NetFlix 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.These revenue sharing agreements enable us to acquire DVDs at a lower upfront cost than traditional direct

purchase arrangements. We share a percentage of the net revenues generated by the use of each particular title

with these studios over a fixed period of time, generally twelve months for each title. At the end of the revenue

sharing period for each title, we typically have the option of either returning the DVDs associated with the title to

the studio or purchasing some or all of those DVDs.

Before the change in our business model, we typically acquired fewer copies of a particular title and utilized

each copy over a longer period of time. The implementation of these revenue sharing agreements improved our

ability to acquire larger quantities of newly released titles and satisfy a substantial portion of subscriber demand

for such titles over a shorter period of time. On January 1, 2001, we revised the amortization policy for the cost

of our library from a “sum-of-the-month” accelerated method using a three-year life to the same accelerated

method of amortization using a one-year life.

The change in life has been accounted for as a change in accounting estimate and was accounted for on a

prospective basis from January 1, 2001. Had we continued to amortize the DVDs acquired prior to January 1,

2001 using a three-year life, amortization expense for 2001 would have been $4.7 million lower than the amount

recorded in our financial statements.

Under our revenue sharing agreements, we remit an upfront payment to acquire titles from the studios. This

payment includes a contractually specified initial fixed license fee that is capitalized. Certain of these payments

also include a contractually specified prepayment of future revenue sharing obligations that is classified as

prepaid revenue sharing expense and is expensed as revenue sharing obligations are incurred. The initial fixed

license fee is amortized on a “sum-of-the-month” basis over one year.

We believe the use of the accelerated method is appropriate for the amortization of our DVD library and the

initial fixed license fee because we normally experience heavy initial demand for a title, which subsides

gradually once the initial demand has been satisfied.

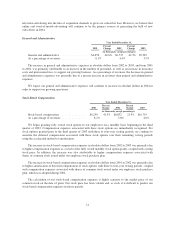

Stock-Based Compensation

We account for stock-based compensation expenses in accordance with the fair value recognition provisions

of SFAS No. 123. During 2001, 2002 and 2003, we recorded total stock-based compensation expenses of

$6.3 million, $8.8 million and $10.7 million, respectively. The application of SFAS No. 123 requires significant

judgment, including the determination of the expected life and volatility for stock options. To determine the

expected life, we review the historical pattern of exercises of stock options. Prior to the third quarter of 2003, we

granted stock options which generally vest over three to four-year periods. Since the third quarter of 2003, we

began granting fully vested stock options to our employees on a monthly basis. As a result, we changed the

expected life from 3.5 years to 1.5 years. In addition, our stock price has fluctuated significantly and has risen

considerably in recent periods. These factors affect our assumptions used in determining the volatility. Given the

volatile market conditions, it is difficult to forecast our stock-based compensation expenses, and changes in our

assumptions could materially impact the amount of stock-based compensation expenses recorded in future

periods.

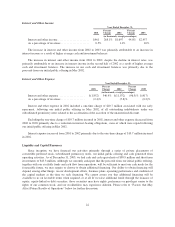

Income Taxes

We record a tax provision, if any, for the anticipated tax consequences of the reported results of operations.

In accordance with SFAS No. 109, Accounting for Income Taxes, the provision for income taxes is computed

using the asset and liability method, under which deferred tax assets and liabilities are recognized for the

expected future tax consequences of temporary differences between the financial reporting and tax bases of

assets and liabilities, and for operating losses and tax credit carryforwards. Deferred tax assets and liabilities are

measured using the currently enacted tax rates that apply to taxable income in effect for the years in which those

tax assets are expected to be realized or settled. We record a valuation allowance to reduce deferred tax assets to

the amount that is believed more likely than not to be realized.

15