NetFlix 2003 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2003 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(in thousands, except share, per share and per DVD data)

operating decisions and assessing performance in accordance with SFAS No. 131, Disclosures about Segments of

an Enterprise and Related Information. The Company’s Chief Executive Officer, who is the chief operating

decision maker as defined in SFAS No. 131, evaluates performance, makes operating decisions and allocates

resources based on financial data consistent with the presentation in the accompanying financial statements.

Recent Accounting Pronouncements

In April 2003, the Financial Accounting Standard Board (“FASB”) issued SFAS No. 149, Amendment of

Statement 133 on Derivative Instruments and Hedging Activities, which amends and clarifies accounting for

derivative instruments, including certain derivative instruments embedded in other contracts, and for hedging

activities under SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities. SFAS No. 149 is

generally effective for derivative instruments, including derivative instruments embedded in certain contracts,

entered into or modified after June 30, 2003, and for hedging relationships designated after June 30, 2003. The

adoption of SFAS No. 149 did not have a material impact on the Company’s operating results or financial

condition.

In May 2003, the FASB issued SFAS No. 150, Accounting for Certain Financial Instruments with

Characteristics of Both Liabilities and Equity, which provides guidance for the classification and measurement

of certain financial instruments with characteristics of both liabilities and equity. SFAS No. 150 is effective for

financial instruments entered into or modified after May 31, 2003, and otherwise is effective at the beginning of

the first interim period beginning after June 15, 2003. The adoption of SFAS No. 150 did not have a material

impact on the Company’s operating results or financial condition.

In January 2003, the FASB issued Interpretation No. 46, Consolidation of Variable Interest Entities, an

interpretation of ARB No. 51. This Interpretation addresses the consolidation by business enterprises of variable

interest entities as defined in the Interpretation. In December 2003, the FASB issued a revised Interpretation No.

46 (“FIN 46R”), which expands the criteria for consideration in determining whether a variable interest entity

should be consolidated. Public companies must apply FIN 46R to entities considered to be special purpose

entities no later than the end of the first reporting period that ended after December 15, 2003, and no later than

the first reporting period that ends after March 15, 2004 for all other entities. The application of FIN 46R is not

expected to have a material effect on the Company’s financial statements.

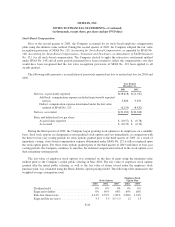

2. DVD Library

Historically, the Company purchased DVDs from studios and distributors. In 2000 and 2001, the Company

entered into a series of revenue sharing agreements with several studios which changed the business model for

acquiring DVDs and satisfying subscriber demand. These revenue sharing agreements enable the Company to

obtain DVDs at a lower up front cost than under traditional direct purchase arrangements. The Company shares a

percentage of the actual net revenues generated by the use of each particular title with the studios over a fixed

period of time, which is typically twelve months for each DVD title (hereinafter referred to as the “Title Term”).

At the end of the Title Term, the Company has the option of either returning the DVD title to the studio or

purchasing the title. Before the change in business model, the Company typically acquired fewer copies of a

particular title upfront and utilized each copy acquired over a longer period of time. The implementation of these

revenue sharing agreements improved the Company’s ability to obtain larger quantities of newly released titles

and satisfy subscriber demand for such titles over a shorter period of time.

In connection with the change in business model, on January 1, 2001, the Company revised the amortization

policy for the cost of its DVD library from a “sum-of-the-month” accelerated method using a three-year life to

F-11