NetFlix 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

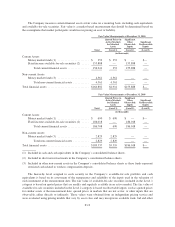

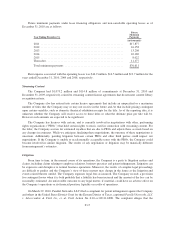

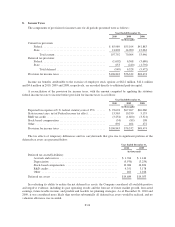

Future minimum payments under lease financing obligations and non-cancelable operating leases as of

December 31, 2010 are as follows:

Year Ending December 31,

Future

Minimum

Payments

(in thousands)

2011 .......................................................... $17,877

2012 .......................................................... 16,158

2013 .......................................................... 13,208

2014 .......................................................... 10,169

2015 .......................................................... 8,022

Thereafter ...................................................... 11,177

Total minimum payments ......................................... $76,611

Rent expense associated with the operating leases was $14.9 million, $14.5 million and $13.7 million for the

years ended December 31, 2010, 2009 and 2008, respectively.

Streaming Content

The Company had $1,075.2 million and $114.8 million of commitments at December 31, 2010 and

December 31, 2009, respectively, related to streaming content license agreements that do not meet content library

recognition criteria.

The Company also has entered into certain license agreements that include an unspecified or a maximum

number of titles that the Company may or may not receive in the future and /or that include pricing contingent

upon certain variables, such as domestic theatrical exhibition receipts for the title. As of the reporting date, it is

unknown whether the Company will receive access to these titles or what the ultimate price per title will be.

However such amounts are expected to be significant.

The Company has licenses with certain, and is currently involved in negotiations with other, performing

rights organizations (“PROs”) that hold certain rights to music used in connection with streaming content. For

the latter, the Company accrues for estimated royalties that are due to PROs and adjusts these accruals based on

any changes in estimates. While we anticipate finalizing these negotiations, the outcome of these negotiations is

uncertain. Additionally, pending litigation between certain PROs and other third parties could impact our

negotiations. If the Company is unable to reach mutually acceptable terms with the PROs, the Company could

become involved in similar litigation. The results of any negotiation or litigation may be materially different

from management’s estimates.

Litigation

From time to time, in the normal course of its operations, the Company is a party to litigation matters and

claims, including claims relating to employee relations, business practices and patent infringement. Litigation can

be expensive and disruptive to normal business operations. Moreover, the results of complex legal proceedings

are difficult to predict and the Company’s view of these matters may change in the future as the litigation and

events related thereto unfold. The Company expenses legal fees as incurred. The Company records a provision

for contingent losses when it is both probable that a liability has been incurred and the amount of the loss can be

reasonably estimated. An unfavorable outcome to any legal matter, if material, could have an adverse effect on

the Company’s operations or its financial position, liquidity or results of operations.

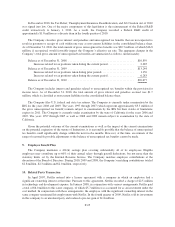

On March 29, 2010, Parallel Networks, LLC filed a complaint for patent infringement against the Company

and others in the United States District Court for the Eastern District of Texas, captioned Parallel Networks, LLC

v. Abercrombie & Fitch Co., et. al, Civil Action No 6:10-cv-00111-LED. The complaint alleges that the

F-17