NetFlix 2003 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2003 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

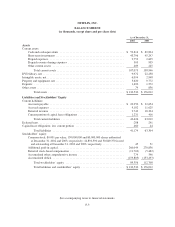

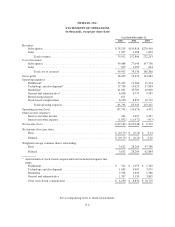

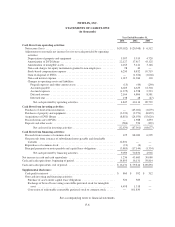

NOTES TO FINANCIAL STATEMENTS

(in thousands, except share, per share and per DVD data)

1. Organization and Significant Accounting Policies

Description of Business

Netflix, Inc. (the “Company”) was incorporated on August 29, 1997 (inception) and began operations on

April 14, 1998. The Company is an online movie rental subscription service, providing subscribers with access to

a comprehensive library of titles. For the standard subscription plan of $19.95 a month, subscribers can rent as

many DVDs as they want, with three movies out at a time, and keep them for as long as they like. There are no

due dates and no late fees. DVDs are delivered directly to the subscriber’s address by first-class mail from

shipping centers throughout the United States. The Company also provides extensive information on DVD

movies, including critic reviews, member reviews, online trailers, ratings and personalized movie

recommendations.

Initial Public Offering

On May 29, 2002, the Company closed the sale of 11,000,000 shares of common stock and on June 14,

2002, the Company closed the sale of an additional 1,650,000 shares of common stock in an initial public

offering at a price of $7.50 per share. A total of $94,875 in gross proceeds was raised from these transactions.

After deducting the underwriting fee of approximately $6,641 and approximately $2,060 of other offering

expenses, net proceeds were approximately $86,174. Upon the closing of the initial public offering, all preferred

stock was automatically converted into common stock.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial

statements, and the reported amounts of revenues and expenses during the reporting periods. Actual results could

differ from those estimates.

Fair Value of Financial Instruments

The fair value of the Company’s cash, short-term investments, accounts payable, accrued expenses and

borrowings approximates their carrying value due to their short maturity.

Cash and Cash Equivalents

The Company considers highly liquid instruments with original maturities of three months or less, at the

date of purchase, to be cash equivalents. The Company’s cash and cash equivalents are principally on deposit in

short-term asset management accounts at two large financial institutions.

Restricted Cash

As of December 31, 2003, other assets included restricted cash of $800 related to a workers’ compensation

insurance deposit.

Short-Term Investments

The Company’s short-term investments generally mature between one and five years from the purchase

date. The Company has the ability to convert these short-term investments into cash at anytime without penalty.

F-7