NetFlix 2014 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2014 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

obligations that are not reflected on the Consolidated Balance Sheets as they do not yet meet the criteria for asset recognition.

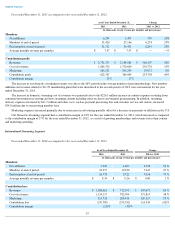

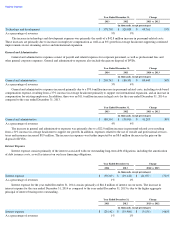

Streaming content obligations increased $2.2 billion from $7.3 billion as of December 31, 2013 to $9.5 billion as of December 31, 2014

primarily due to multi-year commitments associated with our latest market launches in Europe and the continued expansion of our

exclusive and original programming.

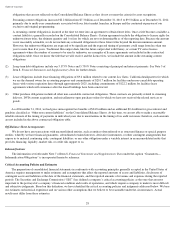

A streaming content obligation is incurred at the time we enter into an agreement to obtain future titles. Once a title becomes available, a

content liability is generally recorded on the Consolidated Balance Sheets. Certain agreements include the obligation to license rights for

unknown future titles, the ultimate quantity and / or fees for which are not yet determinable as of the reporting date. Because the amount

is not reasonably estimable, we do not include any estimated obligation for these future titles beyond the known minimum amount.

However, the unknown obligations are expected to be significant and the expected timing of payments could range from less than one

year to more than five years. Traditional film output deals, like the future output deal with Disney, or certain TV series license

agreements where the number of seasons to be aired is unknown, are examples of license agreements not included in the contractual

obligations table. Once we know the title that we will receive and the license fees, we include the amount in the streaming content

obligations.

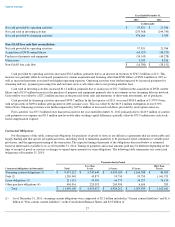

As of December 31, 2014, we had gross unrecognized tax benefits of $34.8 million and an additional $0.4 million for gross interest and

penalties classified as “Other non-current liabilities” on the Consolidated Balance Sheets. At this time, we are not able to make a reasonably

reliable estimate of the timing of payments in individual years due to uncertainties in the timing of tax audit outcomes; therefore, such amounts

are not included in the above contractual obligation table.

Off-Balance Sheet Arrangements

We do not have any transactions with unconsolidated entities, such as entities often referred to as structured finance or special purpose

entities, whereby we have financial guarantees, subordinated retained interests, derivative instruments, or other contingent arrangements that

expose us to material continuing risks, contingent liabilities, or any other obligation under a variable interest in an unconsolidated entity that

provides financing, liquidity, market risk, or credit risk support to us.

Indemnifications

The information set forth under Note 7 of Item 8, Financial Statements and Supplementary Data under the caption “Guarantees—

Indemnification Obligations” is incorporated herein by reference.

Critical Accounting Policies and Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of

America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosures of

contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reported

periods. The Securities and Exchange Commission (“SEC”) has defined a company’s critical accounting policies as the ones that are most

important to the portrayal of a company’s financial condition and results of operations, and which require a company to make its most difficult

and subjective judgments. Based on this definition, we have identified the critical accounting policies and judgments addressed below. We base

our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual

results may differ from these estimates.

28

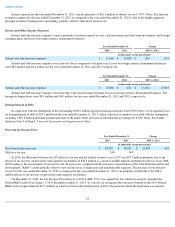

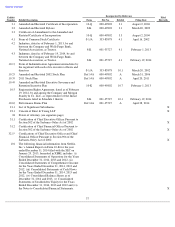

(2) Long-term debt obligations include our 5.375% Notes and 5.750% Notes consisting of principal and interest payments. See Note 5 of

Item 8, Financial Statements and Supplementary Data for further details.

(3) Lease obligations include lease financing obligations of $9.4 million related to our current Los Gatos, California headquarters for which

we are the deemed owner for accounting purposes and commitments of $201.7 million for facilities under non-cancelable operating

leases with various expiration dates through approximately 2025, including commitments of $122.2 million for facilities lease

agreements which will commence after the leased buildings have been constructed.

(4) Other purchase obligations include all other non-cancelable contractual obligations. These contracts are primarily related to streaming

delivery, DVD content acquisition, and miscellaneous open purchase orders for which we have not received the related services or

goods.