NetFlix 2003 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2003 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(in thousands, except share, per share and per DVD data)

The weighted-average fair value of employee stock options granted during 2001, 2002 and 2003 was $0.16,

$5.19 and $5.98 per share, respectively. The weighted-average fair value of shares granted under the employee

stock purchase plan during 2002 and 2003 was $2.90 and $4.43 per share, respectively.

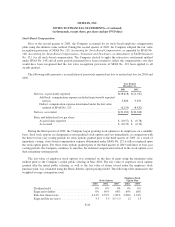

9. Income Taxes

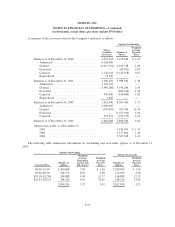

Income tax expense differed from the amounts computed by applying the U.S. federal income tax rate of 34

percent to pretax income (loss) as a result of the following:

Year Ended December 31,

2001 2002 2003

Expected tax expense (benefit) at U.S federal statutory rate of

34%............................................ $(13,130) $(7,463) $ 2,214

Current year net operating loss for which no tax benefit is

recognized ...................................... 11,330 4,105 —

Utilization of net operating loss and reversal of other

temporary differences .............................. — — (5,914)

Stock-based compensation ............................ 1,864 3,343 3,644

Other............................................. (64) 15 56

Totalincometaxexpense............................. $ — $ — $ —

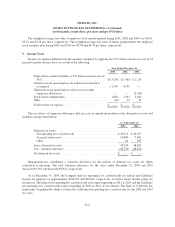

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and

liabilities are presented below:

As of December 31,

2002 2003

Deferred tax assets: .........................................

Net operating loss carryforwards ............................ $34,270 $40,657

Accruals and reserves ..................................... 10,880 7,602

Other .................................................. 80 592

Gross deferred tax assets .................................... 45,230 48,851

Less: valuation allowance .................................... (45,230) (48,851)

Net deferred tax assets ...................................... $ — $ —

Management has established a valuation allowance for the portion of deferred tax assets for which

realization is uncertain. The total valuation allowance for the years ended December 31, 2002 and 2003

decreased $1,301 and increased $3,621, respectively.

As of December 31, 2003, the Company had net operating loss carryforwards for federal and California

income tax purposes of approximately $108,951 and $56,010, respectively, to reduce future income subject to

income tax. The federal net operating loss carryforwards will expire beginning in 2012 to 2023 and the California

net operating loss carryforwards expire beginning in 2005 to 2013, if not utilized. The State of California has

temporarily suspended the ability to utilize the California net operating loss carryforwards for the 2002 and 2003

tax years.

F-21