NetFlix 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

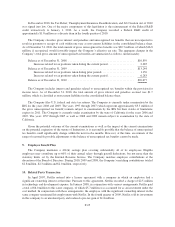

the Northern District of California. On August 14, 2009, the Company filed a motion for summary judgment of

non-infringement. A hearing on the motion was held on November 17, 2009. On December 1, 2009, the Court

granted the Company’s motion for summary judgment of non-infringement. On February 10, 2010, plaintiff

appealed the summary judgment ruling. With respect to this matter, management has determined that a potential

loss is not probable and accordingly, no amount has been accrued. Management has determined a potential loss is

reasonably possible as it is defined by ASC 450; however, based on its current knowledge, management does not

believe that the amount of such possible loss or a range of potential loss is reasonably estimable.

The Company is involved in other litigation matters not listed above but does not consider the matters to be

material either individually or in the aggregate at this time. The Company’s view of the matters not listed may

change in the future as the litigation and events related thereto unfold.

6. Guarantees—Intellectual Property Indemnification Obligations

In the ordinary course of business, the Company has entered into contractual arrangements under which it

has agreed to provide indemnification of varying scope and terms to business partners and other parties with

respect to certain matters, including, but not limited to, losses arising out of the Company’s breach of such

agreements and out of intellectual property infringement claims made by third parties.

The Company’s obligations under these agreements may be limited in terms of time or amount, and in some

instances, the Company may have recourse against third-parties for certain payments. In addition, the Company

has entered into indemnification agreements with its directors and certain of its officers that will require it,

among other things, to indemnify them against certain liabilities that may arise by reason of their status or service

as directors or officers. The terms of such obligations vary.

It is not possible to make a reasonable estimate of the maximum potential amount of future payments under

these or similar agreements due to the conditional nature of the Company’s obligations and the unique facts and

circumstances involved in each particular agreement. No amount has been accrued in the accompanying financial

statements with respect to these indemnification guarantees.

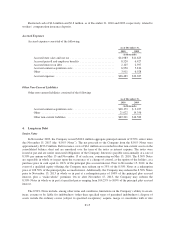

7. Stockholders’ Equity

Stock Repurchase Program

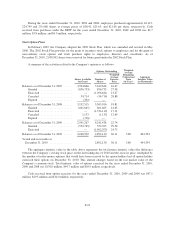

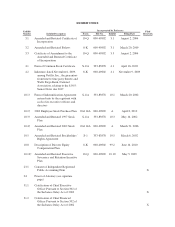

The following table presents a summary of our stock repurchases:

Year ended December 31,

2010 2009 2008

(in thousands, except per share data)

Total number of shares repurchased ..... 2,606 7,371 7,338

Dollar amount of shares repurchased .... 210,259 324,335 199,904

Average price paid per share ........... $ 80.67 $ 44.00 $ 27.24

Range of price paid per share .......... $60.23 – $126.01 $34.70 – $60.00 $19.52 – $31.71

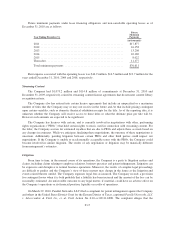

Under the current stock repurchase plan, announced on June 11, 2010, the Company is authorized to

repurchase up to $300 million of its common stock through the end of 2012. As of December 31, 2010, $240.6

million of this authorization is remaining. The timing and actual number of shares repurchased will depend on

various factors including price, corporate and regulatory requirements, debt covenant requirements, alternative

investment opportunities and other market conditions.

F-19