NetFlix 2003 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2003 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

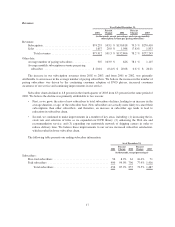

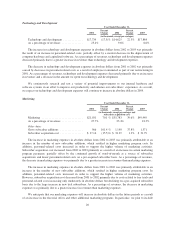

The following table summarizes our cash flow activities:

Year Ended December 31,

2001

Percent

Change 2002

Percent

Change 2003

(in thousands, except percentages)

Net cash provided by operating activities ..... $ 4,847 727.6% $ 40,114 123.8% $ 89,792

Net cash used in investing activities ......... (12,670) 431.2% (67,301) (3.9)% (64,677)

Net cash provided by financing activities ..... 9,059 682.3% 70,870 (93.0)% 4,965

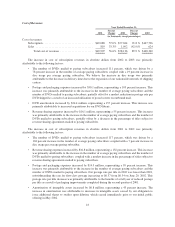

Operating Activities

The increase in net cash provided by operating activities from 2002 to 2003 was primarily attributable to net

income generated in 2003 as compared to a net loss incurred in 2002, adjusted for an increase in the amortization

of our DVD library as a result of increased purchases of titles during 2003, an increase in accounts payable as a

result of our growing operations, an increase in deferred revenue due to a larger subscriber base and an increase

in stock-based compensation expenses. The increase in net cash provided by operating activities from 2002 to

2003 was partially offset by the decrease in non-cash interest expense in 2003. Non-cash interest expense

included a one-time charge of $10.7 million related to an early debt repayment in 2002.

The increase in net cash provided by operating activities from 2001 to 2002 was primarily attributable to a

smaller net loss incurred in 2002 as compared to 2001, adjusted for an increase in deferred revenue due to a

larger subscriber base, an increase in interest expense due to a one-time charge of $10.7 million related to an

early debt repayment, and an increase in accrued expenses and stock-based compensation expenses. The increase

in net cash provided by operating activities from 2001 to 2002 was partially offset by the gain on disposal of

DVDs and a lower amortization of DVD library incurred in 2002.

Investing Activities

The decrease in net cash used in investing activities from 2002 to 2003 was primarily attributable to

substantially smaller purchases of short-term investments in 2003. Purchases of short-term investments were

significantly higher in 2002 as a result of the proceeds from our initial public offering in May 2002. The decrease

in net cash used in investing activities from 2002 to 2003 was partially offset by an increase in both the purchases

of property and equipment to support our growing business, and the acquisitions of DVD titles for our library to

support our larger subscriber base in 2003.

The increase in net cash used in investing activities from 2001 to 2002 was primarily attributable to the

purchases of short-term investments in 2002 using the proceeds from our initial public offering, coupled with an

increase in the acquisitions of DVD titles for our library to support our growing subscriber base. The increase in

net cash used in investing activities from 2001 to 2002 was partially offset by proceeds generated from sales of

DVDs in 2002.

Financing Activities

The decrease in net cash provided by financing activities from 2002 to 2003 was primarily attributable to

substantially smaller proceeds from the issuance of common stock in 2003. Proceeds from the issuance of

common stock were significantly higher in 2002 as a result of our initial public offering. The decrease in net cash

provided by financing activities from 2002 to 2003 was partially offset by a decrease in the repayment of debt

and other obligations in 2003.

The increase in net cash provided by financing activities from 2001 to 2002 was primarily attributable to the

proceeds from the issuance of common stock in our initial public offering in May 2002, partially offset by an

increase in the repayment of debt and other obligations in 2002.

23