NetFlix 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

If we subsequently realize deferred tax assets that were previously determined to be unrealizable, the

respective valuation allowance would be reversed, resulting in a positive adjustment to earnings in the period

such determination is made. In addition, the calculation of tax liabilities involves significant judgment in

estimating the impact of uncertainties in the application of complex tax laws. Resolution of these uncertainties in

a manner inconsistent with management’s expectations could have a material impact on our results of operations

and financial position.

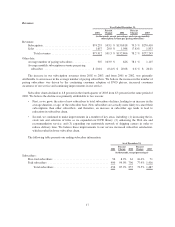

Results of Operations

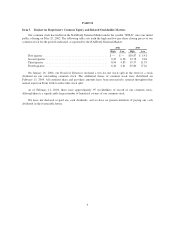

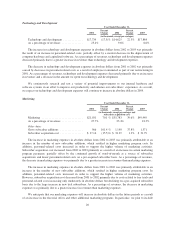

The following table sets forth, for the periods presented, the line items in our Statements of Operations as a

percentage of total revenues. The information contained in the table below should be read in conjunction with the

financial statements and notes thereto included in “Item 8. Financial Statements and Supplementary Data” of this

annual report on Form 10-K.

Year Ended December 31,

2001 2002 2003

Revenues:

Subscription ..................................................... 97.8% 98.7% 99.3%

Sales ........................................................... 2.2 1.3 0.7

Totalrevenues ............................................... 100.0 100.0 100.0

Cost of revenues:

Subscription ..................................................... 64.7 50.4 54.3

Sales ........................................................... 1.0 0.7 0.2

Totalcostofrevenues ......................................... 65.7 51.1 54.5

Grossprofit.......................................................... 34.3 48.9 45.5

Operating expenses:

Fulfillment ...................................................... 17.7 12.7 11.5

Technology and development ....................................... 23.4 9.6 6.6

Marketing ....................................................... 27.7 23.4 18.3

General and administrative ......................................... 6.1 4.4 3.5

Restructuring charges .............................................. 0.9 — —

Stock-based compensation .......................................... 8.2 5.8 4.0

Total operating expenses ....................................... 84.0 55.9 43.9

Operating income (loss) ................................................ (49.7) (7.0) 1.6

Other income (expense):

Interest and other income ........................................... 0.5 1.1 1.0

Interest and other expense .......................................... (2.4) (7.8) (0.2)

Netincome(loss) ..................................................... (51.6)% (13.7)% 2.4%

16