NetFlix 2003 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2003 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(in thousands, except share, per share and per DVD data)

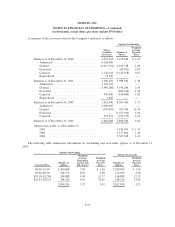

8. Stockholders’ (Deficit) Equity

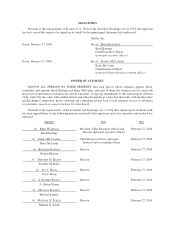

The convertible preferred stock at December 31, 2001 consisted of the following:

Par

Value

Number of

Shares

Authorized

Number of

Shares

Issued and

Outstanding

Dividends

Per Share

Liquidation

Value Per

Share

Total

Liquidation

Value

Series A .......... $0.001 5,000,000 4,444,545 $0.05000 $0.50 $2,222

Series F ........... 0.001 3,500,000 1,712,954 — — —

8,500,000 6,157,499 $2,222

The Company’s obligation to maintain the studios’ equity interests at 6.02 percent of the Company’s fully

diluted equity securities resulted in the Company issuing 3,492,737 shares of Series F preferred stock to the

studios during 2002 (see Note 3). This obligation terminated immediately prior to the Company’s initial public

offering in May 2002. All the outstanding convertible preferred stock automatically converted into 6,433,480

shares of common stock upon the closing of the initial public offering.

Voting Rights

The holders of each share of common stock shall be entitled to one vote per share on all matters to be voted

upon by the Company’s stockholders.

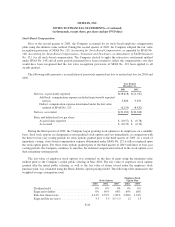

Employee Stock Purchase Plan

In February 2002, the Company adopted the 2002 Employee Stock Purchase Plan, which reserved a total of

1,166,666 shares of common stock for issuance. The 2002 Employee Stock Purchase Plan also provides for

annual increases in the number of shares available for issuance on the first day of each year, beginning with

2003, equal to the lesser of:

• 2 percent of the outstanding shares of the common stock on the first day of the applicable year;

• 333,333 shares; and

• such other amount as the Company’s Board of Directors may determine.

Under the 2002 Employee Stock Purchase Plan, shares of the Company’s common stock may be purchased

over an offering period with a maximum duration of two years at 85 percent of the lower of the fair market value

on the first day of the applicable offering period or on the last day of the six-month purchase period. Employees

may invest up to 15 percent of their gross compensation through payroll deductions. In no event shall an

employee be permitted to purchase more than 8,334 shares of common stock during any six-month purchase

period. During 2002 and 2003, employees purchased 95,492 and 345,112 shares at average prices of $3.80 and

$3.94 per share, respectively. As of December 31, 2003, 1,392,728 shares were available for future issuance

under the 2002 Employee Stock Purchase Plan.

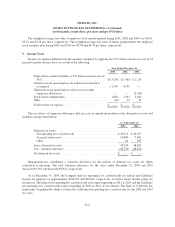

Stock Option Plans

In December 1997, the Company adopted the 1997 Stock Plan, which was amended and restated in October

2001. The 1997 Stock Plan provides for the issuance of stock purchase rights, incentive stock options or non-

F-17