NetFlix 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

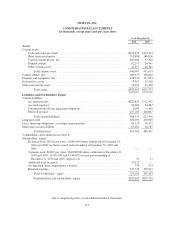

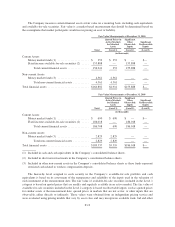

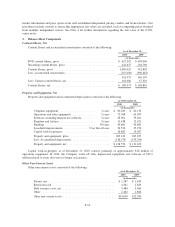

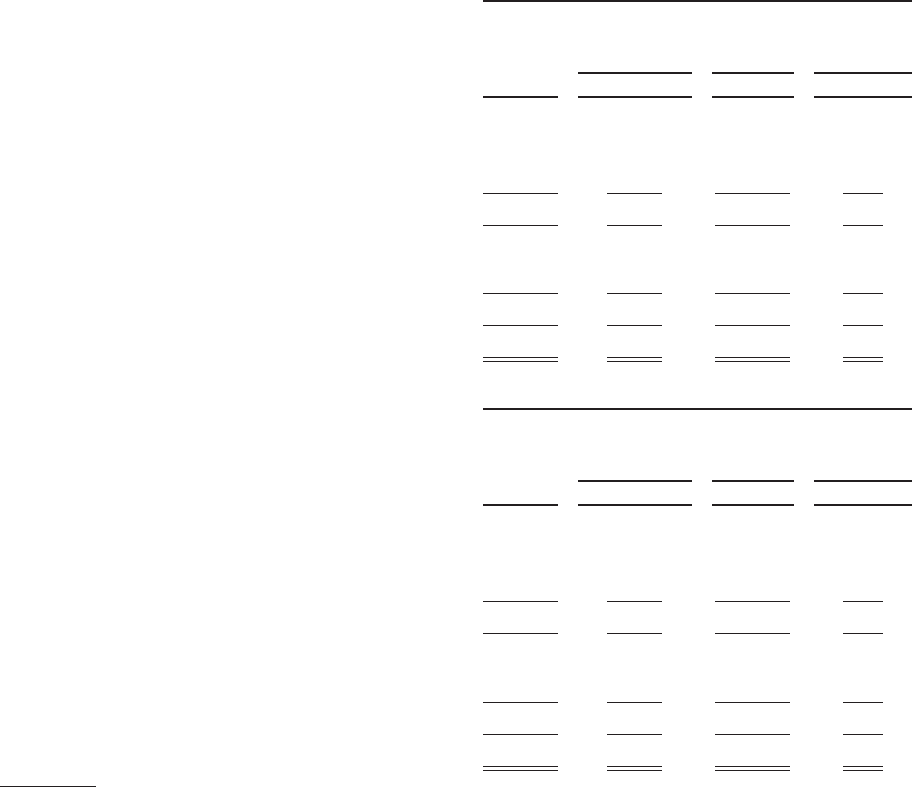

The Company measures certain financial assets at fair value on a recurring basis, including cash equivalents

and available-for-sale securities. Fair value is a market-based measurement that should be determined based on

the assumptions that market participants would use in pricing an asset or liability.

Fair Value Measurements at December 31, 2010

Quoted Prices in

Active Markets

for Identical

Assets

Significant

Other

Observable

Inputs

Significant

Unobservable

Inputs

Total (Level 1) (Level 2) (Level 3)

(in thousands)

Current Assets:

Money market funds (1) ...................... $ 353 $ 353 $ — $—

Fixed income available-for-sale securities (2) ..... 155,888 — 155,888 —

Total current financial assets ............... 156,241 353 155,888 —

Non-current Assets:

Money market funds (3) ...................... 4,561 4,561 — —

Total non-current financial assets ........... 4,561 4,561 — —

Total financial assets ............................. $160,802 $4,914 $155,888 $—

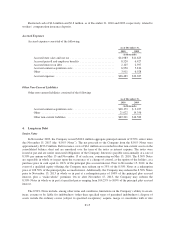

Fair Value Measurements at December 31, 2009

Quoted Prices in

Active Markets

for Identical

Assets

Significant

Other

Observable

Inputs

Significant

Unobservable

Inputs

Total (Level 1) (Level 2) (Level 3)

(in thousands)

Current Assets:

Money market funds (1) ...................... $ 690 $ 690 $ — $—

Fixed income available-for-sale securities (2) ..... 186,018 — 186,018 —

Total current financial assets ............... 186,708 690 186,018 —

Non-current Assets:

Money market funds (3) ...................... 2,829 2,829 — —

Total non-current financial assets ........... 2,829 2,829 — —

Total financial assets ............................. $189,537 $3,519 $186,018 $—

(1) Included in cash and cash equivalents in the Company’s consolidated balance sheets.

(2) Included in short-term investments in the Company’s consolidated balance sheets.

(3) Included in other non-current assets in the Company’s consolidated balance sheets as these funds represent

restricted cash related to workers compensation deposits.

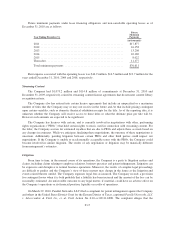

The hierarchy level assigned to each security in the Company’s available-for-sale portfolio and cash

equivalents is based on its assessment of the transparency and reliability of the inputs used in the valuation of

such instrument at the measurement date. The fair value of available-for-sale securities included in the Level 1

category is based on quoted prices that are readily and regularly available in an active market. The fair value of

available-for-sale securities included in the Level 2 category is based on observable inputs, such as quoted prices

for similar assets at the measurement date; quoted prices in markets that are not active; or other inputs that are

observable, either directly or indirectly. These values were obtained from an independent pricing service and

were evaluated using pricing models that vary by asset class and may incorporate available trade, bid and other

F-13