NetFlix 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

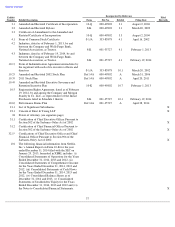

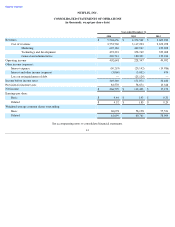

Changes in interest rates could adversely affect the market value of the securities we hold that are classified as short-term investments.

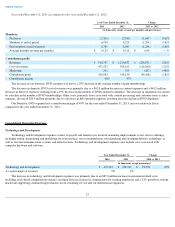

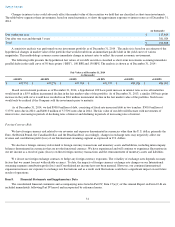

The table below separates these investments, based on stated maturities, to show the approximate exposure to interest rates as of December 31,

2014.

A sensitivity analysis was performed on our investment portfolio as of December 31, 2014 . The analysis is based on an estimate of the

hypothetical changes in market value of the portfolio that would result from an immediate parallel shift in the yield curve of various

magnitudes. This methodology assumes a more immediate change in interest rates to reflect the current economic environment.

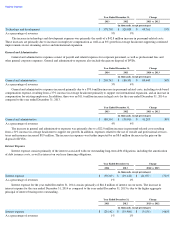

The following table presents the hypothetical fair values of our debt securities classified as short-term investments assuming immediate

parallel shifts in the yield curve of 50 basis points (“BPS”), 100 BPS and 150 BPS. The analysis is shown as of December 31, 2014 :

Based on investment positions as of December 31, 2014, a hypothetical 100 basis point increase in interest rates across all maturities

would result in a $5.9 million incremental decline in the fair market value of the portfolio. As of December 31, 2013, a similar 100 basis point

increase in the yield curve would have resulted in an $8.6 million incremental decline in the fair market value of the portfolio. Such losses

would only be realized if the Company sold the investments prior to maturity.

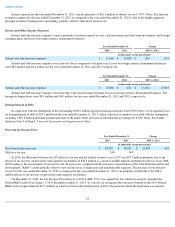

As of December 31, 2014, we had $900.0 million of debt, consisting of fixed rate unsecured debt in two tranches: $500.0 million of

5.375% notes due in 2021; and $400.0 million of 5.750% notes due in 2024. The fair value of our debt will fluctuate with movements of

interest rates, increasing in periods of declining rates of interest and declining in periods of increasing rates of interest.

Foreign Currency Risk

We have foreign currency risk related to our revenues and expenses denominated in currencies other than the U.S. dollar, primarily the

Euro, the British Pound, the Canadian Dollar, and the Brazilian Real. Accordingly, changes in exchange rates may negatively affect our

revenue and contribution profit (loss) of our International streaming segment as expressed in U.S. dollars.

We also have foreign currency risk related to foreign currency transactions and monetary assets and liabilities, including intercompany

balances denominated in currencies that are not the functional currency. We have experienced and will continue to experience fluctuations in

our net income as a result of gains (losses) on these foreign currency transactions and the remeasurement of monetary assets and liabilities.

W e do not use foreign exchange contracts to hedge any foreign currency exposures. The volatility of exchange rates depends on many

factors that we cannot forecast with reliable accuracy. To date, the impacts of foreign currency exchange rate changes on our International

streaming segment contribution profit (loss) and Consolidated net income have not been material. However, our continued international

expansion increases our exposure to exchange rate fluctuations and as a result such fluctuations could have a significant impact on our future

results of operations.

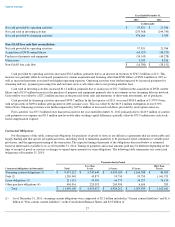

The consolidated financial statements and accompanying notes listed in Part IV, Item 15(a)(1) of this Annual Report on Form 10-K are

included immediately following Part IV hereof and incorporated by reference herein.

31

(in thousands)

Due within one year

$

113,864

Due after one year and through 5 years

381,024

Total

$

494,888

Fair Value as of December 31, 2014

(in thousands)

-150 BPS

-100 BPS

-50 BPS

+50 BPS

+100 BPS

+150 BPS

$

499,791

$

499,276

$

497,704

$

491,957

$

489,026

$

486,095

Item 8.

Financial Statements and Supplementary Data