NetFlix 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Streaming Content

We license and acquire rights to stream TV shows, movies, and original content to members for unlimited viewing. These rights are for a

fixed fee and specify windows of availability. Payment terms for certain content agreements require more upfront cash payments relative to

expense.

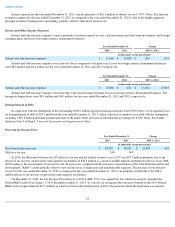

We capitalize the fee per title and record a corresponding liability at the gross amount of liabilities when the license period begins, the

cost of the title is known and the title is accepted and available for streaming. The portion available for streaming within one year is recognized

as “Current content library, net” and the remaining portion as “Non-current content library, net” on the Consolidated Balance sheets. The

acquisition of streaming content rights and the changes in related liabilities are classified within cash provided by operating activities on the

Consolidated Statements of Cash Flows.

We amortize the content library in “Cost of revenues” on a straight line or on an accelerated basis, as appropriate:

We review factors impacting the amortization of the content library, including historical and estimated viewing patterns, on a regular

basis. Our estimates related to these factors require considerable management judgment. Changes in our estimates could have a significant

impact on our future results of operations.

The content library is stated at the lower of unamortized cost or net realizable value. Streaming content (whether capitalized or not) is

reviewed in aggregate at the geographic region level for impairment when an event or change in circumstances indicates a change in the

expected usefulness of the content. The level of geographic aggregation is determined based on the streaming content rights which are

generally specific to a geographic region inclusive of several countries (such as Latin America). No material write down from unamortized cost

to a lower net realizable value was recorded in any of the periods presented.

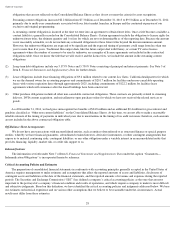

We have entered into certain licenses with performing rights organizations ("PROs"), and are currently involved in negotiations with other

PROs, that hold certain rights to music and other entertainment works "publicly performed" in connection with streaming content into various

territories. Accruals for estimated license fees are recorded and then adjusted based on any changes in estimates. These amounts are included in

the streaming content obligations. The results of these negotiations are uncertain and may be materially different from management's estimates.

Income Taxes

We record a provision for income taxes for the anticipated tax consequences of our reported results of operations using the asset and

liability method. Deferred income taxes are recognized by applying enacted statutory tax rates applicable to future years to differences between

the financial statement carrying amounts of existing assets and liabilities and their respective tax bases as well as net operating loss and tax

credit carryforwards. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes

the enactment date. The measurement of deferred tax assets is reduced, if necessary, by a valuation allowance for any tax benefits for which

future realization is uncertain.

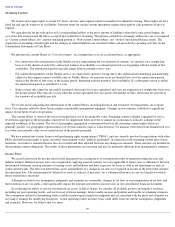

Although we believe our assumptions, judgments and estimates are reasonable, changes in tax laws or our interpretation of tax laws and

the resolution of any tax audits could significantly impact the amounts provided for income taxes in our consolidated financial statements.

In evaluating our ability to recover our deferred tax assets, in full or in part, we consider all available positive and negative evidence,

including our past operating results, and our forecast of future earnings, future taxable income and prudent and feasible tax planning strategies.

The assumptions utilized in determining future taxable income require significant judgment and are consistent with the plans and estimates we

are using to manage the underlying businesses. Actual operating results in future years could differ from our current assumptions, judgments

and estimates. However, we believe that it is more

29

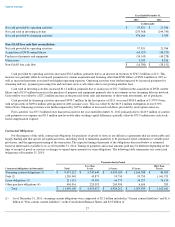

• For content that does not premiere on the Netflix service (representing the vast majority of content), we amortize on a straight-line

basis over the shorter of each title's contractual window of availability or estimated period of use, beginning with the month of first

availability. The amortization period typically ranges from six months to five years.

• For content that premieres on the Netflix service, we expect more upfront viewing due to the additional merchandising and marketing

efforts for this original content available only on Netflix. Hence, we amortize on an accelerated basis over the amortization period,

which is the shorter of four years or the license period, beginning with the month of first availability. If a subsequent season is added,

the amortization period is extended by a year.

•

If the cost per title cannot be reasonably estimated, the license fee is not capitalized and costs are expensed on a straight line basis over

the license period. This typically occurs when the license agreement does not specify the number of titles, the license fee per title or

the windows of availability per title.