NetFlix 2003 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2003 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(in thousands, except share, per share and per DVD data)

the same accelerated method of amortization over one year. The change in life has been accounted for as a

change in accounting estimate and was accounted for on a prospective basis from January 1, 2001. Had the

DVDs acquired prior to January 1, 2001 been amortized using the three-year life, amortization expense for 2001

would have been $4,700 lower than the amount recorded in the accompanying financial statements, which

represents a $1.29 impact on net loss per share in 2001.

Under certain revenue sharing agreements, the Company remits an upfront payment to acquire titles from

the studios. This payment includes a contractually specified initial fixed license fee that is capitalized and

amortized in accordance with the Company’s DVD library amortization policy. Some payments also include a

contractually specified prepayment of future revenue sharing obligations that is classified as prepaid revenue

sharing expense and is charged to expense as future revenue sharing obligations are incurred.

For those DVDs that the Company estimates it will sell at the end of their useful lives, a salvage value of

$2.00 per DVD is provided. For those DVDs that the Company does not expect to sell, no salvage value is

provided. As of December 31, 2002 and 2003, the salvage values of $929 and $1,717, respectively, are included

in DVD library in the accompanying financial statements.

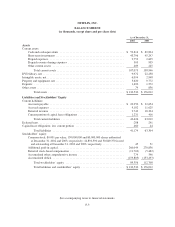

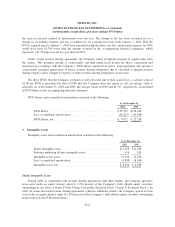

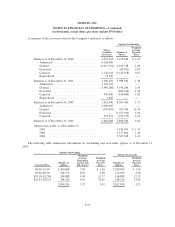

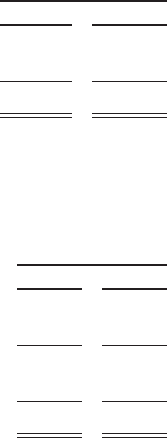

DVD library and accumulated amortization consisted of the following:

As of December 31,

2002 2003

DVD library .............................................. $58,795 $114,186

Less: accumulated amortization ............................... (48,823) (91,948)

DVD library, net .......................................... $ 9,972 $ 22,238

3. Intangible Assets

Intangible assets and accumulated amortization consisted of the following:

As of December 31,

2002 2003

Studio intangible assets ....................................... $11,528 $11,528

Strategic marketing alliance intangible assets ...................... 416 416

Intangible assets, gross ....................................... 11,944 11,944

Less: accumulated amortization ................................ (5,850) (8,996)

Intangible assets, net ......................................... $ 6,094 $ 2,948

Studio Intangible Assets

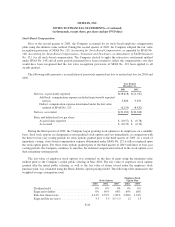

During 2000, in connection with revenue sharing agreements with three studios, the Company agreed to

issue each studio an equity interest equal to 1.204 percent of the Company’s fully diluted equity securities

outstanding in the form of Series F Non-Voting Convertible Preferred Stock (“Series F Preferred Stock”). In

2001, in connection with revenue sharing agreements with two additional studios, the Company agreed to issue

each studio an equity interest equal to 1.204 percent of the Company’s fully diluted equity securities outstanding

in the form of Series F Preferred Stock.

F-12