NetFlix 2010 Annual Report Download - page 52

Download and view the complete annual report

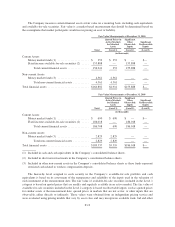

Please find page 52 of the 2010 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Short-term investments are reviewed periodically to identify possible other-than-temporary impairment.

When evaluating the investments, the Company reviews factors such as the length of time and extent to which

fair value has been below cost basis, the financial condition of the issuer, the Company’s intent to sell, or

whether it would be more likely than not that the Company would be required to sell the investments before the

recovery of their amortized cost basis.

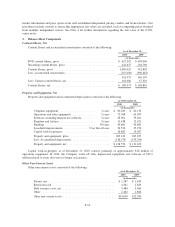

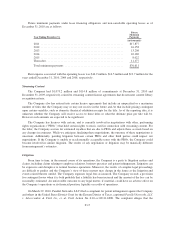

Content Library

The Company obtains content through streaming content license agreements, DVD direct purchases and

DVD and streaming revenue sharing agreements with studios, distributors and other suppliers.

The Company obtains content distribution rights in order to stream TV shows and movies to subscribers’

TVs, computers and mobile devices. Streaming content is generally licensed for a fixed-fee for the term of the

license agreement. The license agreement may or may not be recognized in content library.

When the streaming license fee is known or reasonably determinable for a specific title and the specific title

is first available for streaming to subscribers, the title is recognized on the consolidated balance sheets as current

content library for the portion available for streaming within one year and as non-current content library for the

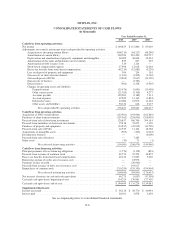

remaining portion. New titles recognized in the content library are classified in the line item “Acquisition of

streaming content library” within net cash provided by operating activities in the consolidated statements of cash

flows. The Company amortizes the content library on a straight-line basis over each title’s window of

availability. The amortization is classified in cost of subscription in the consolidated statements of operations and

in the line item “Amortization of content library” within net cash provided by operating activities in the

consolidated statements of cash flows. For the titles recognized in content library, the license fees due but not

paid are classified on the consolidated balance sheets as “Accounts payable” for the amounts due within one year

and as “Other non-current liabilities” for the amounts due beyond one year. Changes in these liabilities are

classified in the line items “Accounts payable” and “Other assets and liabilities” within net cash provided by

operating activities in the consolidated statement of cash flows. Commitments for the titles not yet available for

streaming are not yet recognized in the content library and are included in footnote 5 to the consolidated financial

statements.

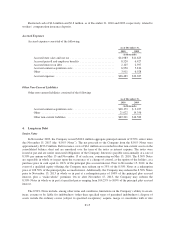

When the streaming license fee is not known or reasonably determinable for a specific title, the title does

not meet the criteria for recognition in the content library. The license fee is not known or reasonably

determinable for a specific title in fixed fee license agreements that do not specify the number of titles, the

license fee per title and the windows of availability per title. Over the term of these agreements, the Company

typically makes periodic fixed prepayments that are classified in prepaid content on the consolidated balance

sheets. The Company amortizes the license fees on a straight-line basis over the term of each license agreement.

The amortization is classified in cost of subscription in the consolidated statements of operations and in the line

item “Net income” within net cash provided by operating activities in the consolidated statements of cash flows.

Changes in prepaid content are classified within net cash provided by operating activities in the line item

“Prepaid content” in the consolidated statements of cash flows. Commitments for licenses that do not meet the

criteria for recognition in the content library are included in footnote 5 to the consolidated financial statements.

The Company acquires DVD content for the purpose of renting such content to its subscribers and earning

subscription rental revenues, and, as such, the Company considers its direct purchase DVD library to be a

productive asset. Accordingly, the Company classifies its DVD library as a non-current asset on the consolidated

balance sheets. The acquisition of DVD content library, net of changes in related liabilities, is classified in the

line item “Acquisition of DVD content library” within cash used in investing activities in the consolidated

statements of cash flows because the DVD content library is considered a productive asset. Other companies in

the in-home entertainment video industry classify these cash flows as operating activities. The Company

amortizes its direct purchase DVDs, less estimated salvage value, on a “sum-of-the-months” accelerated basis

over their estimated useful lives. The useful life of the new release DVDs and back-catalog DVDs is estimated to

be one year and three years, respectively. In estimating the useful life of its DVDs, the Company considers

F-8