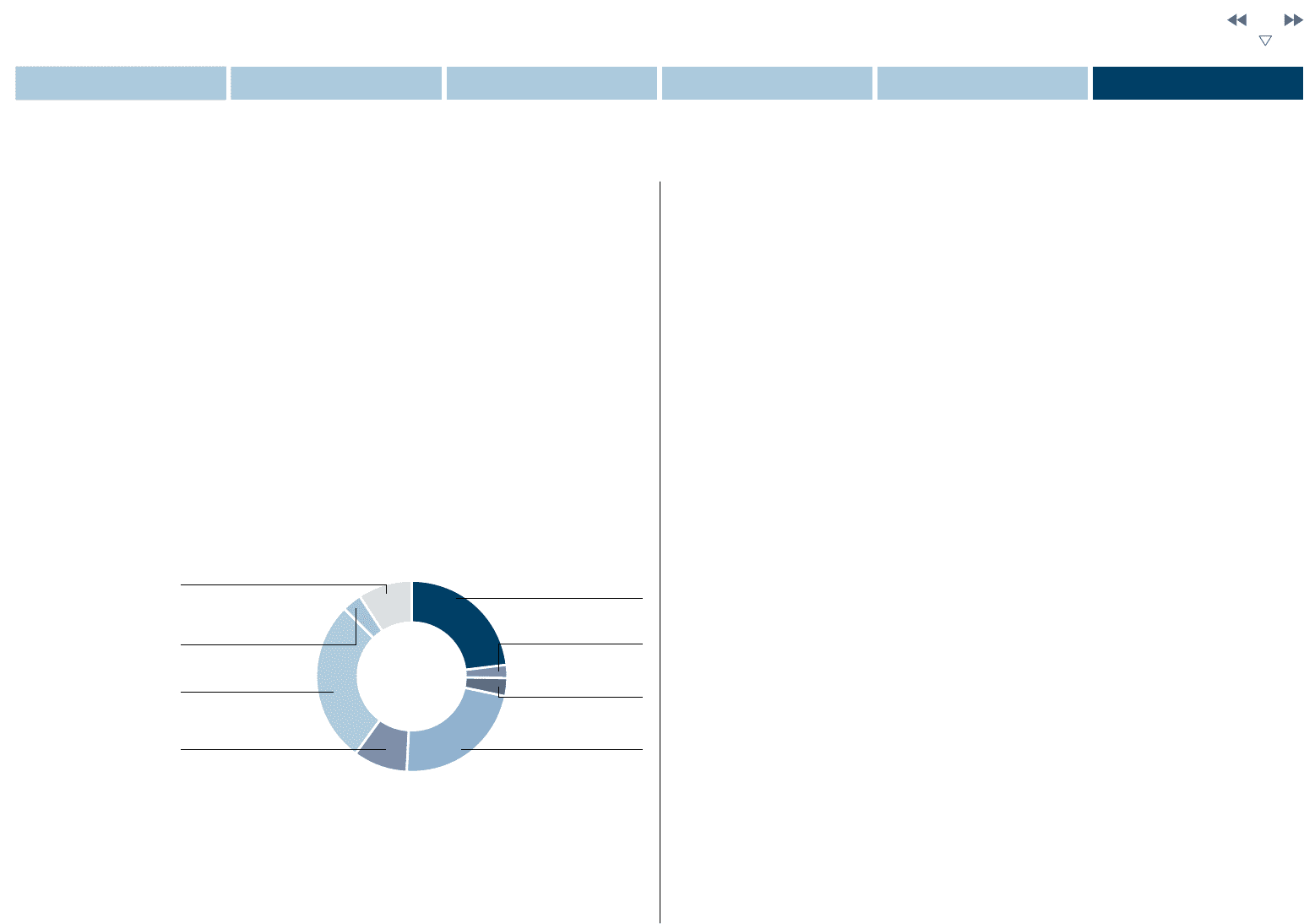

As of March 31, 2013, sales finance companies’ liquidity (cash and

unutilized committed lines) was approximately ¥538 billion. Additionally, we

have a healthy mix of secured (30.8%) and unsecured and other (69.2%)

funding sources, which ensure a stronger balance sheet and incremental

liquidity through utilization of unencumbered assets.

The pie chart below describes our diversified funding sources in sales

finance business.

During fiscal year 2012, we were able to raise new funding through

bank loans, asset-backed securities, asset-backed commercial paper,

commercial paper and bonds reflecting our diversified access to

financing instruments.

2. Interest Rate Risk Management

The sales financing business is exposed to interest rate risks. Interest rate risk

is defined as the potential variance in the earnings of an entity or the fair value

of the portfolio that would result from a fluctuation in the general level of

market interest rates where funds with differing fixed-rate periods or differing

terms are financed and invested.

Nissan measures the risks by using the sensitivity analysis with various

interest rate scenarios and determines the risk tolerance level. Nissan

controls the interest rate maturities of both assets and liabilities to maintain

the risks within an acceptable tolerance level.

The sensitivity analysis mentioned above uses statistical models, such as

the Monte Carlo Simulation Method. However, the actual fluctuation of market

interest rates and its impact may deviate significantly from the assumptions

used in the models. Nissan enters into interest rate derivative financial

instruments to maintain the potential variability of interest rates at the desired

level of risk exposure. The main objective of these transactions is to mitigate

the risks and not to pursue speculative profit maximization.

3. Credit Risks

Nissan is exposed to the risks of failure to recover the full value of financial

receivables for its Auto credit and Lease business with retail customers and

for its Dealer finance business, due to changes in the economic situation and

credit quality of customers. Nissan manages the credit risks closely by

establishing an effective screening and collection system and structure. Credit

applicants are all subject to credit assessments of their creditworthiness

under a detailed scoring system. Based on the information directly obtained

from applicants and from credit bureaus, loan authorization is made in a

comprehensive manner by considering the following points: applicant’s credit

history; applicant’s capacity to pay, which is estimated by debt ratio, payment

to income ratio and disposable income; applicant’s stability; and loan

conditions including the loan collateral, loan advance and payment terms. In

addition to carrying out this screening process, whenever required, Nissan

takes into account qualitative information by conducting field visits to

customers or referring to past business records with Nissan in accordance

with characteristics of regional business practices and risks.

Sales Finance Business Funding Sources (As of March 2013)

Group Finance

(Inter-Company)

23.1%

Equity

9.0%

Commercial Paper

2.3%

ABS off B/S

3.3%

S/T Loan

3.0%

ABS on B/S

27.5%

L/T Loan

22.7%

Bonds

9.1%

37

CORPORATE GOVERNANCE

NISSAN MOTOR COMPANY ANNUAL REPORT 2013

CONTENTS

MANAGEMENT MESSAGES

CORPORATE FACE TIME

PERFORMANCE

NISSAN POWER 88