NetFlix 2003 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2003 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(in thousands, except share, per share and per DVD data)

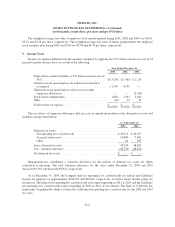

13. Selected Quarterly Financial Data (Unaudited)

Quarter Ended

March 31 June 30 September 30 December 31

2003

Totalrevenues ............................... $55,669 $ 63,187 $72,202 $81,185

Grossprofit ................................. $25,662 $ 27,946 $33,554 $36,721

Netincome(loss) ............................ $(2,375) $ 3,313 $ 3,303 $ 2,271

Net income (loss) per share:

Basic .................................. $ (0.05) $ 0.07 $ 0.07 $ 0.05

Diluted................................. $ (0.05) $ 0.05 $ 0.05 $ 0.04

Subscribers at end of period .................... 1,052 1,147 1,291 1,487

2002

Totalrevenues ............................... $30,527 $ 36,360 $40,731 $45,188

Grossprofit ................................. $15,369 $ 18,268 $19,235 $21,798

Netloss(1) ................................. $(2,729) $(13,115) $ (2,850) $ (2,254)

Net loss per share—basic and diluted ............. $ (0.67) $ (0.64) $ (0.07) $ (0.05)

Subscribers at end of period .................... 603 670 742 857

(1) In July 2001, the Company issued subordinated promissory notes and warrants to purchase 13,637,894

shares of its common stock at an exercise price of $1.50 per share for net proceeds of $12,831. The

subordinated notes had an aggregate face value of $13,000 and stated interest rate of 10 percent.

Approximately $10,884 of the proceeds was allocated to the warrants as additional paid-in capital and

$1,947 was allocated to the subordinated notes payable. The resulting discount of $11,053 was accreted to

interest expense using an effective annual interest rate of 21 percent. The face value of the subordinated

notes and all accrued interest were due and payable upon the earlier of July 2011 or the consummation of a

qualified initial public offering. The Company consummated a qualified initial public offering in May 2002

and repaid the face value and all accrued interest on the subordinated promissory notes. The repayment

resulted in a non-cash other expense of $10,695, related to the acceleration of the accretion of the discount,

during the quarter ended June 30, 2002.

F-23