NetFlix 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

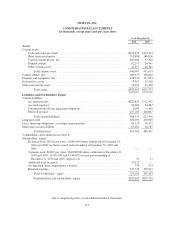

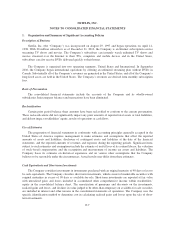

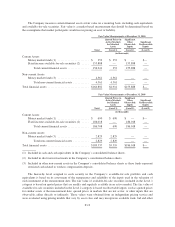

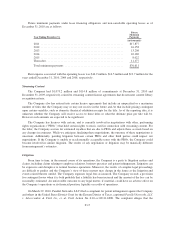

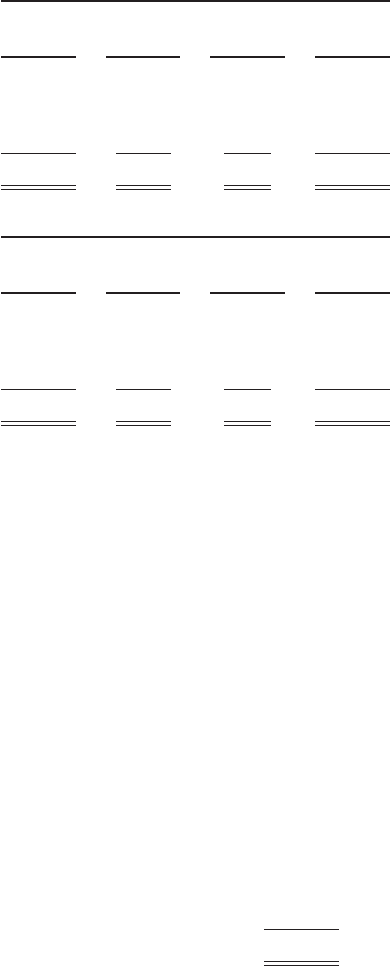

2. Short-term Investments

The Company’s investment policy is consistent with the definition of available-for-sale securities. The

Company does not buy and hold securities principally for the purpose of selling them in the near future. The

Company’s policy is focused on the preservation of capital, liquidity and return. From time to time, the Company

may sell certain securities but the objectives are generally not to generate profits on short-term differences in

price. Short-term investments are therefore classified as available-for-sale securities and are reported at fair value

as follows:

December 31, 2010

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

(in thousands)

Corporate debt securities ..................... $109,745 $1,043 $(101) $110,687

Government and agency securities ............. 42,062 331 (101) 42,292

Asset and mortgage backed securities ........... 2,881 168 (140) 2,909

$154,688 $1,542 $(342) $155,888

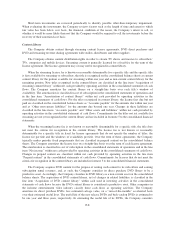

December 31, 2009

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

(in thousands)

Corporate debt securities ..................... $ 82,362 $ 915 $(106) $ 83,171

Government and agency securities ............. 96,998 72 (416) 96,654

Asset and mortgage backed securities ........... 6,262 143 (212) 6,193

$185,622 $1,130 $(734) $186,018

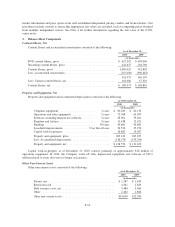

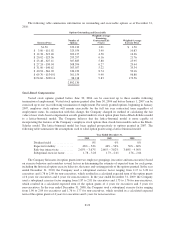

Because the Company does not intend to sell the investments that are in an unrealized loss position and it is

not likely that the Company will be required to sell the investments before recovery of their amortized cost basis,

the Company does not consider those investments with an unrealized loss to be other-than-temporarily impaired

at December 31, 2010. There were no material other-than-temporary impairments or credit losses related to

available-for-sale securities in 2010, 2009 or 2008.

The gross realized gains on the sales of available-for-sale securities for the three years ended December 31,

2010, 2009 and 2008 were $1.0 million, $1.9 million and $4.9 million, respectively. There were no material gross

realized losses from the sale of available-for-sale investments for the years ended December 31, 2010 and 2009.

The gross realized losses on the sales of available-for-sale securities for the year ended 2008 were $1.8 million.

Realized gains and losses and interest income are included in interest and other income.

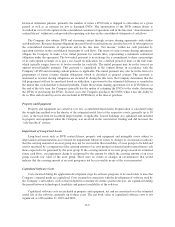

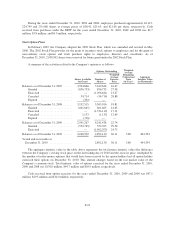

The estimated fair value of short-term investments by contractual maturity as of December 31, 2010 is as

follows:

(in thousands)

Due within one year .............................................. $ 18,966

Due after one year and through 5 years ............................... 134,014

Due after 5 years and through 10 years ............................... —

Due after 10 years ............................................... 2,908

Total short-term investments ....................................... $155,888

F-12