NetFlix 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

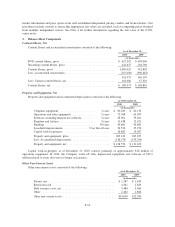

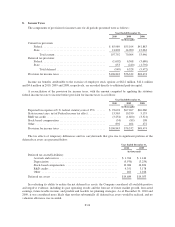

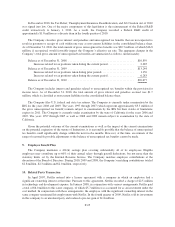

8. Income Taxes

The components of provision for income taxes for all periods presented were as follows:

Year Ended December 31,

2010 2009 2008

(in thousands)

Current tax provision:

Federal ........................................... $ 85,989 $55,104 $41,883

State ............................................. 21,803 14,900 12,063

Total current ................................... 107,792 70,004 53,946

Deferred tax provision:

Federal ........................................... (1,602) 6,568 (3,680)

State ............................................. 653 (240) (1,792)

Total deferred .................................. (949) 6,328 (5,472)

Provision for income taxes ................................ $106,843 $76,332 $48,474

Income tax benefits attributable to the exercise of employee stock options at $62.2 million, $12.4 million

and $4.6 million in 2010, 2009 and 2008, respectively, are recorded directly to additional paid-in-capital.

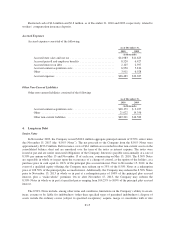

A reconciliation of the provision for income taxes, with the amount computed by applying the statutory

federal income tax rate to income before provision for income taxes is as follows:

Year Ended December 31,

2010 2009 2008

(in thousands)

Expected tax expense at U.S. federal statutory rate of 35% ...... $ 93,694 $67,267 $46,060

State income taxes, net of Federal income tax effect ............ 15,565 10,350 5,155

R&D tax credit ......................................... (3,254) (1,600) (3,321)

Stock-based compensation ................................ (54) (89) 108

Other ................................................. 892 404 472

Provision for income taxes ................................ $106,843 $76,332 $48,474

The tax effects of temporary differences and tax carryforwards that give rise to significant portions of the

deferred tax assets are presented below:

Year Ended December 31,

2010 2009

(in thousands)

Deferred tax assets/(liabilities):

Accruals and reserves ........................................ $ 1,764 $ 1,144

Depreciation ............................................... (5,970) (3,259)

Stock-based compensation .................................... 19,084 16,824

R&D credits ................................................ 4,351 3,178

Other ..................................................... 461 1,166

Deferred tax assets .............................................. $19,689 $19,053

In evaluating its ability to realize the net deferred tax assets, the Company considered all available positive

and negative evidence, including its past operating results and the forecast of future market growth, forecasted

earnings, future taxable income, and prudent and feasible tax planning strategies. As of December 31, 2010 and

2009, it was considered more likely than not that substantially all deferred tax assets would be realized, and no

valuation allowance was recorded.

F-24