NetFlix 2010 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2010 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

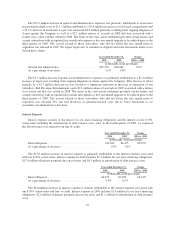

activities, or any other measure of financial performance or liquidity presented in accordance with GAAP. The

following table reconciles net cash provided by operating activities, a GAAP financial measure, to free cash flow,

a non-GAAP financial measure:

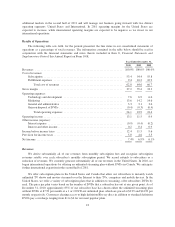

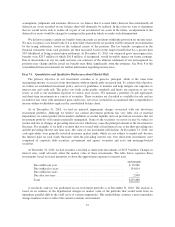

Year Ended December 31,

2010 2009 2008

(in thousands)

Non-GAAP free cash flow reconciliation:

Net cash provided by operating activities ............ $276,401 $ 325,063 $ 284,037

Acquisition of DVD content library ................. (123,901) (193,044) (162,849)

Purchases of property and equipment ............... (33,837) (45,932) (43,790)

Acquisition of intangible assets .................... (505) (200) (1,062)

Proceeds from sale of DVDs ...................... 12,919 11,164 18,368

Other assets ................................... (70) 71 (1)

Non-GAAP free cash flow ................... $131,007 $ 97,122 $ 94,703

Free cash flow for the year ended December 31, 2010 increased $33.9 million as compared to the year

ended December 31, 2009 primarily due to lower DVD content library and property and equipment expenditures.

These reduced spending levels more than offset the decrease in net cash provided by operating activities

described above.

Free cash flow for the year ended December 31, 2009 increased $2.4 million as compared to the year ended

December 31, 2008 primarily due to an increase in cash flow from operations, offset by higher DVD content

library expenditures and a decrease in the proceeds from sale of previously viewed DVDs.

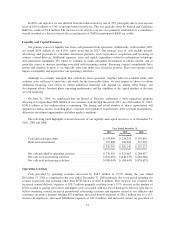

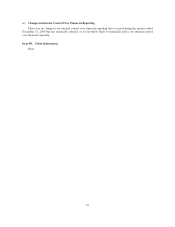

Contractual Obligations

For the purposes of this table, contractual obligations for purchases of goods or services are defined as

agreements that are enforceable and legally binding and that specify all significant terms, including: fixed or

minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing of

the transaction. The expected timing of payment of the obligations discussed above is estimated based on

information available to us as of December 31, 2010. Timing of payments and actual amounts paid may be

different depending on the time of receipt of goods or services or changes to agreed-upon amounts for some

obligations. The following table summarizes our contractual obligations at December 31, 2010:

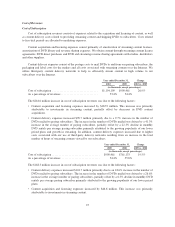

Payments due by Period

Contractual obligations (in thousands): Total

Less than

1 year 1-3 years 3-5 years

More than

5 years

8.50% senior notes ............. $ 319,000 $ 17,000 $ 34,000 $ 34,000 $234,000

Operating lease obligations ....... 53,038 13,693 21,995 12,304 5,046

Lease financing obligations (1) .... 23,573 4,184 7,372 5,886 6,131

Content obligations (2) .......... 1,299,176 530,878 531,698 236,600 —

Other purchase obligations ....... 157,957 85,546 68,036 4,375 —

Total .................... $1,852,744 $651,301 $663,101 $293,165 $245,177

(1) In the first quarter of 2010, we extended the facilities leases for the Los Gatos buildings. See note 5 to the

consolidated financial statements for further discussion of our lease financing obligations.

(2) Content obligations include agreements to acquire and license content that represent long-term liabilities or

that are not reflected on the consolidated balance sheets. For those agreements with variable terms, we do

not estimate what the total obligation may be beyond any minimum quantities and/ or pricing as of the

reporting date. For those agreements that include renewal provisions that are solely at the option of the

content provider, we include the commitments associated with the renewal period to the extent such

commitments are fixed or a minimum amount is specified. For these reasons, the amounts presented in the

table may not provide a reliable indicator of our expected future cash outflows.

33