NetFlix 2003 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2003 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

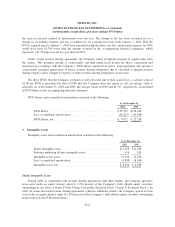

NOTES TO FINANCIAL STATEMENTS—(Continued)

(in thousands, except share, per share and per DVD data)

The Tax Reform Act of 1986 imposes restrictions on the utilization of net operating loss carryforwards and

tax credit carryforwards in the event of an “ownership change,” as defined by the Internal Revenue Code. The

Company’s ability to utilize its net operating loss carryforwards is subject to restrictions pursuant to these

provisions.

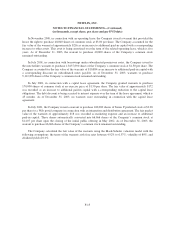

10. Employee Benefit Plan

The Company maintains a 401(k) savings plan covering substantially all of its employees. Eligible

employees may contribute up to 15 percent of their annual salary through payroll deductions, but not more than

the statutory limits set by the Internal Revenue Service. The Company matches employee contributions at the

discretion of the Board of Directors. During 2001, 2002 and 2003, the Company’s matching contributions totaled

$304, $0 and $0, respectively.

11. Restructuring Charges

During 2001, the Company recorded a restructuring charge of $671 relating to severance payments made to

45 employees terminated in an effort to streamline the Company’s operations and reduce expenses. All liabilities

related to this restructuring charge have been paid.

12. Subsequent Event

On January 16, 2004, the Company’s Board of Directors approved a two-for-one split in the form of a stock

dividend on all outstanding shares of its common stock. As a result of the stock split, the Company’s

stockholders received one additional share for each share of common stock held on the record date of February 2,

2004. The additional shares of common stock were distributed on February 11, 2004. All common share and per-

share amounts in the financial statements and related notes have been retroactively adjusted to reflect the stock

split for all periods presented. In addition, the Company has reclassified $23 and $26 from additional paid-in

capital to common stock as of December 31, 2002 and 2003, respectively.

F-22