NetFlix 2003 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2003 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(in thousands, except share, per share and per DVD data)

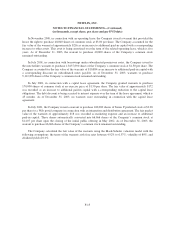

In November 2000, in connection with an operating lease, the Company issued a warrant that provided the

lessor the right to purchase 40,000 shares of common stock at $3.00 per share. The Company accounted for the

fair value of the warrant of approximately $216 as an increase to additional paid-in capital with a corresponding

increase to other assets. This asset is being amortized over the term of the related operating lease, which is five

years. As of December 31, 2003, the warrant to purchase 40,000 shares of the Company’s common stock

remained outstanding.

In July 2001, in connection with borrowings under subordinated promissory notes, the Company issued to

the note holders warrants to purchase 13,637,894 shares of the Company’s common stock at $1.50 per share. The

Company accounted for the fair value of the warrants of $10,884 as an increase to additional paid-in capital with

a corresponding discount on subordinated notes payable. As of December 31, 2003, warrants to purchase

9,112,870 shares of the Company’s common stock remained outstanding.

In July 2001, in connection with a capital lease agreement, the Company granted warrants to purchase

170,000 shares of common stock at an exercise price of $1.50 per share. The fair value of approximately $172

was recorded as an increase to additional paid-in capital with a corresponding reduction to the capital lease

obligations. The debt discount is being accreted to interest expense over the term of the lease agreement, which is

45 months. As of December 31, 2003, no warrants were outstanding in connection with the capital lease

agreement.

In July 2001, the Company issued a warrant to purchase 100,000 shares of Series F preferred stock at $9.38

per share to a Web portal company in connection with an integration and distribution agreement. The fair market

value of the warrants of approximately $18 was recorded as marketing expense and an increase to additional

paid-in capital. These shares automatically converted into 66,666 shares of the Company’s common stock at

$14.07 per share upon the closing of the initial public offering in May 2002. As of December 31, 2003, the

warrant to purchase 66,666 shares of the Company’s common stock remained outstanding.

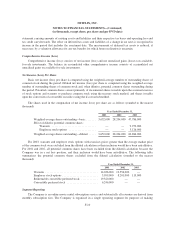

The Company calculated the fair value of the warrants using the Black-Scholes valuation model with the

following assumptions: the terms of the warrants; risk-free rates between 4.92% to 6.37%; volatility of 80%; and

dividend yield of 0.0%.

F-15