Nissan 2013 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2013 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

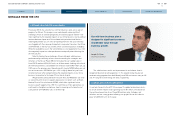

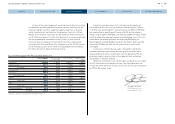

In terms of financial management, we will continue to focus on ensuring

cost efficiency, generating positive automotive free cash flow even with the

increased capital investments supporting capacity expansions in growing

markets worldwide and maintaining a strong balance sheet with sufficient

liquidity. The chart below summarizes the pro-forma key financial metrics of

our 2013 full-year forecast. I use the term “pro-forma” as we have maintained

the use of proportional consolidation of our China JV in these financial

metrics for ease in comparison to the fiscal 2012 results. Under revised

accounting rules that are effective with the beginning of the 2013 fiscal year,

we will no longer account for our China JV using proportional consolidation

but rather will switch to equity method accounting.

In brief, on a pro-forma basis (with continued use of proportional

consolidation for our China JV), net revenue is forecast to grow 16.3% to

11.2 trillion yen; operating profit is forecast to grow over 33% to 700 billion

yen, representing an operating profit margin of 6.3%; and net income is

forecast to grow 23% to 420 billion yen, reflecting a 3.8% net margin. Please

note that applying the new equity accounting methodology for our China JV

would reduce the forecast pro-forma net revenue by 830 billion yen.

Operating profit would be 90 billion yen lower and ordinary profit would be

reduced by 20 billion yen, while the net income amount would remain

unchanged.

In closing, our mid-term business plan is designed to significantly

enhance shareholder value through business growth that drives higher

revenue, profits and strong sustained free cash flow generation. We will

enhance enterprise value, maintain a strong balance sheet and provide

shareholders an attractive dividend.

Reflecting confidence in our mid-term plan and based on our outlook

for 2013 including continued positive Free Cash Flow generation, we

announced in May 2013 our intention to increase the fiscal 2013 dividend

by 20% to 30 yen per share.

Joseph G. Peter

Chief Financial Officer

Nissan Motor Co., Ltd.

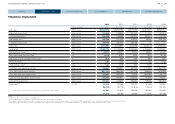

FY12 actual (A) FY13 pro-forma

outlook (B)*

Vs. FY12 (B–A) Change vs. FY12

(B/A)

Net revenue 9,629.6 11,200.0 +1,570.4 +16.3%

Operating profit 523.5 700.0 +176.5 +33.7%

OP margin 5.4% 6.3% +0.9%

Ordinary profit 529.3 665.0 +135.7 +25.6%

Net income 342.4 420.0 +77.6 +22.6%

Net income ratio 3.6% 3.8% +0.2%

CAPEX 524.5 570.0 +45.5 +8.7%

Sales ratio 5.4% 5.1% –0.3%

R&D 469.9 520.0 +50.1 +10.7%

Sales ratio 4.9% 4.6% –0.3%

FX rate assumptions JPY/USD 82.9 95.0 +12.1

JPY/EUR 106.8 122.0 +15.2

Fiscal 2013 Management Pro-Forma Outlook (billion yen)

* Based on continuation of proportional consolidation of China JV

15

NISSAN MOTOR COMPANY ANNUAL REPORT 2013

MANAGEMENT MESSAGES

CONTENTS

CORPORATE FACE TIME

PERFORMANCE

CORPORATE GOVERNANCE

NISSAN POWER 88