Nissan 2013 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2013 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

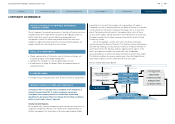

In addition, we have created an area on our intranet called

“Companywide Risk Management.” Information relating to risk management

is also distributed to subsidiaries in Japan, North America, Europe and

other overseas regions, and to important affiliated companies.

Nissan is currently engaged in meeting the goals of the Nissan Power

88 mid-term business plan. To achieve the ambitious goals of raising both

global market share and operating profit margins, we need to fully utilize

our existing production capacity in countries around the world so that new

spending can be curtailed, and we also need a highly efficient production

setup so production can be restored quickly in case a plant is forced to

shut down due to unforeseen circumstances.

To support the mid-term business plan from a risk-management

perspective, our efforts will also be expanded worldwide and throughout

the supply chain by incorporating the important lessons learned from the

March 2011 earthquake and tsunami in east Japan and the 2011 flooding

in Thailand.

The Current State of Nissan’s Risk Management

Below we present some of our efforts to address Nissan’s corporate risks.

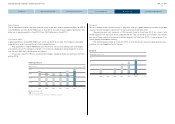

1 Risks Related to Financial Market

1) Automotive

1. Liquidity

An automotive business must have adequate liquidity to provide for the

working capital needs of day-to-day normal operations, capital investment

needs for future expansion and repayment of maturing debt. Liquidity can be

secured through internal cash and cash equivalents, internal cash flow

generation and external borrowings.

As of the end of fiscal year 2012 (March 31, 2013), Nissan’s automotive

business had ¥771 billion of cash and cash equivalents (compared with ¥781

billion as of March 31, 2012). In addition to cash, Nissan had approximately

¥480 billion of committed lines available for drawing as of March 31, 2013.

As for external borrowings, Nissan raises financing through several

sources including bond issuance in capital markets, long- and short-term

loans from banks, commercial paper issuance and committed credit lines

from banks.

Nissan has a liquidity risk management policy that is intended to ensure

adequate liquidity for the business while at the same time ensuring mitigation

of liquidity risks such as unmanageable bunched maturities of debt. In the

policy, Minimum Required Liquidity is defined, objectively considering several

factors including debt maturity, upcoming mandatory payments (such as

dividends, investments and taxes) and peak operating cash needs. We also

benchmark our liquidity targets with other major Japanese corporations and

global auto companies to ensure we are reasonable in our assumptions.

2. Financial Market

Nissan is exposed to various financial-market-related risks, such as foreign

exchange, interest rates and commodity prices. It is the general policy of

Nissan not to use derivative products as a primary tool to manage foreign

exchange and commodity price risks as it does not provide a permanent

solution to mitigate these risks. In some cases, Nissan does hedge select

currencies and commodity price risks. Nissan is taking the following measures

to minimize financial market risks.

l Foreign exchange

As a company engaged in export activities, Nissan is faced with various

foreign currency exposures that result from the currency of input cost being

different from the currency of sale to customers. In order to minimize foreign

exchange risk on a more permanent basis, Nissan is working to reduce

foreign currency exposure by such measures as shifting production to the

countries where vehicles are sold and procurement of raw materials and parts

in foreign currencies. In the short term, Nissan may hedge risks in foreign

exchange volatility within a certain range by using derivative products in

accordance with the internal policies and procedures for risk management

and operational rules regarding derivative transactions.

l Interest rates

The interest rate risk management policy is based on two principles: long-

term investments and the permanent portion of working capital are financed

at fixed interest rates while the non-permanent portion of working capital and

liquidity reserves are built at floating rates.

l Commodity prices

Nissan purchases raw materials in the form of parts provided by the suppliers,

as well as direct purchase. Nissan is exposed to the price fluctuation risks of

35

CORPORATE GOVERNANCE

NISSAN MOTOR COMPANY ANNUAL REPORT 2013

CONTENTS

MANAGEMENT MESSAGES

CORPORATE FACE TIME

PERFORMANCE

NISSAN POWER 88