NetFlix 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

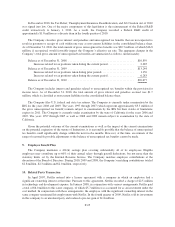

In December 2010, the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010

was signed into law. One of the major components of this legislation is the reinstatement of the Federal R&D

credit retroactively to January 1, 2010. As a result, the Company recorded a Federal R&D credit of

approximately $1.8 million as a discrete item in the fourth quarter of 2010.

The Company classifies gross interest and penalties and unrecognized tax benefits that are not expected to

result in payment or receipt of cash within one year as non-current liabilities in the consolidated balance sheet.

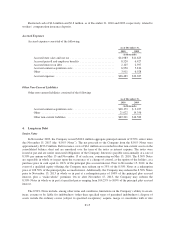

As of December 31, 2010, the total amount of gross unrecognized tax benefits was $20.7 million, of which $16.8

million, if recognized, would favorably impact the Company’s effective tax rate. The aggregate changes in the

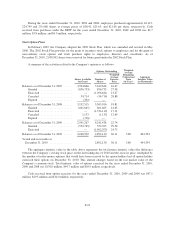

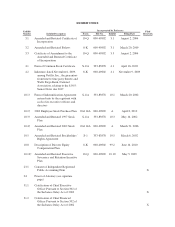

Company’s total gross amount of unrecognized tax benefits are summarized as follows (in thousands):

Balance as of December 31, 2008 .............................................. $10,859

Increases related to tax positions taken during the current period .................. 2,385

Balance as of December 31, 2009 .............................................. $13,244

Increases related to tax positions taken during prior periods ...................... 1,150

Increases related to tax positions taken during the current period .................. 6,283

Balance as of December 31, 2010 .............................................. $20,677

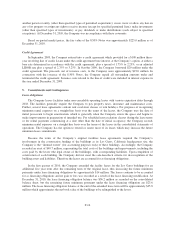

The Company includes interest and penalties related to unrecognized tax benefits within the provision for

income taxes. As of December 31, 2010, the total amount of gross interest and penalties accrued was $1.7

million, which is classified as non-current liabilities in the consolidated balance sheet.

The Company files U.S. federal and state tax returns. The Company is currently under examination by the

IRS for the years 2008 and 2009. The years 1997 through 2007 (which represent approximately $3.5 million of

the gross unrecognized tax benefit) remain subject to examination by the IRS but their statute of limitations

expires in 2011. The Company is currently under examination by the state of California for the years 2006 and

2007. The years 1997 through 2005 as well as 2008 and 2009 remain subject to examination by the state of

California.

Given the potential outcome of the current examinations as well as the impact of the current examinations

on the potential expiration of the statute of limitations, it is reasonably possible that the balance of unrecognized

tax benefits could significantly change within the next twelve months. However, at this time, an estimate of the

range of reasonably possible adjustments to the balance of unrecognized tax benefits cannot be made.

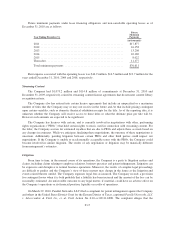

9. Employee Benefit Plan

The Company maintains a 401(k) savings plan covering substantially all of its employees. Eligible

employees may contribute up to 60% of their annual salary through payroll deductions, but not more than the

statutory limits set by the Internal Revenue Service. The Company matches employee contributions at the

discretion of the Board of Directors. During 2010, 2009 and 2008, the Company’s matching contributions totaled

$2.8 million, $2.3 million and $2.0 million, respectively.

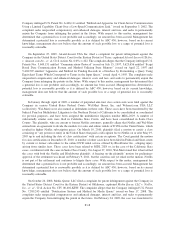

10. Related Party Transaction

In April 2007, Netflix entered into a license agreement with a company in which an employee had a

significant ownership interest at that time. Pursuant to this agreement, Netflix recorded a charge of $2.5 million

in technology and development expense. In January 2008, in conjunction with various arrangements Netflix paid

a total of $6.0 million to this same company, of which $5.7 million was accounted for as an investment under the

cost method. In conjunction with these arrangements, the employee with the significant ownership interest in the

same company terminated his employment with Netflix. In the fourth quarter of 2009, Netflix sold its investment

in this company to an unrelated party and realized a pre-tax gain of $1.8 million.

F-25