NetFlix 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

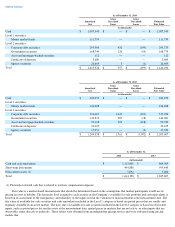

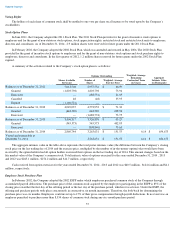

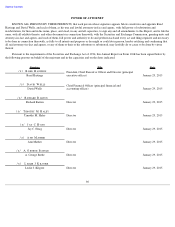

9. Accumulated Other Comprehensive (Loss) Income

The following table summarizes the changes in accumulated balances of other comprehensive (loss) income, net of tax:

All amounts reclassified from accumulated other comprehensive (loss) income were related to realized gains (losses) on available-for-

sale

securities. These reclassifications impacted "Interest and other income (expense)" on the Consolidated Statements of Operations.

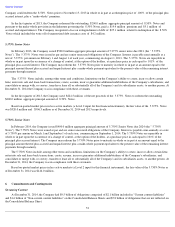

Income before provision for income taxes was as follows:

The components of provision for income taxes for all periods presented were as follows:

59

Foreign currency

Change in

unrealized gains on

available-for-sale

securities

Total

(in thousands)

Balance as of December 31, 2012

$

1,381

$

1,538

$

2,919

Other comprehensive income before reclassifications

1,772

(1,597

)

175

Amounts reclassified from accumulated other comprehensive income

—

481

481

Net increase (decrease) in other comprehensive income

1,772

(1,116

)

656

Balance as of December 31, 2013

$

3,153

$

422

$

3,575

Other comprehensive (loss) income before reclassifications

(7,768

)

337

(7,431

)

Amounts reclassified from accumulated other comprehensive (loss)income

—

(

590

)

(590

)

Net decrease in other comprehensive (loss) income

(7,768

)

(253

)

(8,021

)

Balance as of December 31, 2014

$

(4,615

)

$

169

$

(4,446

)

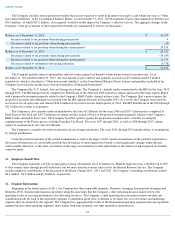

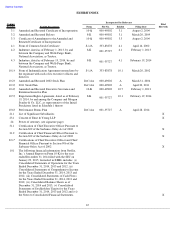

10.

Income Taxes

Year Ended December 31,

2014

2013

2012

(in thousands)

United States

$

325,081

$

159,126

$

27,885

Foreign

24,288

11,948

2,595

Income before income taxes

$

349,369

$

171,074

$

30,480

Year Ended December 31,

2014

2013

2012

(in thousands)

Current tax provision:

Federal

$

86,623

$

58,558

$

34,387

State

9,866

15,154

7,850

Foreign

16,144

7,003

1,162

Total current

112,633

80,715

43,399

Deferred tax provision:

Federal

(10,994

)

(18,930

)

(26,903

)

State

(17,794

)

(2,751

)

(3,168

)

Foreign

(1,275

)

(363

)

—

Total deferred

(30,063

)

(22,044

)

(30,071

)

Provision for income taxes

$

82,570

$

58,671

$

13,328