NetFlix 2014 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2014 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

content agreements and is expected to continue to be significant as we enter into more agreements with upfront cash payments, such as original

content agreements. Working capital differences include deferred revenue, taxes and semi-annual interest payments on our outstanding debt.

Our receivables from members generally settle quickly and deferred revenue is a source of cash flow.

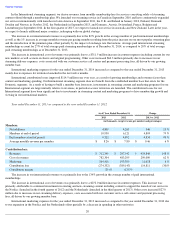

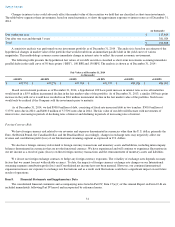

Cash provided by operating activities decreased $81.3 million, primarily due to increased payments for content other than DVD library of

$835.1 million or 32%, as well as increased payments associated with higher operating expenses. The increased use of cash was partially offset

by a $1,130.1 million or 26% increase in revenues.

Cash used in investing activities decreased $213.1 million, primarily due to a decrease of $242.2 million in the purchases of short-term

investments, net of proceeds from sales and maturities. This decrease was offset by an increase of $15.6 million purchases of property and

equipment.

Cash provided by financing activities increased $65.4 million primarily due to the $392.9 million net proceeds from the issuance of the

5.750% Notes in the year ended December 31, 2014 as compared to the $490.6 million net proceeds from the issuance of the 5.375% Notes less

the $219.4 million redemption of our 8.50% Notes in the year ended December 31, 2013. This increase was partially offset by a decrease of

$56.3 million from the issuance of common stock, including the impact of excess tax benefits.

Free cash flow was $393.5 million lower than net income for the year ended December 31, 2014 primarily due to $534.2 million of

content cash payments over expense partially offset by $115.2 million of non-cash stock-based compensation expense and $25.5 million of

favorable other working capital differences.

Free cash flow was $128.7 million lower than net income for the year ended December 31, 2013 primarily due to $227.9 million of

content cash payments over expense and $45.3 million non-favorable other working capital differences. This was partially offset by $73.1

million non-cash stock-

based compensation expense, $46.3 million in deferred revenue and $25.1 million loss on debt extinguishment, the cash

impact of which is a financing activity and therefore not included in free cash flow.

26

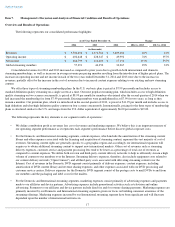

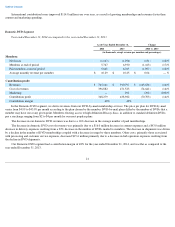

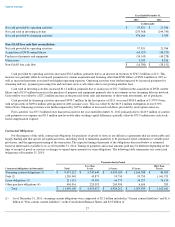

Year Ended December 31,

2014

2013

(in thousands)

Net cash provided by operating activities

$

16,483

$

97,831

Net cash used in investing activities

(42,866

)

(255,968

)

Net cash provided by financing activities

541,712

476,264

Non-GAAP free cash flow reconciliation:

Net cash provided by operating activities

16,483

97,831

Acquisition of DVD content library

(74,790

)

(65,927

)

Purchases of property and equipment

(69,726

)

(54,143

)

Other assets

1,334

5,939

Non-GAAP free cash flow

$

(126,699

)

$

(16,300

)