NetFlix 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Description of Business

Netflix, Inc. (the “Company”) was incorporated on August 29, 1997 and began operations on April 14, 1998. The Company is the world’

s

leading Internet television network with over 57 million members in nearly 50 countries enjoying more than two billion

hours of TV shows and

movies per month, including original series, documentaries and feature films. Members can watch as much as they want, anytime, anywhere,

on nearly any Internet-connected screen. Members can play, pause and resume watching, all without commercials or commitments.

Additionally, in the United States ("U.S."), members can receive DVDs.

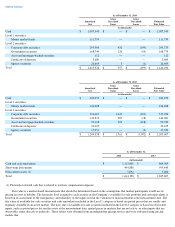

The Company has three reportable segments, Domestic streaming, International streaming and Domestic DVD. A majority of the

Company’s revenues are generated in the United States, and substantially all of the Company’s long-

lived tangible assets are held in the United

States. The Company’s revenues are derived from monthly membership fees.

Basis of Presentation

The consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries. Intercompany balances

and transactions have been eliminated.

Use of Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of

America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of

contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting

periods. Significant items subject to such estimates and assumptions include the amortization policy for the streaming content library; the

recognition and measurement of income tax assets and liabilities; and the valuation of stock-based compensation. The Company bases its

estimates on historical experience and on various other assumptions that the Company believes to be reasonable under the circumstances.

Actual results may differ from these estimates.

New Accounting Pronouncements

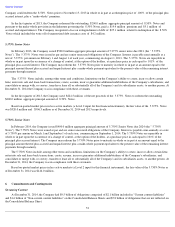

In May 2014, the Financial Accounting Standards Board issued Accounting Standards Update ("ASU") 2014-09,

Revenue from Contracts

with Customers (Topic 606) which amended the existing accounting standards for revenue recognition. ASU 2014-09 establishes principles for

recognizing revenue upon the transfer of promised goods or services to customers, in an amount that reflects the expected consideration to be

received in exchange for those goods or services. It is effective for annual reporting periods beginning after December 15, 2016. Early adoption

is not permitted. The amendments may be applied retrospectively to each prior period presented or retrospectively with the cumulative effect

recognized as of the date of initial application. The Company is currently in the process of evaluating the impact of adoption of the ASU on its

consolidated financial statements, but does not expect the impact to be material.

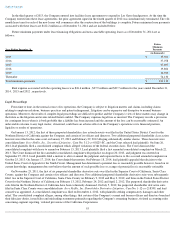

Cash Equivalents and Short-term Investments

The Company considers investments in instruments purchased with an original maturity of 90 days or less to be cash equivalents. The

Company also classifies amounts in transit from payment processors for customer credit card and debit card transactions as cash equivalents.

The Company classifies short-term investments, which consist of marketable securities with original maturities in excess of 90 days as

available-for-sale. Short-term investments are reported at fair value with unrealized gains and losses included in “Accumulated other

comprehensive (loss) income” within Stockholders’

equity in the Consolidated Balance Sheets. The amortization of premiums and discounts on

the investments, realized gains and losses, and declines in value judged to be other-than-temporary on available-for-sale securities are included

in “Interest and other income (expense)”

in the Consolidated Statements of Operations. The Company uses the specific identification method to

determine cost in calculating realized gains and losses upon the sale of short-term investments.

Short-term investments are reviewed periodically to identify possible other-than-temporary impairment. When evaluating the

investments, the Company reviews factors such as the length of time and extent to which fair value has been below cost basis, the financial

condition of the issuer, the Company’s intent to sell, or whether it would be more likely than not that the Company would be required to sell

the investments before the recovery of their amortized cost basis.

46

1.

Organization and Summary of Significant Accounting Policies